Weekly Market Update 4/22/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What year did Apple Computer introduce the first iPod?

-

What city was the location of the first U.S. hosted Olympics?

Answers at the bottom.

Market News

-

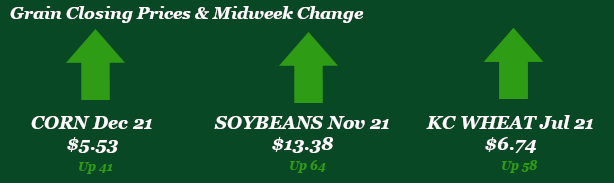

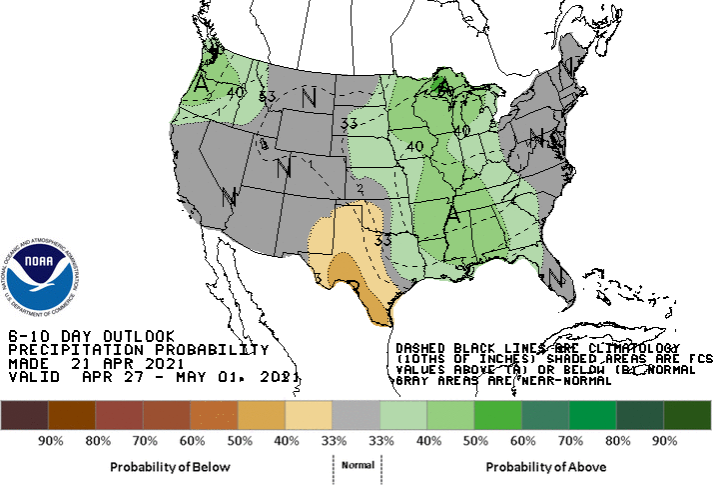

What a day of markets! Honestly, what a week of markets. Today we put in contract highs for the new crop contract month in all three commodities - corn, soybeans and wheat. The market closed limit up in May and July corn, and traded at the limit part of the day for July wheat. Cold weather has created concerns about planting progress and early planted crops and bulls seem to be in charge as managed money flows into commodities. Cash prices for old and new crop are incredibly attractive across all the commodities - these levels are worth some serious thought about what makes sense for your operation.

-

On the other hand, a resurgance of COVID-19 cases globally has pressured stock markets today. DJIA is currently down 351 points to 33,785. NASDAQ down 147 to 13,802 and S&P 500 is down 42 to 4,130. The US dollar index is up slightly today after being down earlier in the week - it is currently around 91.34.

-

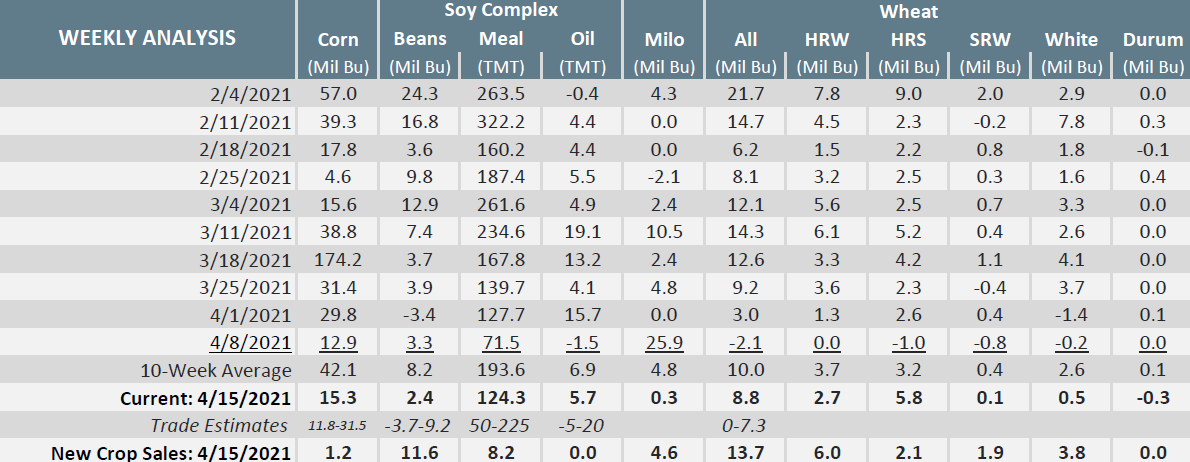

Export Sales today were ho-hum for corn and relatively solid for beans, wheat and milo. You can see the full details in the below snapshot and more information in the commodity recaps.

