Weekly Market Update 01/21/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

1. What Kansas crop contributes to making packing peanuts?

2. Since we are on the subject of Peanuts, do you remember the line up of Charlie Brown’s baseball misfits?

Answers at the bottom.

Market News

- This week has held a change of administration for the United States as President Joe Biden was sworn into office on Wednesday, January 20th. The first item on his agenda was a decision to revoke a permit for the Keystone XL Pipeline that is an extension of the Keystone Pipeline that has carried Canadian crude oil to the U.S. for 12 years. Added to the pipeline revoke, President Biden is leading the U.S. into rejoining the Paris Accord as well as the World Health Organization.

- U.S. Dollar weakness continues as the dollar lost roughly 0.6% since the start of the week as the hope for recover wanes. Crude oil has managed to hold between $52-53/bbl for the week and trading 6-month highs. Stock markets have been trading tremendously even before the administration change. Both the Dow Jones Industrial Average and NASDAQ are trading at all-time highs with the DJIA at 31,225~ and the NASDAQ at 13,520~.

- Flash sales for soybeans, corn, and hard red winter wheat this week have added support to the market. NOPA crush numbers weighed heavily on soybean futures at the start of the week. The weather in Argentina and parts of Brazil has still been left wanting with needs for rain in many areas. The ongoing truck strike in South America looks to be indefinite. Mexico looks to no longer import GMO corn.

|

Weather

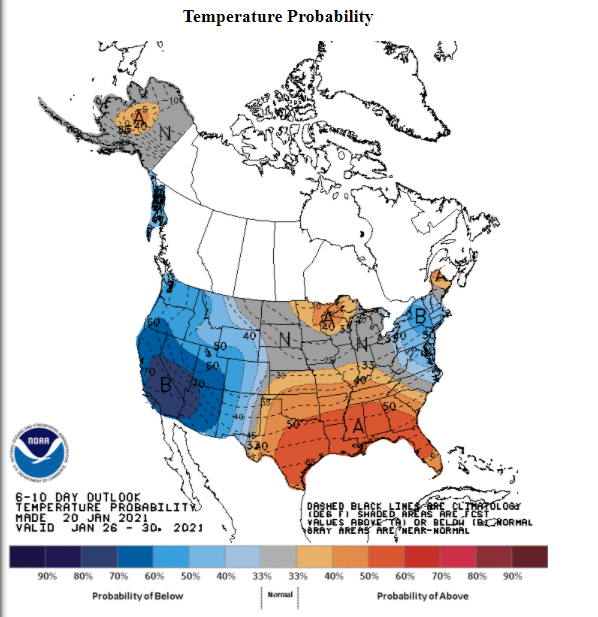

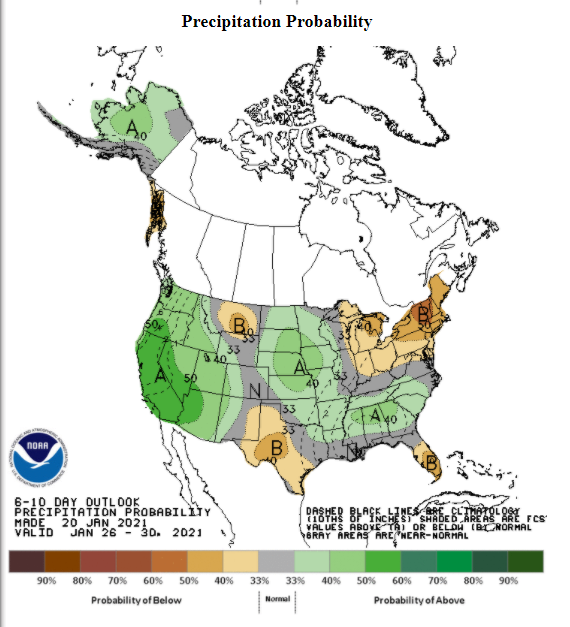

Temperatures are staying warm and breaking the trend. We see high’s in the 50’s going into the weekend before we get a little cool off to start next week. Looking at the 6-10 day we see temperatures remain above average. We also see a slight chance of moisture returning next week. This wheat crop could really use some moisture after the great start we had earlier this fall.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

