Weekly Market Update 12/2/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Which country did eggnong come from?

-

Which one of Santa's reindeer has the same name as another holiday mascot?

Answers at the bottom.

Market News

-

Over the past week the 10-Year Treasurey has traded a 28 basis point range and is one of the largest 5 day moves since early 2020. The bond market has seen some volatility with the discovery of the omicron COVID variant, and FED Chairman Powell stated that it is time to retire the word "transitory" in regards to inflation. FED also looks to start raising rates as early as May, with a minimum of 2 rate hikes by the end of 2022.

-

Stock markets took a dip late Wednesday on omicron variant news and Chairman Powell's comments, but have seen some recvoery into Thursday. DOW is up 617 points, S&P 500 up 64 points, and NASDAQ up 127 points.

-

Crude oil up 1.80/bbl after this morning's dip, closing at 67.37/bbl.

-

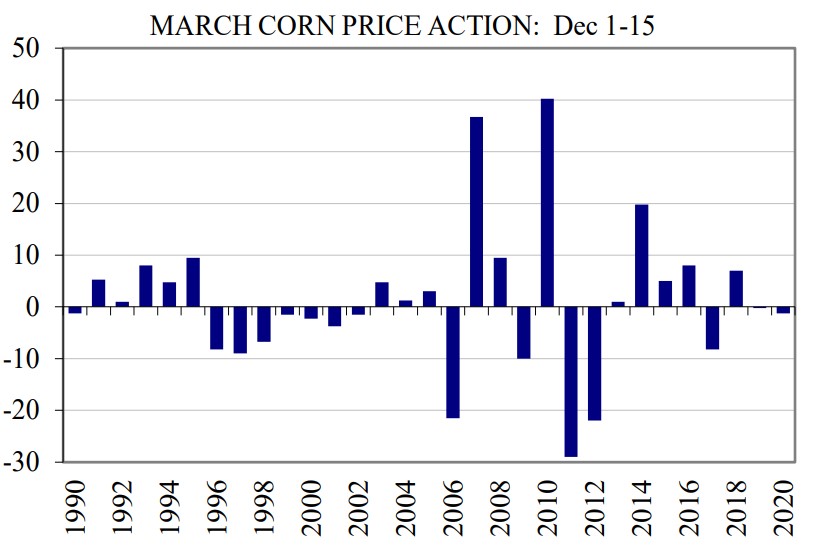

March corn price action could swing either way, though in recent history the "abnormal years" tend to see downside into on March futures into the beginning of December, like in 2012 and 2020. Farmer selling has been hot with inflated prices, as input costs continue to rise.

| MARCH CORN PRICE ACTION |

|

|

Weather

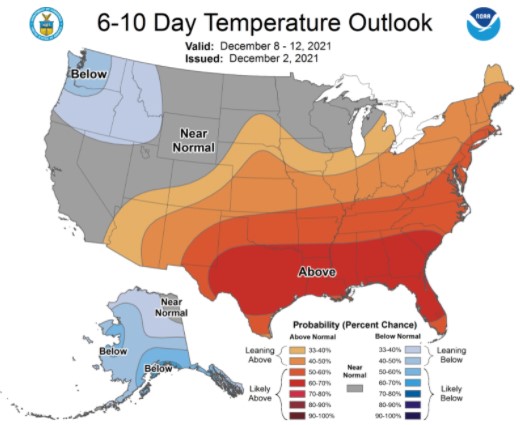

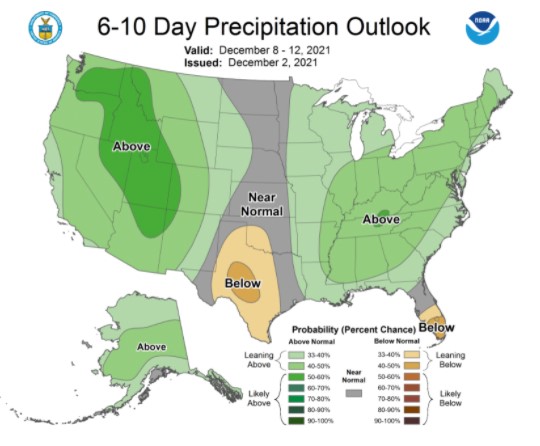

Looking ahead at the forecast, weather overall looks to stay warmer than normal with precipitation about normal for this time of year. Even with the warmer, southwest Kansas could see some highs as low as the 40's and some overnights dip into the teens. Winter wheat is in need of some moisture, as well as cooler temps.

|

|

Corn

Corn was able to hold off COVID fears Friday and finish in the green, buoyed by a better-than-expected and marketing-year high Export sales report. The momentum wouldn’t hold for Monday and Tuesday and saw bulls tamed and shut up. Month end sell off and COVID fears saw the corn market erode quickly. Ethanol production has kept us in the green yesterday and helping today as well as corn following wheat’s lead. Production showed 1,035K barrels per day, down from last week’s 1,079K, but up from 974K in the same week last year. Corn export inspections were inline with trade estimates at 30.2 million bushels shipped. Export sales were decent as well with 40.2 million bushels sold. Mexico was the number 1 buyer at 16.7 million bushels followed by Canada at 7.8 million bushels. Funds showed corn as buyers with 25,556 contracts being added to the current long of 366,691 contracts. Be on the look out next Thursday for the USDA WASDE release.

Wheat

Last week’s news of a new COVID variant found in South Africa sent the markets tumbling down. World wheat markets were also sharply down. Throw in end of the month sell off from funds and you create a $1 sell off quickly. KC wheat seems to be rebounding a bit today. Overall worldwide supply concern remains, and we should be back in the green once the COVID news runs its course. Australia is looking at a bumper wheat crop, but heavy rains have knocked the top off and issues regarding quality remain a high concern. Export inspections this week were steady according to trade estimates at 9.2 million bushels shipped, HRW was the leader at 4.4 million bushels. Export sales were ugly with 2.9 million bushels sold, well below the average trade guess. Last Friday’s CFTC report pegged KC wheat as buyers of 5,049 contracts bringing the current long to 65,609 contracts. Expect tomorrow’s CFTC report to show funds as sellers. Crop progress showed Winter Wheat condition for the U.S. as unchanged at 44% good to excellent. Kansas jumped 1% to 62% good to excellent well ahead of the 5-year average of 44% good to excellent.

Soybeans

Soybeans are on the rebound today and look to have stopped the bleeding for now. Along with all the other commodities the new COVID variant omicron led to hard downward pressure from the end of last week and into the beginning of this week. Today beans seem to be playing follow the leader and look to finish in the green for a second consecutive day. The bigger story that has been developing is the South American bean crop. Weather has continued to be conducive to a good crop so far and planting is nearly complete in Brazil. U.S. demand will be the focus next week in the USDA WASDE report. Without an increase in domestic crushings the expected drop in Chinese demand will lead to the carry out being increased and a bearish outlook for beans. Export inspections were strong to start the week out pacing the trade estimates at 78.7 million bushels inspected to ship. Export sales were ho-hum at 39.1 million bushels sold, toward the lower end of expectations. Funds from last week showed beans as buyer adding 19,868 contracts to the current long 49,356 contracts.

Milo

Milo seeing a little pop this week with China buying 13.3 million bushels of milo, 4.7 million bushels of that was a shift from previous “unknown” purchases. Export inspections reported 7.5 million bushels shipped.

Trivia Answers

-

England

-

Cupid