Weekly Market Update 2/11/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

- Valentine’s Day is the second most popular day of the year for sending cards. What is the first most popular day?

Market News

-

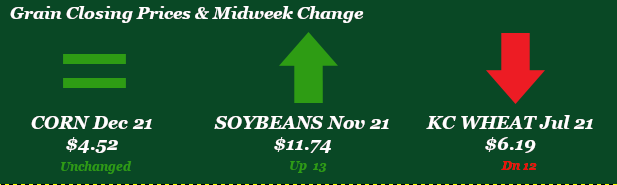

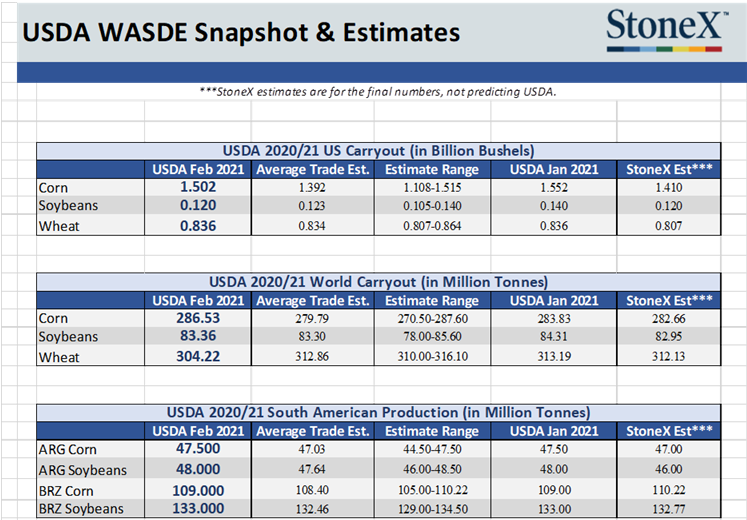

Commodity markets saw pressure this week as Tuesday’s WASDE report was mostly a dud, especially for corn. The market was expecting big increases for corn exports in light of recent Chinese purchases, but USDA only printed a 50 million bushel increase. Beans and wheat were left relatively unchanged. See the below graphic and commodity summaries for more info.

-

The US Dollar Index is weaker this week, trading in the $90-90.5 range. DJIA has been gaining ground, trading in the neighborhood of 31,400 today, S & P having a relatively quiet week.

-

Global oil prices made more gains this week, supported by continued rebounding fuel demand. Despite weakness today, crude oil is up ~$2.00 on the week, currently trading around $58/bbl.

-

With WASDE in the rearview mirror, markets will largely be turning back to watching exports and the South American weather situation in absence of any other major headlines.

