Weekly Market Update 8/5/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What trendy symbol is actuallly called an octothorpe?

-

What is the national animal of Scotland?

Answers at the bottom.

Market News

-

Stock markets saw some upside today as jobless claim numbers show continued economic recovery. According to Reuters, "The number of Americans filing new claims for unemployment benefits declined further last week, while layoffs dropped to their lowest level in just over 21 years in July as companies held on to workers amid a labor shortage." Weekly jobless claims fell 14,000 to 385,000 with continuing claims dropping 366,000 to 2.93 million.

-

Purdue University Center for Commercial Agriculture, along with the CME Group, conducted a producer survey over May, June and July of 2021. While grain prices are maintaining appealing levels, producer concern over input prices continues to climb. According to the survey, 51% of producers expect input costs to climb 4% or more over the next year, 30% expect costs to rise 8% or more, and 18% expect costs to climb 12% or more.

-

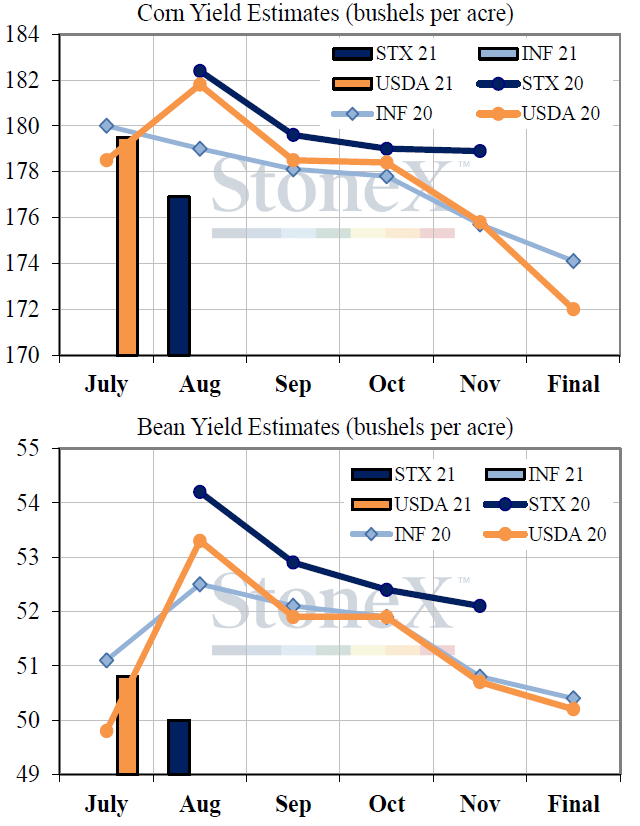

IHS Markit, formerly Informa, has estimated 2021 US corn production at 14.911 billion bushels with an estimated yield of 176.5 bpa. IHS Markit also estimated 2021 US bean production at 4.464 million bushes with an estimated yield of 51.5 bpa. This comes after StoneX estimated the 2021 corn yield at 176.9 bpa and the 2021 bean yield at 50 bpa.

|

StoneX 2021 Corn And Bean Yield Estimates |

|

|

Weather

While the weekend still looks to hold precipitation for key growing regions, the 6-10 day forecasts look to hold higher-than-normal tempuratures along with lower-than-normal to normal precipitation.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

Evolving forecasts have led to mixed trade this week for corn. Last weekend brought rains for southeastern South Dakota, eastern Nebraska and western Iowa, while the rest of this week was mostly dry and hot across the belt. Rains are holding in the forecast this weekend for decent coverage and amounts across problem areas of Iowa and southern Minnesota. The models continue to differ and change, so expect the market to continue keeping a close eye on them. Crop conditions were down 2% this week to 62% good-to-excellent, with increases in the eastern Corn Belt brought down by declining conditions in the Plains. Ahead of next week’s WASDE report, StoneX released their yield survey results on Tuesday. Yield came in at 176.9, which is 2.6 lower than the current USDA estimate. It will be interesting to see how next Thursday shakes out. Export sales were solid this week at 2.7 million bushels of old crop and 32.7 million bushels for new crop, despite a few more cargoes of old crop corn sold to China being cancelled. Export inspections blew the top estimate out of the water at 54.5 million bushels, putting the pace back in line to hit current USDA estimates. Local basis is weaker both in the old and new crop slots.

Wheat

Wheat can be described as topsy-turvy this week. Monday kicked things off with a bang seeing a 30-cent rally. This was mostly due to Russian SovCon cutting harvested acres resulting in a 220-230 million bushel decrease in production. Couple this with issues in the Black Sea region and EU and the rally was on. Spring wheat issues are still being talked about, but this story is getting a tad bit old. The wheat market seems to be running out of steam to finish out the week, seeing yesterday down 13-cents and today starting out down roughly 3-cents. Export inspections for wheat this week were inline with projections at 14.2 million bushels shipped. Export sales for wheat were a little harder to come by 11.3 million bushels were sold, close to low end of trade expectations. This is partly due to the U.S. wheat prices outpacing world pricing at the moment. Not much to report from the crop progress report. Spring got a 1% bump to 10% good to excellent, but we all know this crop is made and its not pretty this year. Harvest is chugging along in the north with the majority of states wrapped up. Funds this week had KC wheat adding to the existing long position 4,020 contracts bringing the long to a grand total of 31,765. No surprise there with the price action we’ve seen in the futures.

Soybeans

Soybeans are trying to regain the sell off the market saw on Tuesday. Weather has been the main factor in beans with few headlines. Export inspections this week were 6.7 million bushels shipped just as trade estimates expected. Export sales were almost nonexistent for old crop with roughly 400,000 bushels sold and new crop at 15.6 million bushels sold for the week ending 7/29/21. Rumors yesterday of China kicking the tires on soybeans cause the market to jump to the green. Today we had a flash sale of 300,000 metric tonnes sold to unknown “China” this morning. Crop conditions saw a surprising 2% increase to 60% good to excellent on Monday. Trade expectations were looking for a 1% drop. Funds showed beans sell off 1,823 contracts bring the current long position down to 94,051 contracts.

Milo

Milo tagging along for mixed trade in corn futures, while basis is weaker. Export inspections were reported at 2.1 million bushels, down from last week’s 3.6 million. Export sales nothing to write home about, with 100,000 bushels in the old crop slot and no new crop sales. Milo sold this week is headed to Mexico, with a small cancellation by the Chinese. Crop conditions were down 4% this week, at 62% good-to-excellent. Kansas conditions were down 1% to 66% good-to-excellent. Milo in our area is headed out by and large, with many areas desperately needing a drink.

Trivia Answers

-

The #hashtag! According to the Merriam-Webster dictionary, the "octo-" prefix refers to the eight points on the popular symbol, but the "thorpe"...well, no one knows.

-

The unicorn. Yep, you read that right. UNICORN.