Weekly Market Update 12/30/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

When was the first "time ball" drop on record?

-

When did the New Year's Eve Ball first drop in Times Square?

Answers at the bottom.

Market News

-

Happy New Year from Garden City Cooperative! We will close at noon on New Year's Eve and be closed New Year's Day.

-

Outside markets look to ride the rally into the first of the year. Stock markets are off recent historic highs, but still quite strong. DJIA trading around 36,500, S&P 500 trading around 4,800, and NASDAQ trading around 15,850. Crude is off the highs of November, but still trading strong as well, around 77.00/bbl.

-

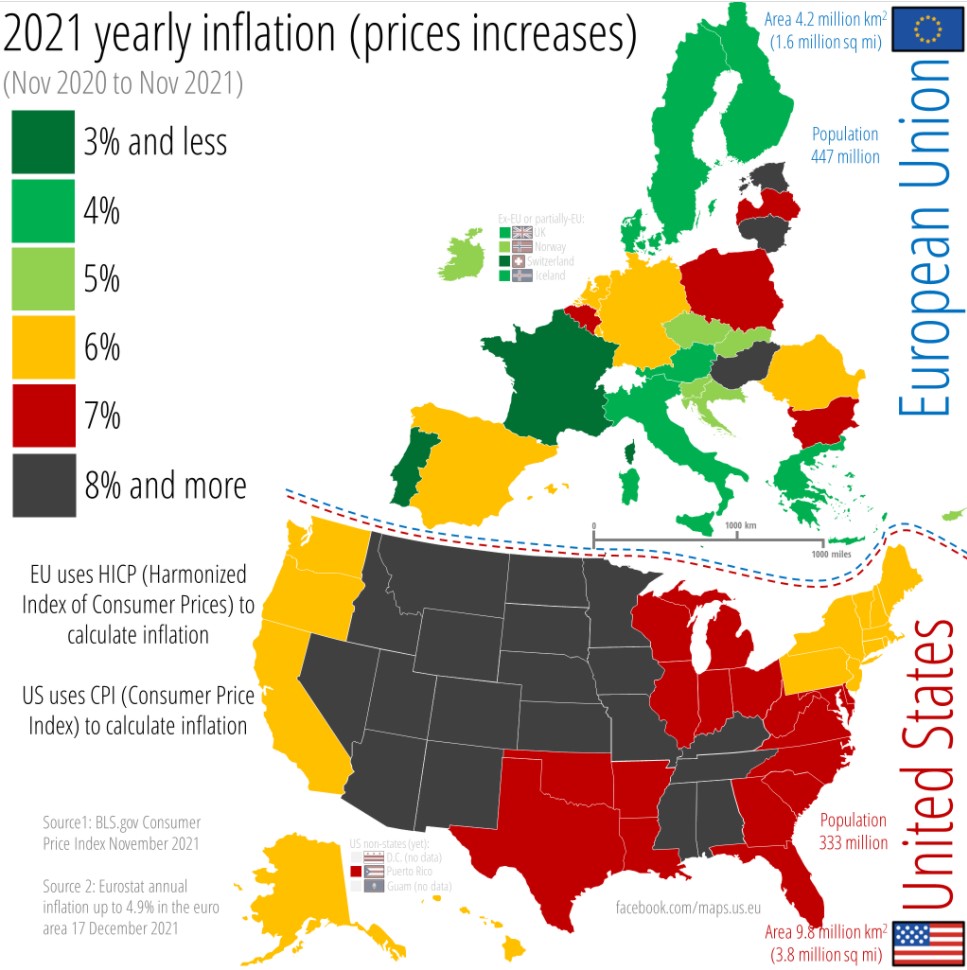

Inflation is hitting 30-year highs as the Midwest is taking the brunt of price increases. Some sources say the midwest has seen a 7% increase while other sources report an increase in excess of 8% in the heart of the U.S. According to Yahoo!Finanace, Gus Faucher chief economist at PNC Financial Serivces Group, believes that the U.S. will see a slowing of inflation over 2022.However he also states that inflation will run a bit higher than what the Fed wants.

