Weekly Market Update 01/14/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

1. How many one-pound loaves of white bread can be made from the flour of one bushel of wheat?

2. Speaking of bread... how many sandwiches does the average American eat in a year?

Answers at the bottom.

Market News

- What a wild week of markets. This week's WASDE report left bulls in the driver's seat, with corn trading up the limit in the front three trading months on Tuesday. The markets have continued to grind up the rest of the week, finding support from a solid export sales report this morning. We have blown through resistance levels, but we will need to continue seeing bullish headlines to support these levels. Cash price is attractive in both old and new crop slots across the commodities.

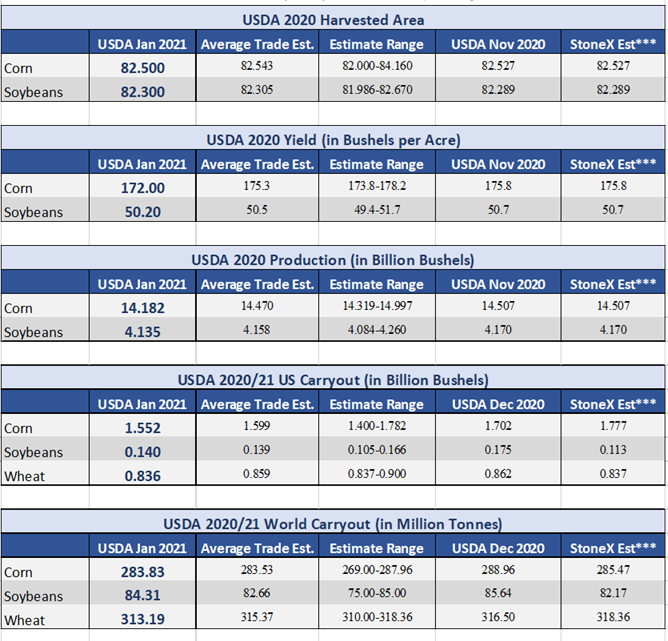

- This week's headline was the January WASDE released on Tuesday. USDA fed this bull market with a larger-than-expected corn yield deduction that pushed the corn carryout down to 1.552 billion bushels. Soybeans also had a reduction in yield that pushed an already tight carryout down even more.More detail can be seen in the snapshot below, as well as within the commodity summaries.

- After lackluster export sales last week, today's report had solid numbers for corn, soybeans, and milo. Wheat was disappointing, coming in below the low end of estimates.

- The market continues to keep an eye on what's happening politically as we prepare to transition administrations. Outside markets are higher, while fresh economic news and data remains scarce. With WASDE out of the way, commodity markets will turn back to following South American weather, exports and domestic demand.