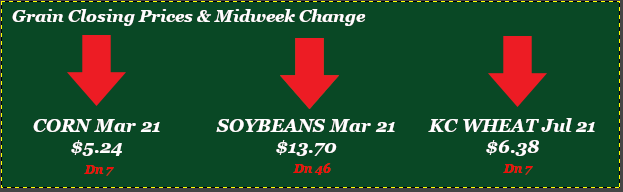

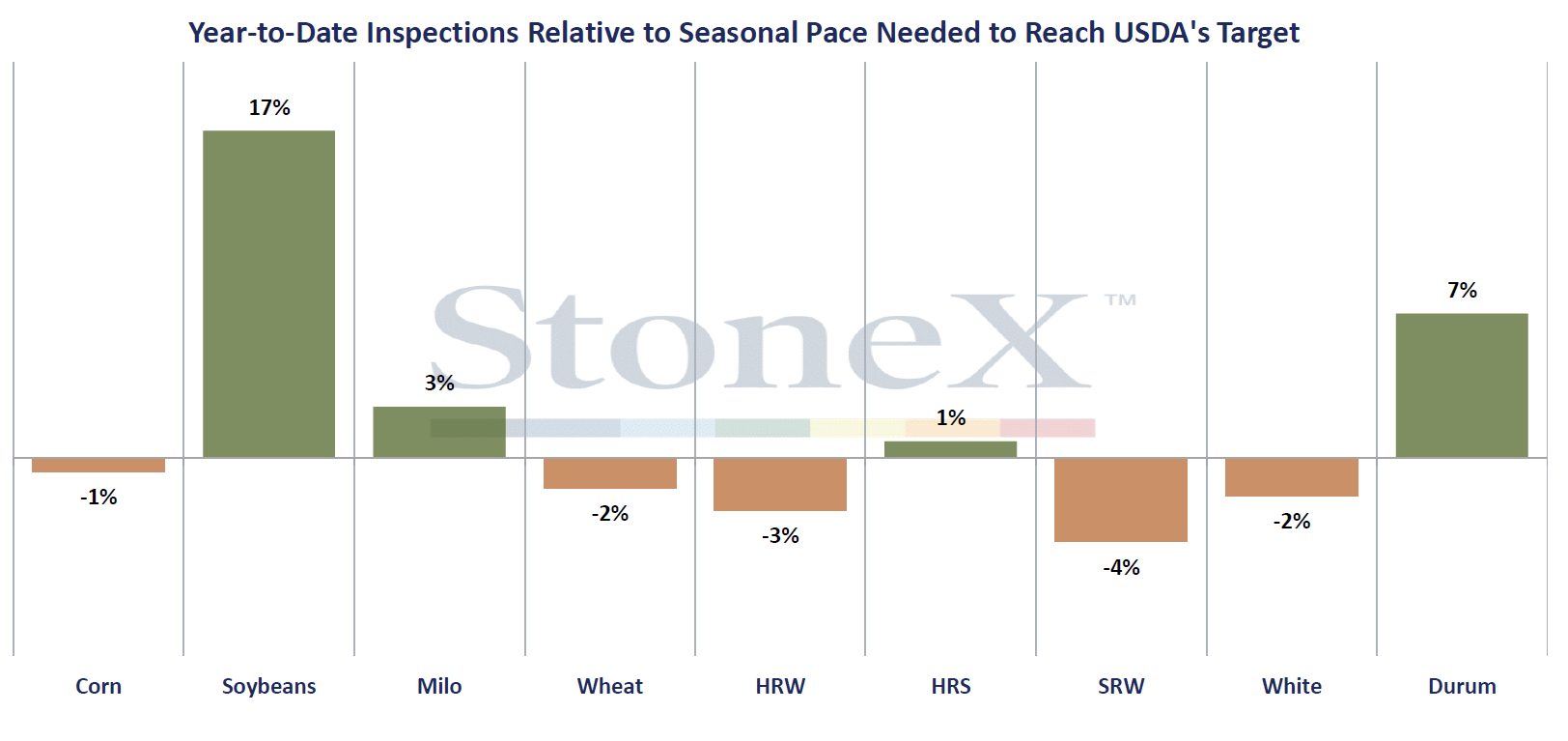

Corn

Corn has seen a less-than-enthusiastic week after last week’s USDA report. Friday’s CFTC report had funds still holding longs at 374K for the week prior and estimated funds currently sit long at 367K. While the markets took Monday off, Tuesday seemed to see little strength for corn with the days to follow offering no hope. Flash sales were fairly promising as the U.S. saw sales to Mexico, Japan, Israel, Taiwan, and unknown. Tuesday’s export inspections report had corn at 34.5 million bushels versus the 10-week average of 37.4 million bushels. According to Bloomberg, China’s Ag Ministry approved 2 new GMO corn varieties for import. This comes as hog production is reaching 88% of pre-swine flu levels. Export sales report is delayed until Friday. Ethanol report is delayed until Friday also. Informa has 2021 corn acres estimated at 94.2 million, 3.4 million above 2020. Locally corn basis has stayed flat.

Wheat

Wheat has lost slowly grinded down in a small way this week after last week’s huge rally. Supply issues in the EU and Black Sea regions remain a hot topic, as Russian export estimates are declining on top of an additional export tax increase. There are also rumors of coming export restrictions on wheat coming out of Argentina. These headlines, along with the fact China has sold 30 MMT of wheat out of their reserves since October (compare this with 1 MMT last year), are keeping traders’ eyes on the global supply situation and could bode well for US wheat. Last Friday’s CFTC report indicated that the funds were small buyers of KC wheat, adding 605 contracts to bring their net long up to 55,062 contracts. Export inspections this week were in line with estimates, at 3.6 million bushels compared with the 10-week average of 4.8 million. Mexico was by far the largest destination. We won’t have an export sales report until tomorrow with the short week. Locally, basis remains mostly steady, with wheat trading into feed in many parts