Weekly Market Update 4/1/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

- It’s opening day for baseball! What were the Kansas City Royals named after?

- Who has the highest single season batting average in Royal’s history?

Answers at the bottom.

Market News

-

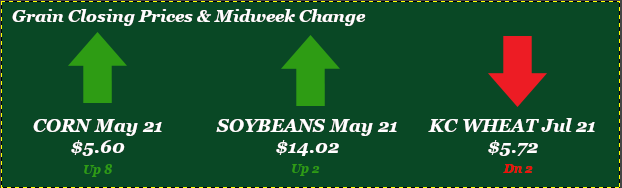

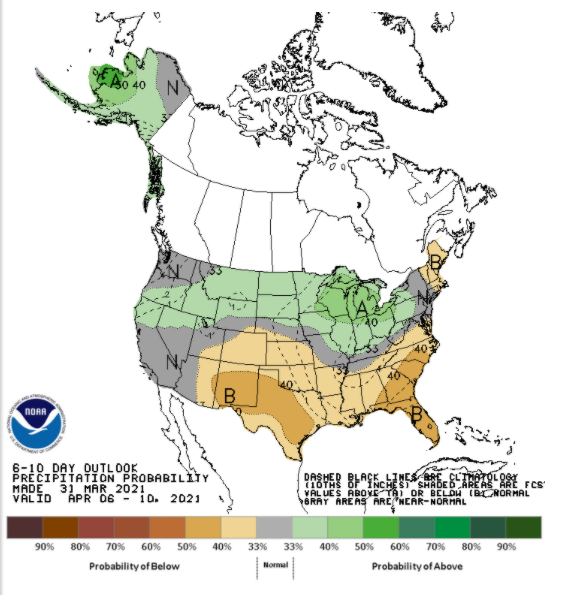

Overall bullish quarterly Stocks and Acreage Report yesterday from the USDA. Bean stocks were down significantly from March 1, while wheat and corn stocks were down slightly as well. Prospective plantings pegged corn down at 91.144 million acres, beans down at 87.6 million acres, and wheat up at 46.358 million acres.

-

U.S. Dollar seeing a little strength into mid-week, topping at about 93.43, but weakening into Thursday morning at 93.00.

-

The DJIA’s recent high hit 33,234, tapered off some and has stayed fairly flat the last couple of days. S&P has also seen some strength this week currently trading about 4,009. NASDAQ also saw a spike this morning, trading around 13,472.

