Weekly Market Update 2/04/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

1. Who is the only player from a losing team to be awarded Super Bowl MVP?

2. Which city has hosted the most Super Bowls?

3. Who is the youngest coach to win the Super Bowl?

Answers at the bottom.

Market News

- The US Dollar Index has been steadily quiet this week, trading in the $90-91 range. The DJIA has been a slight, but steady riser with highs breaking 31,000. NASDAQ has been trading similar to the DJIA gradually stronger through the week. S & P is up over 100 points on the week and seeing some strength.

- Global oil prices extended gains today continuing to be supported by production cuts. Crude oil has shot up nearly $4.00 through the week reaching new highs in over a year with highs above $56/bbl.

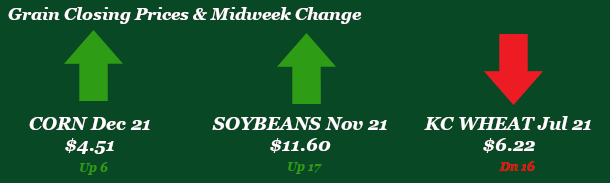

- Flash sales for corn have added support for the week. Hard red winter wheat is weaker and soybeans have been steady this week with little change. China continues to be a buyer in U.S. corn with 228.3 mbu for the week ending 1/28/21. Brazil’s corn crop estimated yield is 4.1bbu, down from the estimated 4.3bbu.

- USDA will publish the February WASDE next Tuesday (2/9) at 11AM. While normally a snoozer since it comes after a trainload of January reports, this one may be different because of massive Chinese corn purchases and a historically tight soybean balance sheet.

