Weekly Market Update 4/15/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Where were the Declaration of Independence, the Constitution, and the Bill of Rights stored during World War II?

-

How long did the Battle of the Alamo last?

Answers at the bottom.

Market News

-

Inflation concerns pushing the dollar down on the week, hovering between 91.6-91.7. DJIA up today, hanging around 34,000, S&P 500 also up 39 points at the moment around 4,164. NASDs & ps & pAQ also edging higher, currently up 153 points around 14,011.

-

Last week's WASDE was largely a non-event. Corn carryout was tightened, soybean stocks remain tight headed into summer, and wheat carryouts were up. With this report in the rearview mirror, the market has been back to trading weather as we get into planting season - all eyes are on acreage needs for corn and soybeans.

-

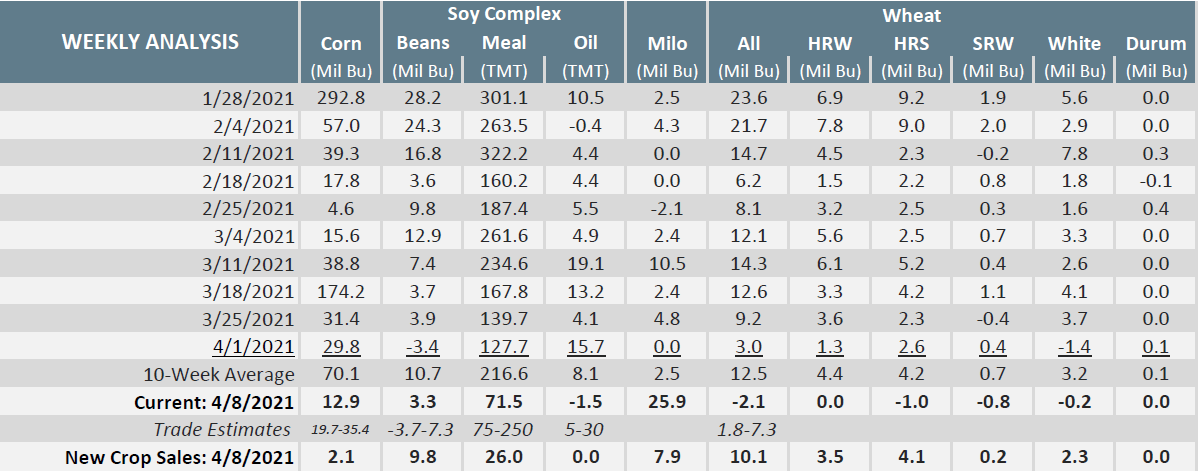

Export Sales report this morning was really nothing to write home about - corn was below trade estimates, wheat was solid in the new crop slot and rough for old crop, and beans were par for the course. One notable exception is big sales numbers for milo, over 25 million bushels of old crop and 10 million bushels of new.crop. You can see report details in the snapshot below.