| 2021 INFLATION (NOV 2020-NOV 2021) |

|

|

Weather

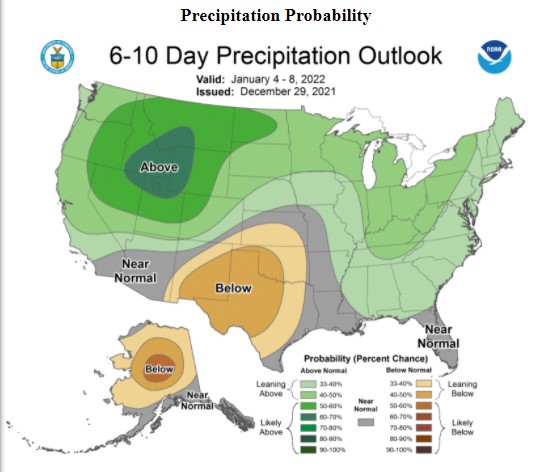

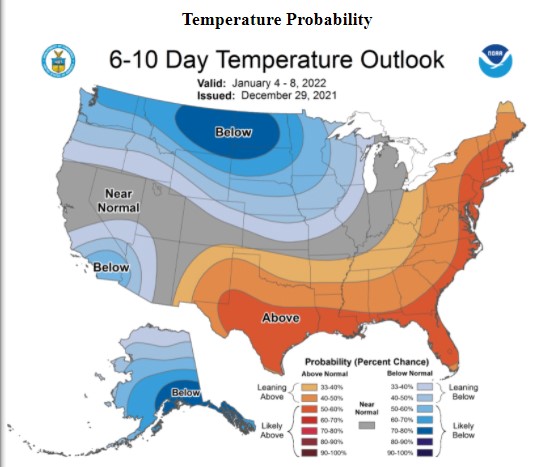

Southwest Kansas has a chance of snow heading into the weekend, but forecasts aren't predicting enough to make an impact on soil moisture. 1-2" of snow expected Saturday with highs in the teens. The 6-10 day forecast has precipitation continuing below normal with temps in the normal range.

|

|

Corn

Tuesday’s massive commodity sell off has set the tone for this in-between holiday week, as corn seems content to continue to slip lower headed into the end of the year. South American weather has been the big fundamental focus, as analysts lower their Argentina and Brazil corn production numbers in light of dry conditions in the southern region. Rains have creeped into the forecast for areas suffering, which is certainly putting a damper on the market. Likewise, dry parts of the Eastern Corn Belt have received much-needed precipitation in the last few days with more looking to come. Export sales this week were better than expected, at 49.1 million bushels of old crop and 2.4 million bushels of new crop. Inspections were reported at 28.3 million bushels, down from the previous week at 39.4 million. This week’s EIA data showed ethanol production up 8K barrels/day week-on-week to 1,059K barrels/day. Managed money continues to flow into commodities, with the funds reported this week as adding 14,436 contracts to bring their net long up to 360,416 contracts.Wheat

It’s been an ugly week for wheat, with both the March and July contracts down over 35 cents. News on continued tensions between the Ukraine and Russia has been limited this week, but you can bet that the trade will have a sharp eye on the conflict between USDA’s estimated #1 and #2 exporters of wheat. President Biden is scheduled to discuss the Russian troop buildup with Vladimir Putin later today. Global wheat production estimates are creeping up, with both Russia and Argentina getting bumps in analysts’ estimates of their crops amid favorable weather conditions. Meanwhile, U.S. wheat country is in desperate need of a shot of moisture with a winter storm forecasted headed into the weekend. Export inspections were overall disappointing for the wheat complex this week, but HRW provided a bright spot at 7.0 million bushels – the highest reported in over a month. Export sales were reported at 7.3 million bushels for all wheat and 3.2 million for HRW, both sub-par numbers. Monday’s CFTC report had managed money adding 1,643 contracts to bring their net long up to 58,807 contracts.Soybeans

Volatility has been the name of the game for beans this week, and today’s big dip is no exception. Like corn, South American weather has been a focal point. Northern areas of South America have received enough rain that some parts are flooding, while the dry southern region has been receiving much-needed moisture. Depending on what flooded areas mean for early harvest, it could be good for U.S. export demand. Strong crush margins have boded well for domestic crush demand, with crushers struggling to get enough beans to cover their needs. Export inspections this week were inline with estimates at 58.0 million bushels, but still well below the 10-week average of 87.4 million. Export sales were lackluster at 19.3 million bushels of old crop and 2.8 million bushels of new crop. While disappointing, it’s not surprising as the last two weeks have been relatively quiet on the bean booking front. Monday’s CFTC report indicated that the funds were net buyers of beans, adding 31,949 contracts to bring their net long up to 72,924 contracts.Milo

Corn futures have pressured milo cash prices this week, while basis has remained steady in the area. Export inspections were down week-on-week, but still strong at 6.9 million bushels. Export sales were reported at 7.2 million bushels, which was decent but did include some cancellations. China is still the big kid on the block, as the destination for virtually all shipments and the largest buyer this week, but we haven’t yet seen basis values pop in a big way.Trivia Answers

-

1833

-

1907