|

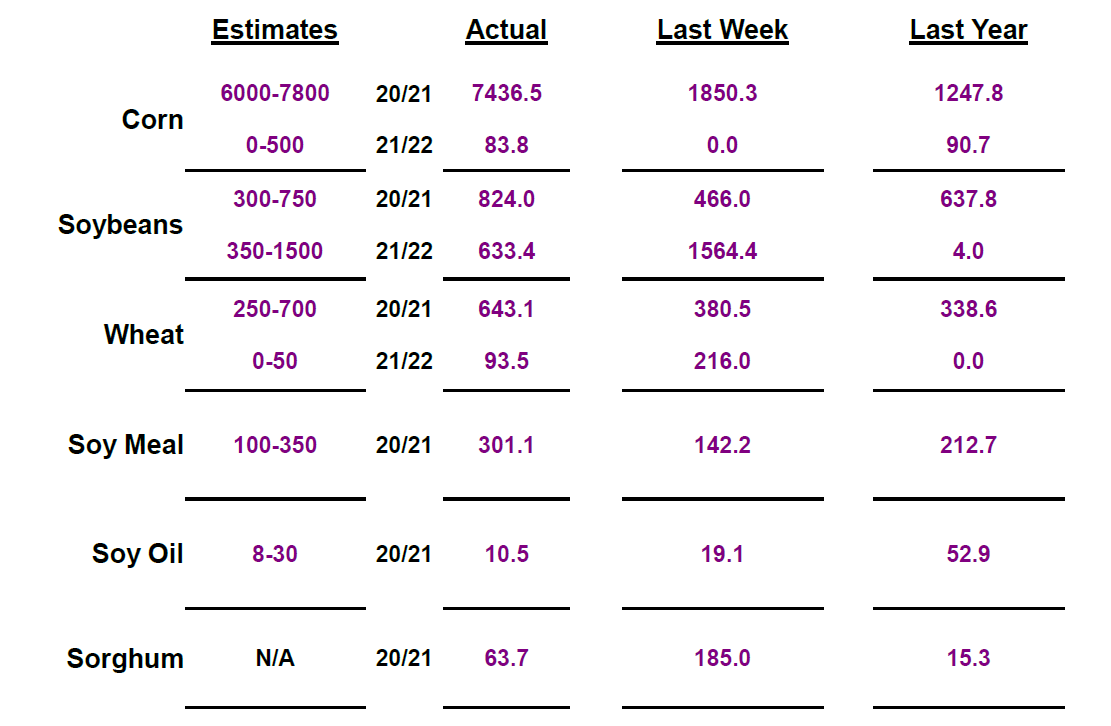

Export Sales Snapshot (in thousand tonnes) |

|

Weather

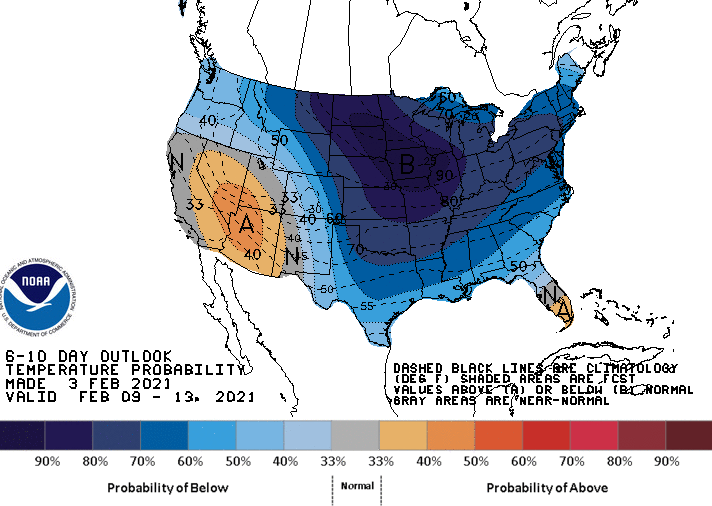

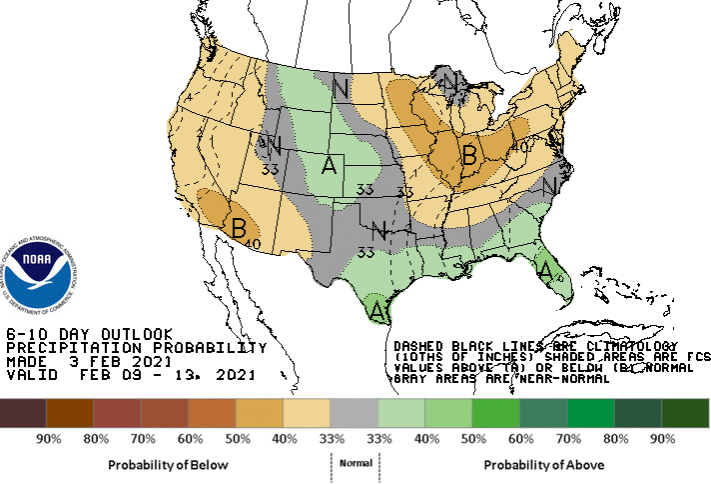

Warm and breezy to start this week. Temps were unusually warm for the beginning of February, with highs close to or above 70. Look for the weather to cool back down going into the weekend with highs in the 40s & 50s, then get your winter coats back out as next week will be cold and dry. Highs will be lucky to get above freezing in some areas with lows breaking into the single digits.|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

The month of January went out on top as corn futures gained a whopping 63 cents! Front month corn also exceeded the 5.50 level for the first time since 2013 this week. Then CH made new highs again today, topping out at 5.58. CZ has made some small gains this week after the pressure of last week, flirting with 4.50 levels. While CZ levels are off their recent highs, futures still hold desirable levels for contracting new crop bushels. As for CH, well, selling 5.50 corn that was placed in the bin while futures sat around 3.80 never hurt anyone. CFTC had funds long at 364K contracts as of Friday’s report and current fund positions are estimated at 384K. Monday’s export inspections came in at 43.5 million bushels versus 55.2 million bushels last week. Ethanol production increased slightly for the week at 936K barrels per day versus last week’s 933K barrels per day. On the comparable week last year, ethanol production held 1.081 million barrels per day in production. Over the past 6 weeks ethanol output has stalled at the 933-945K range. Export sales this week held big news for corn as expected, coming in at 292.8 million bushels versus 72.8 million bushels last week. Chinese buying has halted over the past week but likely sets the USDA up for a massive corn export sales figure.

Wheat

Wheat has traded both sides this week, but mostly weaker from direction in row crops and daily fund selling. Friday’s CFTC report indicated that the funds were buyers of wheat, adding 2,146 contracts to bring their net long up to 60,239 contracts. However, selling put pressure on the market Tuesday and Wednesday. Rumors continue to float about export taxes on wheat out of Russia – the market will continue to look for news on that front. Domestic milling and baking markets seem softer as the pipeline remains full, but wheat feeding has provided support in the western part of wheat country. Wheat continues to slowly trade into feed markets in western Kansas and the Texas and Oklahoma panhandles. Export inspections this week were somewhat lackluster at 3.6 million bushels, down from last week’s 5.2 million. Top destinations included Japan, South Korea and Thailand. Export sales were near the top of the range of estimates at 6.9 million bushels, up from last week at 4.0 million bushels. There were also 1.4 million bushels of new crop sales. Basis remains steady locally, with cash levels still attractive. Much of our draw area received much-needed moisture in the last week but more would certainly be welcome, especially in our southern territories.

Soybeans

Despite choppy daily trade, soybeans are up on the week. Rain continues to fall in Brazil, while parts of Argentina remain dry. Crop estimates for South America have been raised, with more increases possible when harvest gets going. It will be interesting to see where USDA pegs the South American crop in next week’s WASDE. USDA reported December crush at 193.8 million bushels on Monday, in line with trade estimates and setting a new all-time high for the month of December. Record crush, paired with strong exports, continue to make every bushel count as we head towards possibly record low soybean ending stocks. This will be another interesting estimate to look for from the USDA next week. Export inspections were above trade estimates at 65.9 million bushels, which is still well ahead of the pace needed to hit the USDA estimate. Export sales were better than expected, at 30.3 million bushels in the old crop slot and 23.3 million bushels in the new crop slot. An important headline to follow in terms of exports is rumored ASF in Chinese hogs. Expect continued volatile trade based on daily headlines ahead of next week’s WASDE.

Milo

Milo prices are still riding the corn futures roller coaster as basis stays pretty hot. 5.00 new crop milo is definitely an attractive contracting level. Export inspections pegged sorghum at 7.5 million bushels versus 7.1 million bushels last week while export sales this morning sat lower at 2.5 million bushels.

Trivia Answers

1. Dallas Cowboys linebacker Chuck Howley was named the MVP of Super Bowl V despite losing to the Baltimore Colts.

2. Miami, Florida has hosted 11 Super Bowls.

3. Mike Tomlin was 36 years old when he led the 2008 Steelers to a victory over the Cardinals in Super Bowl XLIII.