|

February WASDE Snapshot |

|

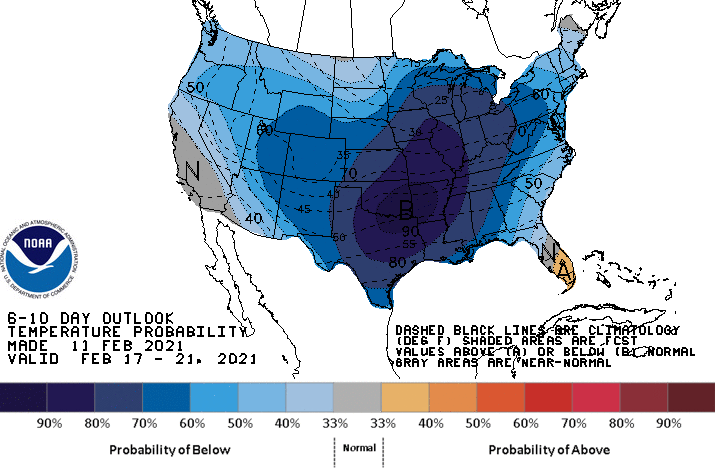

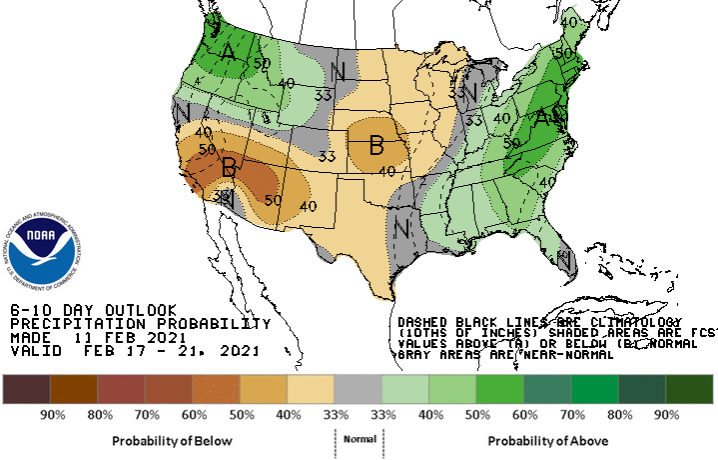

Weather

It has been cold and looks to remain cold, with single digit highs and negative lows headed into the weekend and into next week. Temperatures are forecasted to get back in the 30’s towards the end of next week. Much of our area has received some moisture in the form of snow and ice, with chances for more over the weekend.|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

The week started out with a bang in anticipation of the WASDE closing at $5.64 up 15cents. Then the big news came with the February WASDE report, most expected the USDA to lower all corn stocks much more than they did. With this news corn drop dramatically off multi year highs for old crop Tuesday morning and hit limit down on Wednesday with little news to rally from and a cancellation of 5.1 million bushels export sale. Thursday looks more promising coming of lows to close at $5.41. For this week corn is down roughly .23cents. New crop saw the same reaction as old crop but looks to be hanging around the $4.50 range. Corn exports were down compared to last week’s 292.8 million bushels, but in the expected trading range. The week ending 2/4/21, old crop corn sales are 57.0mbu. CFTC had funds long 345K contracts as of Friday’s report. U.S. ethanol production for the week ended 2/05/21 with 937k barrels per day. Production was nearly unchanged from the previous week's 936k barrels per day, continuing the extremely consistent pace over the past 7 weeks.

Wheat

Wheat has struggled this week, following the direction of row crops. USDA left the domestic wheat balance sheet unchanged in the February WASDE. One number that was being watched was feed usage, but with USDA leaving the corn balance sheet alone and questions lingering about what extent wheat will be fed, USDA kicked this can down the road. Global production was up 800k tonnes, and global ending stocks down 9 MMT, primarily on decreases in China and India. Export inspections this week were a strong 5.2 million bushels, up from last week at 4.0 million. Export sales were solid at 7.8 million bushels, also up from last week at 6.9 million. Friday’s CFTC report indicated that managed money were net sellers of wheat this week, bringing their net long down almost 4,000 contracts to 56,401. Russia announced this week that they would be implementing a formula-based export tax starting June 2nd – there are still a lot of questions surrounding this, but importers will be keeping a close eye as this develops. This week’s cold blast across the Plains has traders concerned about the possibility of winter kill, but moisture has been welcome and precipitation chances remain above normal for the coming week.

Soybeans

Beans are seeing some recovery today after yesterday’s sharp correction. While beans were mostly left at status quo in Tuesday’s WASDE report, market disappointment in the corn balance sheet put pressure on the other commodities. USDA lowered US carryout by 20 million bushels to 120 million bushels, with a like increase in exports. This was in line with market expectations. All other elements of the US balance sheet were left unchanged. World carryout was lowered 1 MMT. South American production was left unchanged. Argentina is forecasted to remain dry for the next two weeks, while Brazil is forecasted to receive some precipitation. Both countries remain behind average harvest progress, but as Brazil gets further into harvest, we should get a better feel for their production. Export inspections this week were in line with estimates at 66.2 million bushels. Export sales were above estimates for old crop, at 29.6 million bushels. New crop bean sales were reported at 6.6 million. Sales to date are 20% ahead of USDA estimates. Beans should continue to see support with such a tight carryout, strong export demand, and continued South American issues.

Milo

Board pressure from disappointments in the US corn balance sheet have dampened cash prices, but local basis remains strong in old crop and new crop slots. Export inspections were a solid 7.9 million bushels this week, with all of it headed to China. Export sales were at 4.3 million bushels in the old crop slot, up from last week at 2.5 million bushels. China was this week’s only buyer. Milo export sales are currently 23% ahead of the USDA export estimate. Tuesday’s WASDE report left sorghum supply and use at virtually unchanged, with 5 million bushels of domestic use shifted to exports. Cash prices are still incredibly attractive for both old and new crop and are worth some consideration.

Trivia Answers

Christmas