Weekly Market Update 4/29/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Who is the only country artist to have a Top 20 hit on the Billboard Hot Country Songs chart for six decades?

-

What is the only state in the United States that does not have a flag in a shape with four edges?

Answers at the bottom.

Market News

-

Energy markets have maintained their bullish tone after yesterday's DOE inventory report did not confirm the expected sizable build on crude, coming in at only a 100k barrel build. Diesel demand remained strong as farmers continue to plant and demand can be expected to stay strong over the coming weeks. Gasoline continues to break through levels of resistance. WTI crude around 65.08, Brent crude around 68.64 today.

-

Yesterday the dollar reached a nearly 9-week low due to government spending and low interest rates. Today it's holding steady around 90.6. Stock markets are seeing slight strength, with NASDAQ, DJIA and S&P 500 all trading higher in today's session.

-

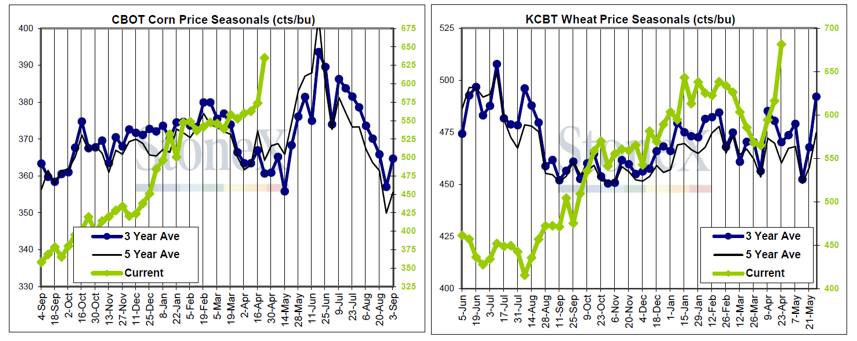

Despite some fallback yesterday and today, all crop prices remain incredibly attractive. For perspective, we've included seasonal charts for corn and wheat futures below - the green line designates this year and is so much higher than previous years that it requires its own price scale on the right-hand side of the chart. Recent market action is blowing seasonals from previous years out of the water. Volatile, high markets can make it challenging to make decisions. Reach out to your grain originator if we can be of assistance in the development and execution of your marketing plan.