|

USDA Quarterly Stocks and Prospective Plantings |

|

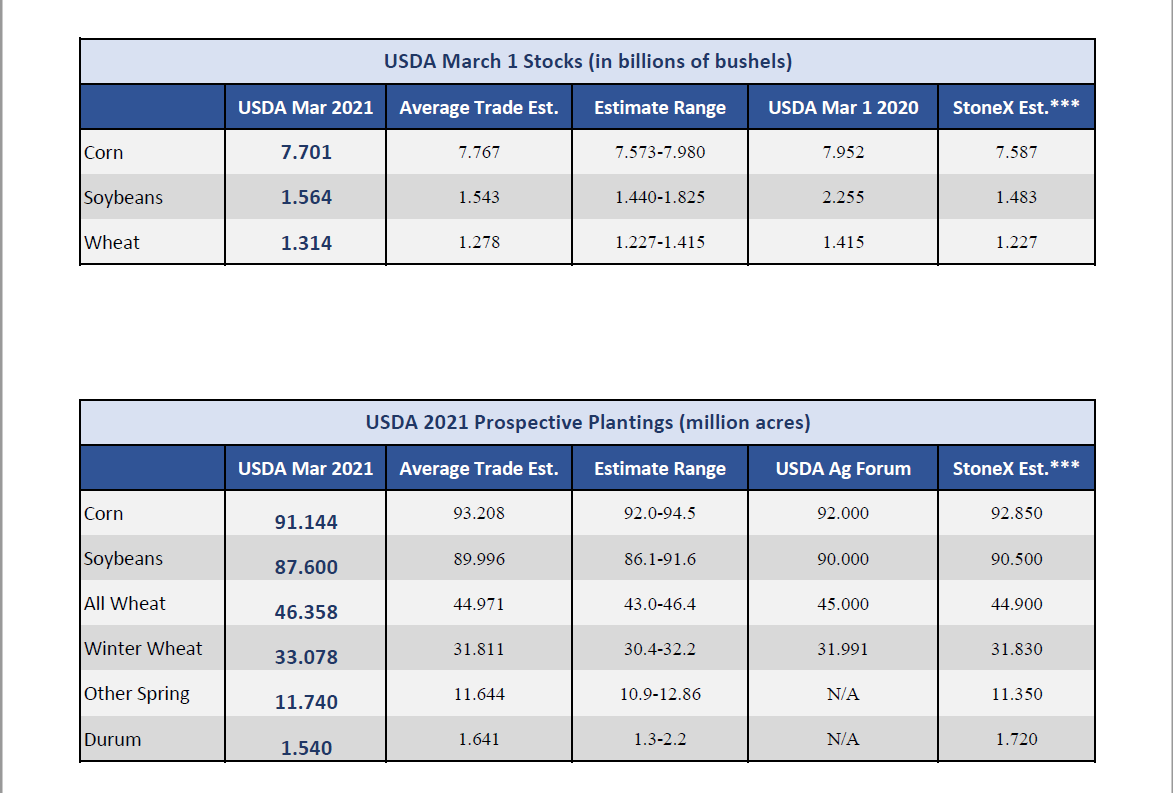

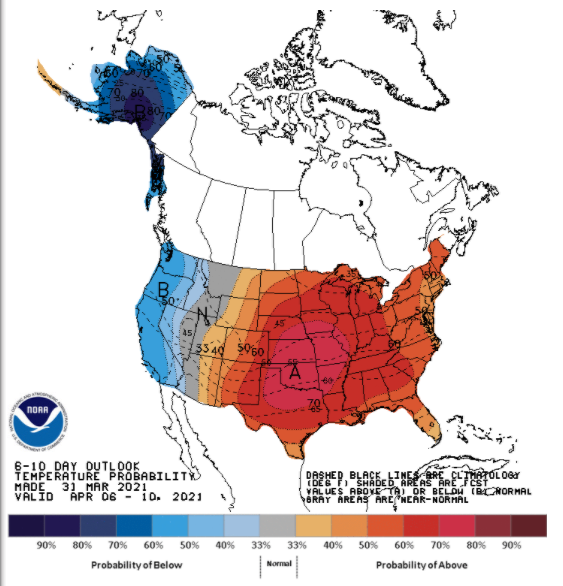

Weather

Spring is finally upon us as we enter the month of April. However, crops could still use some moisture. The 6-10 day forecast has temps above normal for southwest Kansas, mostly in the 70’s and 80’s for highs. Precipitation will be lacking and slightly below normal for that same 6-10 day period.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

After slipping early in the week, corn is up sharply since yesterday’s surprising USDA report – with the board up the limit yesterday out through July 2022 futures mixed in today’s trade. The March Stocks and Planting Intentions is the kickoff for the marketing year and gives us a double whammy with both the quarterly stocks report and a fresh look at planted acres. Stocks came in at 7.701 billion bushels, down from last year and slightly below the average trade estimate. Eyes were largely on the acreage estimate, with the trade expecting a large increase in acreage due to high prices – guesses were anywhere from 92.0-94.5 million acres. This made it a big surprise when the USDA walked out a 91.1 million acre estimate, which while still up slightly from last year, was drastically lower than expectations. Paired with an also lower-than-expected soybean acreage number, the markets surged post-report. In other news, export sales came in decent this morning at 31.4 million bushels, which was in line with estimates but down from the previous week’s huge 174.2 million. Inspections were reported at 66.7 million bushels, down from the previous week but ahead of the 10-week average of 61.5 million bushels. With the USDA report in the rear-view mirror, the market should be back to watching weather and export demand as we get closer to planting.

Wheat

The USDA released their quarterly stocks, planted acres, and production report yesterday with wheat seeing bearish numbers. Stocks came in at 1.314 billion bushels above the average trade estimate, wheat planting acres were 46.358 million acres also above trade guesses. Kansas acres are estimated at 7.3 million acres, up 700k from last year. Even with the bearish wheat numbers corn and beans still pulled wheat higher for the day 17 cents. We are seeing some pull back today after yesterday’s wild ride. Export inspections report this week was below the trade guesses at 11.1 million bushels. Export sales showed good numbers this week at 9.2 million bushels, 3 million bushels being new crop. Unfortunately, this is not enough to move the needle market-wise. CFTC report showed funds pull back 12,100 contracts this week, bringing the wheat long position to 26,242 contracts.

Soybeans

Beans made their presence felt yesterday being lock limit up across the next 6 trading months. If you thought the USDA was pulling an early April fools joke a day early you were wrong. Stocks came in as expected to trade estimates with 1.564 billion bushels. Acres on the other hand is where the “shocker” came. Average trade estimated acres at 89.996 million acres, the USDA report was well below that with 87.6 million acres leading the market up. Overnight we saw the market gap higher, but the nearby months have back tracked are down for the day. New crop has stayed strong and in the green today. Export inspections were within trades estimates at 15.6 million bushels. Export sales this week showed 3.9 million bushels sold. With what the USDA reported in acres and what they predict for demand we are looking at a net negative carryout. It will be interesting to see what the June acres numbers look like. Funds showed 6,813 contracts added to the overall net long of 162,853 contracts. Another thing to keep an eye on as mentioned last week, the African Swine Flu in china seems to appear worse than what had been reported. Time will tell how this affects our domestic demand.

Milo

Milo has been along for this wild ride in corn futures, while basis has weakened. Old crop basis has been hit the hardest, as bids have become harder to come by. New crop basis is also wider as sellable levels at the gulf have fallen. Yesterday, USDA pegged 2021 milo acres at 6.9 million acres, up 18% from last year. Kansas is estimated to have 20% more milo acres than last year.

Trivia Answers

- The Royal’s name pays homage to the American Royal, a livestock show, rodeo, and championship barbeque competition held in KC since 1899.

- George Brett finishing the 1980 season at .390, though carrying at or above a .400 as late into the season as September 19th.