|

Export Sales Report |

|

|

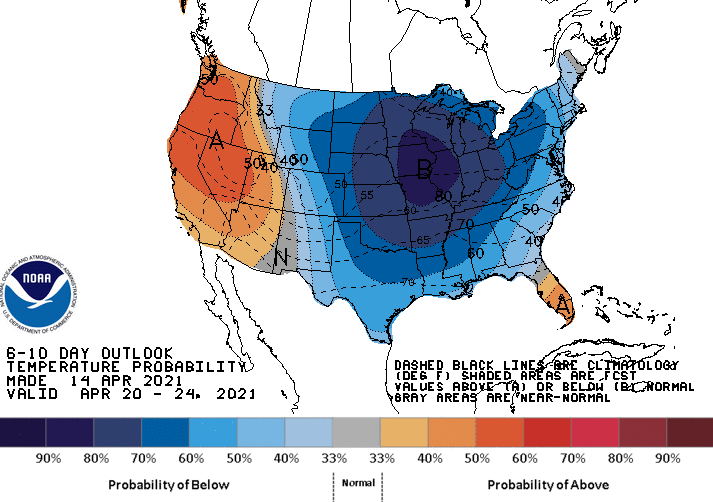

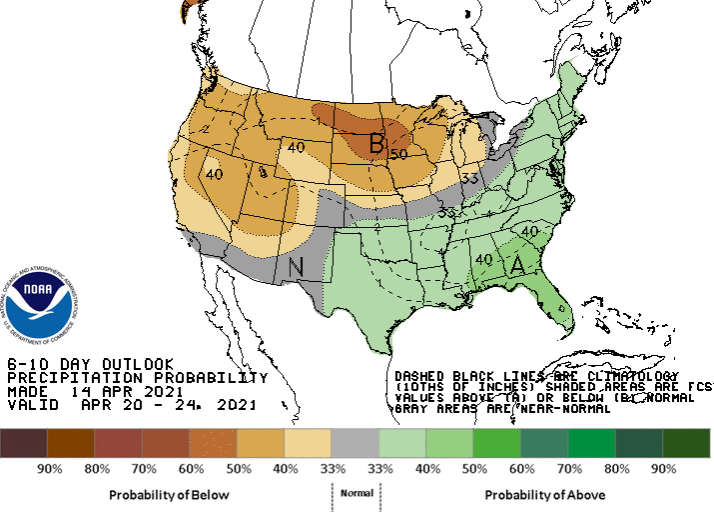

Weather

Hope you hadn’t already put away your winter coats for the year! After beautiful temperatures last weekend and early this week, it’s turned colder headed into the end of the week. Highs are forecasted in the 40s and 50s for the next several days, with nighttime lows below freezing. Chances for precipitation show up today, tomorrow, and early next week.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

Corn futures seeing some strength this week as carryout continues to be reduced and weather is a concern along with Safrihna corn crop concerns. Friday’s WASDE had world corn carryout at 283.85 million tonnes versus March’s WASDE report at 287.67 million tonnes. U.S. carryout was sitting at 1.352 billion bushels vs March at 1.502 million bushels. Not too much change in South American corn production either with Argentina at 47.0 million tonnes and Brazil at 109 million tonnes. Friday’s CFTC had corn funds still holding long at 386.6K contracts. This week’s export inspections had corn at 62.4 million bushels, down from last week’s 85.1 million bushels and also down from the 10-week average of 67.9 million bushels. Monday’s crop progress report showed corn planting pace at 4% nationwide versus 2% the week prior. Kansas sits at 8% planted versus 2% last week and 5% last year. Ethanol production was ho hum for the week with production and stocks down. Thursday’s export sales pegged corn down heavy at 12.9 million bushels versus last week at 29.8 million bushels and the 10-week average of 70.1 million bushels. Could see futures trend higher as weather concerns progress and carryout continues to tick away. Locally, corn basis stays steady.

Wheat

Wheat is getting a bump this week with colder temps, dry future forecast, and a weaker dollar. Last Friday’s USDA report showed U.S. carryout increased by 16 million bushels to 852 million bushels, with imports down 10 million bushels and feed/residual use down 25 million bushels. A bit surprised with feed use being decreased due to the high price of corn. Export inspections were strong for wheat this week coming in at 16.8 million bushels shipped. Export sales this week for wheat is rough in the front-end delivery with cancellations of 2.1 million bushels, new crop was much better with 10.1 million bushels sold. CFTC report showed KC wheat having a sell off of 7,212 contracts this week, bringing the net long down to 14,510 contracts. Export sales has wheat down this morning and with moisture chances on the horizon could keep the market bogged down for the day. Look for wheat to bounce back with dry conditions returning next week.

Soybeans

U.S. carryout for soybeans was unchanged in Friday’s USDA report. Exports were raised, but crush/residual use was reduced for a net even. Beans are seeing a slight bump this week with cold weather delaying planting in much of the north. Export inspections for soybeans were toward the higher end of expectations this week at 12 million bushels, export sales reported within range at 3.3 million bushels, 9.8 million bushels of new crop. Beans added to their long position this week with 12,425 contracts bringing the long to 154,305 contracts. South America harvest is moving right along at 85% complete. This is still behind last year’s pace of 89% complete delaying safrinha planting. African swine flu in China is still making headlines with more and more issues emerging, this could affect bean demand. March 2021 NOPA crush report shoed 178 million bushels, down from the 179.2-million-bushel average trade estimate and 181.4 million from last March, though well above 155.2 million bushels last month.

Milo

Milo export inspections were decent for the week coming in at 7.4 million bushels versus last week at 9.4 million bushels. Export sales were huge for milo at 25.9 million bushels versus 0 last week and the 10-week average of 2.5 million bushels. Locally basis is staying steady.

Trivia Answers

- Fort Knox

- After a thirteen-day siege, the actual Battle of the Alamo lasted only 90 minutes.