January WASDE Snapshot

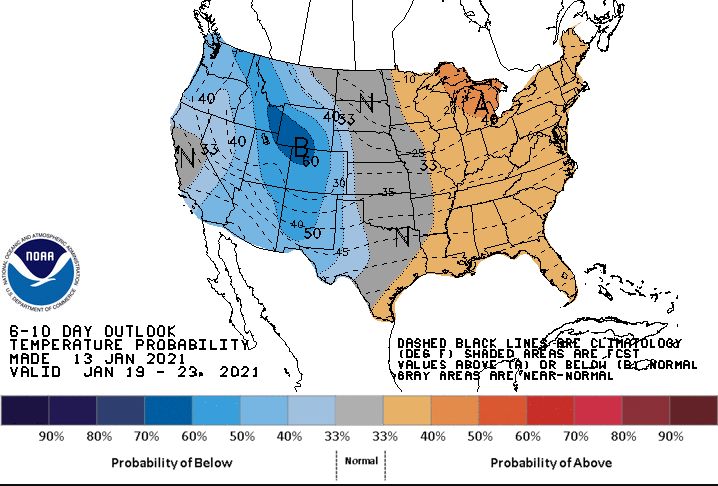

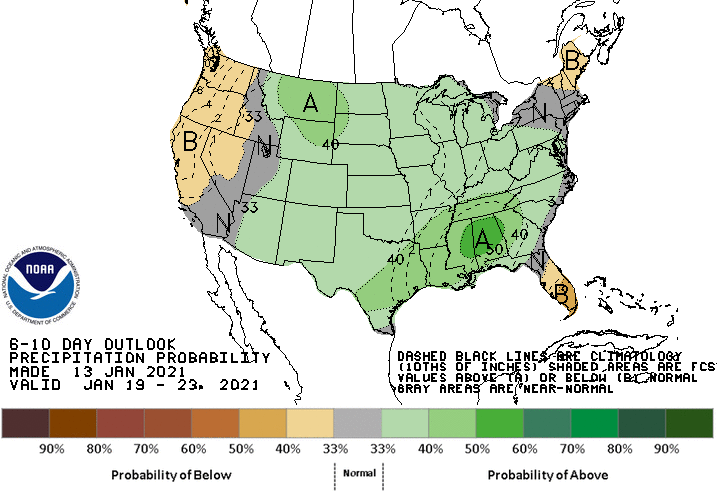

Weather

The wind is howling across our draw area today, with much of the region under high wind warnings through tomorrow. Temperatures look to remain steady in the extended forecast, with highs in the 40s and 50s and overnight freezing temperatures. Precipitation looks unlikely, with rains needed in SWKS for growing wheat.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

Corn has seen some great moves over the past week, largely in part to Tuesday’s USDA report and this morning’s export sales report. Over the past week corn has gained 27 cents and made new highs, topping out at 4.65 1/2. The big news on USDA’s WASDE was corn bpa coming in at 172.00 versus 175.8. US carryout was also lower from 1.702 billion bushels to 1.552 billion bushels while world carryout sits at 283.83 million tonnes versus December at 288.96 million tonnes. Dec 1 stocks set at 11.322 billion bushels versus the average trade estimate of 11.951. Exports added to the rally this morning as corn sales came in at 56.6 million bushels versus the 10-week average of 52.6 and last week at 29.5 million bushels. Ethanol demand dropped this week while stocks rose adding a little pressure to the market. The question as we progress into 2021 is where does corn top out. It seems to continually make new highs. Legging into contracting is never a bad idea at these levels. Locally, basis seems to feel weaker for corn.

Wheat

Wheat closed up double digits again today on its ride to the top. Bullish stories keep feeding this rally daily it seems. The week started big with the news that Russia had imposed their new export tax on wheat trying to leave the country. This had traders confident that export supplies would suffer and that set the foundation for the huge move to come. With the stage set, all eyes moved to USDA for the release of the WASDE report. It did not disappoint and brought fireworks to the market. US carryout was pegged at 836 million bu. which was reduced 27 million bu. Vs the Dec WASDE. World carryout was also reduced over 3 million tons. This sent the market into a frenzy. We closed up 26 cents on the July 21 contract but traded as high as up 30 following the report’s release. Export sales this week were disappointing. Wheat posted a 221,900 ton number. This failed to reach even the bottom end of the trade estimate. The CFTC report from last Friday had managed money down slightly bringing to new net long to 55,457 contracts. We expect tomorrow’s new report to be drastically different after what has transpired this week. All in all, wheat is on a serious heater. Barring production risk wheat producers should really consider taking advantage of these prices.

Soybeans

Soybeans continue their massive rally up 24 today at the close. Beans have seen unprecedented gains in the last month. We have had a near 3-dollar rally in the March contract since the beginning of December. The market is begging for bushels right now as is evident with the $2.34 inverse between old crop and new crop. The WASDE on Tuesday gave a major boost to beans led by a reduction in yield by .5 bushels. This in turn led the 2020 production to be reduced by 35 million bushels which is well below the trade estimate. South America continues to be dry, keeping the bulls well fed. Export sales roared back this week after last week’s dud. Soybeans had a 908,000 ton number which crushed all of the estimates and led to a major up day today. CFTC report from last Friday had beans down around 20,000 contracts for the week putting them a total of 175,827 contracts long. Again, this will surely change on tomorrows report after the huge rally this week. Beans continue to be in the driver’s seat and as long as South America stays dry momentum will remain in their favor.

Milo

Milo has been along for the futures ride this week, with attractive selling opportunities in old and new crop. After last week's disappointing zero, milo export sales were back on track this week at a solid 7.5 million bushels. This is above the 10-week average of 7.1 million. Old crop demand is becoming harder to nail down, making it likely that basis could weaken. New crop demand is steady, with basis improving at our locations at today's close.

Trivia Answers

1. According to the Kansas Wheat Commission, one bushel of wheat yields enough flour to make 70 one-pound loaves of white bread.

2. The average American eats 193 sandwiches in a year. That's a lot of sandwiches!