-

Your GCC Grain Team is rolling out enrollment for our 2021 Summit Max contract. This contract prices bushels from May 13th through July 30th and prices an equal amount of bushels each day at the daily market high - essentially at the end, your contract price is the average of the daily high within the pricing period. This contract is available for corn and milo. Reach out to your local grain originator for more information.

|

Export Sales Report |

|

|

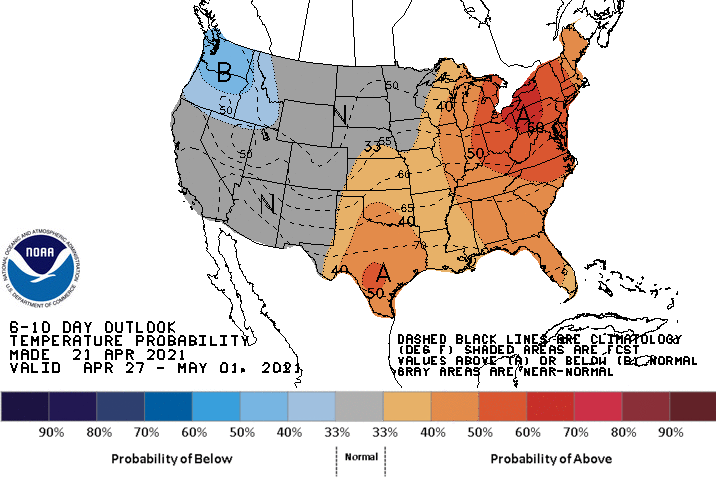

Weather

After a chilly beginning of the week, Mother Nature has decided it's time to feel more like spring. Daytime highs in the 60s and nighttime lows above freezing are forecasted for the rest of the week, with this Sunday and Monday currently looking like highs in the upper 80s. Next week should be pretty nice, with highs in the 60s and 70s and no concern for nighttime freezing temperatures. Chances for precipitation are slim to none.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

Corn up big on the week, fueled by this cold snap that has created planting delays and concern for early planted corn. May and July corn both closed limit up, with double digit gains in every contract month through July 2022. Last week’s CFTC report indicated that the funds were net buyers this week, adding 15,374 contracts to bring their net long up to 401,993 contracts. For perspective, the record net long is 429,189 contracts. Fund buying is likely a big part of this recent rally. Export inspections this week were nice at 60.0 million bushels, but down from last week’s 68.0 million. Export sales were on the low end of estimates this morning, coming in at 15.3 million old crop bushels and 1.2 million bushels of new crop. Monday’s Crop Progress report pegged the U.S. corn crop at 8% planted, up 4% from the previous week and even with the 5-year average. Ethanol production was unchanged this week, with stocks slightly lower. GCC basis has strengthened across our locations and is well above historic levels for new crop.

Wheat

Bulls are in control of the wheat market, with the July contract up close to 60 cents this week and almost a dollar since April 1st. Numerous market factors are at play here: freezing temperatures across wheat country this week, direction from corn and beans, dryness in the EU, a lower US dollar and an influx of managed money into commodities. All eyes will be on next week’s crop conditions report after this week’s below freezing temperatures, but at this point the consensus seems to be that serious damage was limited. On Monday, the U.S. crop was reported as unchanged from the previous week at 53% good-to-excellent. Kansas was reported at 55% good-to-excellent. Export sales were above expectations for all wheat this week, with HRW reported at 2.7 million bushels for old crop and 6.0 million bushels for new crop. Inspections were reported at 5.2 million bushels, ahead of the 10-week average of 4.4 million bushels. The funds were net sellers of wheat in last Friday’s CFTC report, bringing their net long down 3,482 contracts to 11,028 contracts long. Local basis remains steady and slightly stronger than historical averages. Cash prices are attractive across all our locations – it’s worth considering what levels could make sense for your crop.

Soybeans

Old crop and new crop futures have both made contract highs today, with new crop up over 60 cents this week. Cold, wet weather in the last several days hasn’t been conducive to early bean planting, but a warmer dry spell next week should allow for good progress. On Monday, the soybean crop was reported at 3% planted, with the majority of that being Mississippi, Louisiana, and Arkansas. Last Friday’s CFTC report indicated that managed money reduced their net long by 12,047 contracts to 142,258 contracts. It will be interesting to see what that looks like after this week, with a lot of this market movement being attributed to algorithms and funds. Export inspections were okay at 6.8 million bushels, down from the previous week at 12.4 million. Export sales were reported at 11.6 million bushels of new crop and 2.4 million bushels of old crop. Current export sales are ~100 million bushels over USDA projections, which would be the entire estimated carryout if realized.

Milo

Milo has been along for this crazy ride in corn futures, while basis has remained steady. Export sales were decent at 0.3 million bushels of old crop and 4.6 million bushels of new crop. This was down from last week’s huge 25 million number, but right in line with the 4.8 million bushel 10-week average. Inspections were reported at a solid 12.4 million bushels, the highest number in a month and well ahead of the 7.2 million bushel 10-week average. Export inspections are 5% ahead of the pace needed to reach the USDA Export Estimate. The U.S. milo crop was reported at 15% planted on Monday, with the Texas crop 51% planted.

Trivia Answers

-

2001

-

St. Louis, Missouri hosted the Summer Olympics in 1904. It was also the first non-European city to host the Games.