|

Corn and Wheat Seasonal Charts as of 4/23/21 |

|

|

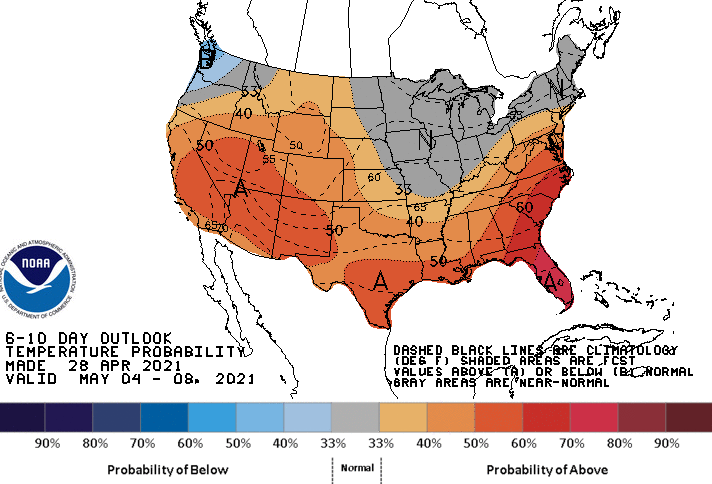

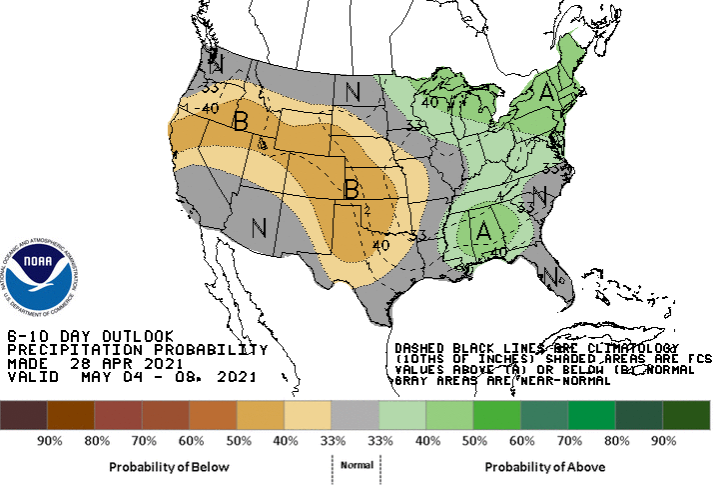

Weather

It looks like the rest of the week should be favorable for field work as corn planters start to roll across much of our territory. Warm, dry weather dominates the forecast through the weekend with highs in the 80s and sun. Next week looks like it's going to cool off some with highs in the 60s and some forecasted chances of rain.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

Corn seeing some volatility with thoughts of huge fund buying at the end of last week only to turn out not as massive as expected. CN gained roughly 16 cents over the past week, while CZ lost about a nickel. Both contracts saw sharp upturns with CN peaking at 6.84 and CZ at 5.93. Dryness in Brazil adding some support to the market, though cooler temps will limit corn stresses. Export inspections came in decent for corn at 76.8 million bushels versus 61.4 million bushels last week and the 10-week-average at 70.2 million bushels. Monday’s crop progress report showed corn planting at 17% for the US, about 7% behind last year’s pace. Kansas sits at 20% planted versus last year at 22% planted. Wednesday’s ethanol report has stocks down and demand up and still steady with its “new normal.” Export sales came in more on the side of “meh” at 20.5 million bushels versus 15.3 million bushels last week and the 10-week-average of 38.0 million bushels. Export sales could be a struggle as the US is behind Ukraine and Argentina on corn price. Corn funds are currently estimated long at 529K. Locally basis stays steady and corn planting in southwest Kansas is lagging some.

Wheat

Wheat started off the week at a breakneck pace but has been coming back down to earth the past couple of days. Tuesday, we saw wheat hit a high of $7.41. We have seen huge trading ranges all week (35-40 cents) and it looks to continue into the summer months if wheat keeps following the corn and bean craziness. Export inspections were on the high end of the estimated range this week at 20.7 million bushels. Nothing to exciting for export sales week ending 4/22/21 at 8.2 million bushels and 8.7 million bushels of new crop sales. Funds showed buying of 7,719 contracts and bring the total net long position to 18,747 contracts. Slight chances for rain over the next 7-10 days would be greatly appreciated. Crop progress report showed winter wheat rating decrease from 53% good/excellent to 49% across the U.S. The decrease was mainly due to the late cold snap experienced last week. Kansas remained unchanged at 55% good/excellent.

Soybeans

Large trading ranging is the theme of the week with commodities. Soybeans have traded in a 20-57 cent range all week. Planting is picking up the pace as weather is finally beginning to cooperate for the time being in most areas. Dryness in South America has helped boost beans and Europe now looks to be having moisture issues too. Export inspections were within trading range estimates this week at 8.6 million bushels. Export sales for the week ending 4/22/21 were above trade guesses at 10.7 million bushels with new crop sales of 16.1 million bushels. Demand for beans remains strong and sales continue to keep pace 170 million bushels above the USDA estimates for the year, this could lead to a negative carryout for soybeans. CFTC report has beans adding 30,286 contracts to their long position, increasing the overall number of contracts to 172,544. Funds have been a big driving force with the volatility in the market with big swings either way daily. Crop progress report showed beans making a 5% jump this week in planting numbers to 8% completed, ahead of the 5 year average of 5%.

Milo

Milo riding the corn roller coaster as basis levels are flat. Export Inspections for milo came in at 7.2 million bushels versus 12.4 million bushels last week and the 10-week-average of 7.6 million bushels. Export sales today have milo pegged at 4.2 million bushels versus last week at .03 million bushels and the 10-week-average of 4.4 million bushels.

Trivia Answers

-

Dolly Parton (1960s-2010s)

-

Ohio