Weekly Market Update 4/8/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

- Who is the only U.S. president to have been a club member of Augusta National Golf Club (home of The Masters)?

Answers at the bottom.

Market News

-

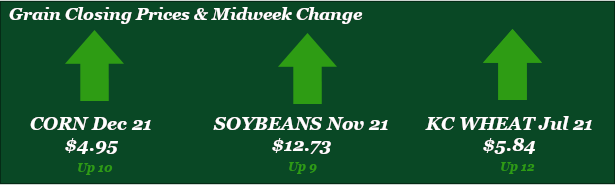

USDA will release their April WASDE report tomorrow at 11 A.M. Corn & wheat look strong heading into the report while beans are being dragged down a bit.

-

Crop progress report increased winter wheat ratings to 53% good/excellent, up from 46% going into winter.

-

The DJIA had a big jump on the open Monday after the long weekend, jumping more than 300 points. The Dow has battled back off morning lows to be up about 45 points and sitting at 33,493.54. The S&P had a jump of about 35 points to start the week and is trending higher overall, 4095.75 up around 15 points on the day. The NASDAQ had a jump of roughly 115 points to start and is popping today up 130 points at 13819.34. The US Dollar Index is down about 80 points on the week at $92.10.

|

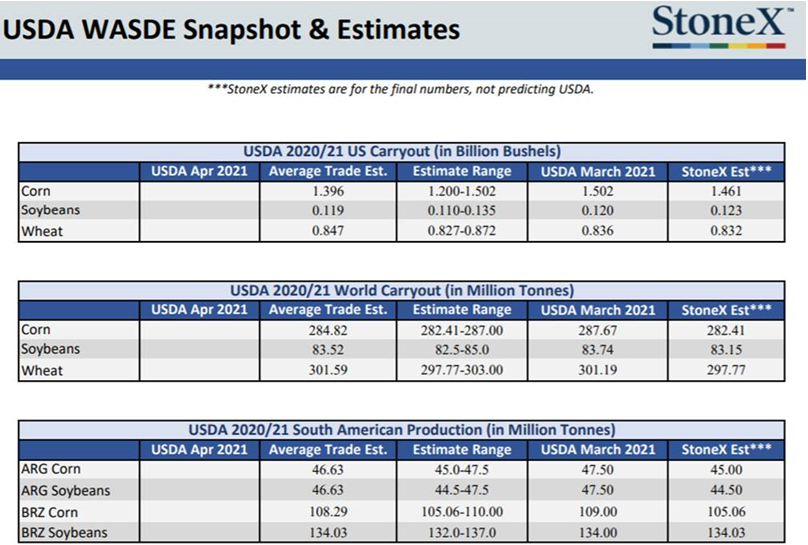

WASDE Cheat Sheet |

|

Weather

After the hot, dry, and windy week we had next week looks to be cooler and have a chance of moisture in the 6–10-day outlook. Any moisture will be welcomed.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

Corn seeing a mostly quiet week even after last week’s Stocks and Prospective Plantings report. Corn saw some weakness early in the week, but more China buying rumors seem to be hitting the market today offering strength. Friday’s CFTC report had corn funds long at 395K with today’s estimate at 417K. Export inspections this week came in at 75.3 million bushels versus last week’s 67.7 million bushels and the 10-week average of 64.6 million bushels. Monday’s crop progress report showed corn 2% planted across the U.S. with Kansas also sitting at 2% planted. Ethanol report on Wednesday showed stocks down and production up. Production still can’t seem to reach pre-COVID levels. Export sales this morning were disappointing for corn at 29.8 million bushels versus 31.4 million bushels last week and the 10-week average of 74.4 million bushels. New crop sales came in at 2 million bushels. Friday’s WASDE could continue to give strength to the market most suspect. Locally basis is steady as corn planting gets underway.

Wheat

Concern about dry conditions, paired with strong export numbers this morning and direction from row crops, has wheat in the green today. Export sales this morning were strong for all wheat in the new crop slot, with HRW posting 1.3 million old crop bushels and 3.3 million for new crop. Export inspections were reported at 6.0 million bushels for HRW, the highest week so far for 2021. Friday’s CFTC report had the funds as sellers this week, bringing their net long down 4,520 to 21,722 contracts. This week was the first national Crop Progress report of the year – HRW states were mostly higher from the last state reports. The U.S. winter wheat crop is currently at 53% good-to-excellent, with Kansas at 54% and Oklahoma at 70%. Dryness is a concern in spring wheat country, primarily in the Dakotas and Montana, and colder temperatures are forecasted across the southern Plains in the coming days. The trade will continue to keep an eye on this. Feed wheat demand remains strong, and we’ve seen the mills come back with incremental demand as well. Average trade guesses for tomorrow’s WASDE report are slight increases to U.S. and world carryout.

Soybeans

Beans also up on the week. Export sales report this morning showed a net cancellation of 3.4 million bushels of old crop beans, but new crop continues at a record pace with 12.4 million bushels sold. Inspections were at 11.0 million this week, within trade estimates but lower than last week at 16 million. Rising numbers of ASF within the Chinese hog herd will be something to watch regarding demand, but right now isn’t creating huge waves. Soybean oil demand has also been strong and supportive of this bean rally. The Brazilian soybean crop estimates continue to rise as their harvest progresses, while favorable U.S. weather has farmers itching to jump in their planters. Tomorrow’s WASDE isn’t expected to hold any huge surprises for beans, but I suppose we wait and see what USDA will print. The trade is expecting decreases to U.S. and global carryout due to increased export demand.

Milo

Milo basis seeing some weakness this past week, though it was short-lived. Could see some basis volatility heading into summer months. Export inspections for milo were at 6.5 million bushels versus 9.6 million bushels last week and the 10-week average of 7.1 million bushels. Export sales were disappointing at 0 for the week.

Trivia Answers

- Dwight D. Eisenhower