of our region. It will be interesting to see what that means for corn. Along with what’s happening with wheat exports, expect the market to keep a close eye on South American weather and its implications for row crops. Cash levels remain attractive across our region – we haven’t been near these levels in about three years – so is it worth considering what could make sense for your operation.

Soybeans

This short week has been rough on soybeans after South America realized some rains over the weekend. Brazil has continued to receive some rain through the week, with precipitation in the forecast through the 10-day. Argentina is forecasted dry this week, with some rain in the forecast in the 6-10 day. This week we got December 2020 crush numbers – and although below the average trade estimate, the 183.2 million bushel crush number set a new record for the month of December. This was also up from November 2020 at 181.0 million and last December at 174.8 million. Cumulative 2020/21 crush is at 711 million bushels, already 42 million ahead of last year’s pace. USDA is currently estimating only a 35 million bushel increase year-on-year. Export inspections this week were above the range of estimates at 75.6 million bushels, with the majority of the bushels destined for China through the PNW and the US gulf. The funds were buyers of beans again this week, adding 9,342 contracts to bring their net long to 166,485 contracts. Expect the market to continue watching South American weather in the days to come.

Milo

Old crop milo demand is hit or miss as basis values hold steady. Not too much news for sorghum this week with the export sales report delayed until Friday. Milo export inspections came in at 6.3 million bushels versus the 10-week average of 7.2 million bushels. Local elevator basis saw a little downside movement this past week.

Trivia Answers

1. Sorghum

2. 1st Base – Shermy, 2nd Base – Linus, 3rd Base – Pig Pen, Short Stop – Snoopy, Right Field – Lucy, Center Field – Patty, Left Field – Violet, Catcher - Schroeder