Weekly Market Update 01/28/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

1. Where were the Kansas City Chiefs located before moving to Kansas City? Bonus: What was their original team name?

2. At one time, the Kansas City Stockyards were the second busiest in the nation next to Chicago. In what year did the stockyards close?

Answers at the bottom.

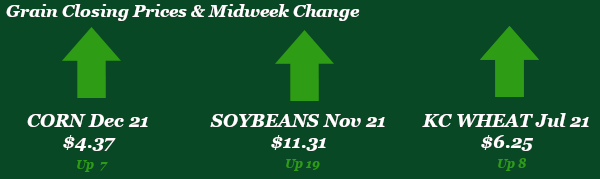

Market News

- Crude oil has managed to hang on to the $52/bbl level for the past week, shooting up past $53.00/bbl Thursday morning. According to Investing.com, crude oil price stability has been helped by signs of US economic growth, indicating the economy closed the year out in a relatively solid state despite political conflict and a pandemic.

- The US Dollar Index looks to have levelled out after signs of some recovery. For the past week the Dollar has traded the $90-91 range, offering little to seeing anything stronger in the near future. THE DJIA dipped off recent highs earlier in the week and has now returned to trading up near 30,760. NASDAQ has traded gradually weaker over the past week, now trading at about 13,400. S & P also saw some weakness and is trading around 3,800.

- An estimated 177,938 shipping containers to China were rejected in October and November, costing roughly $632 million. Instead, empty containers were sent to China to be filled with more profitable Chinese exports according to CNBC. The Federal Maritime Commission has received petitions from US agriculture exporters stating that trade delays could threaten profits and ruin reputations. The commission launched an investigation to review trade data out of ports in California, New York and New Jersey to assess if there were any violations to the shipping act. The rejections come at a crucial time for exports as November is generally the start of peak export season.

|

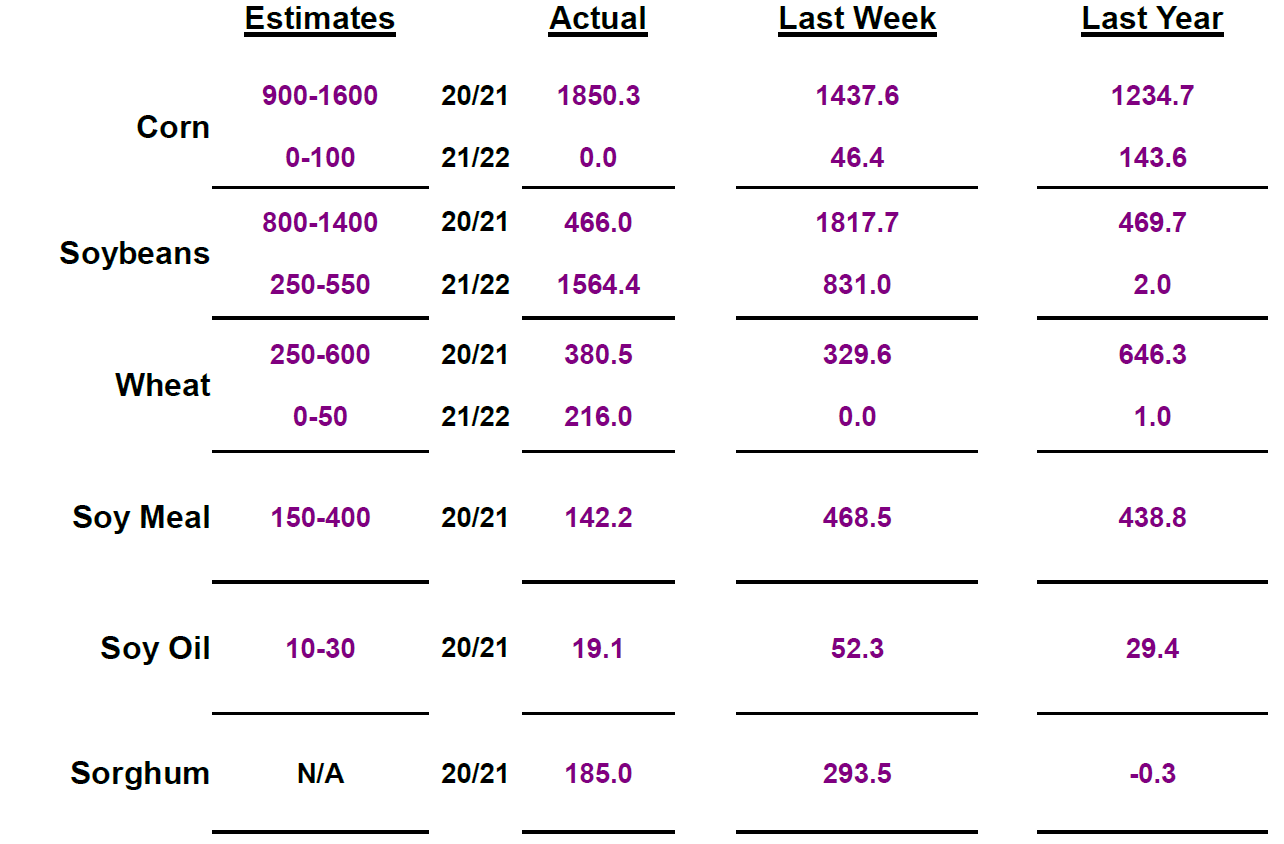

Export Sales Snapshot |

|

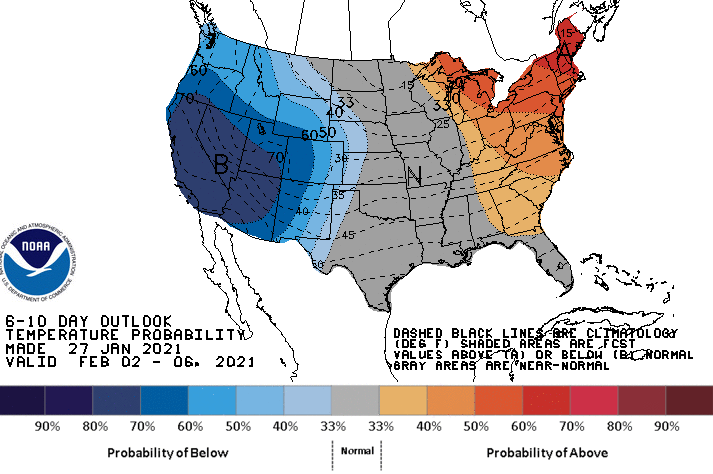

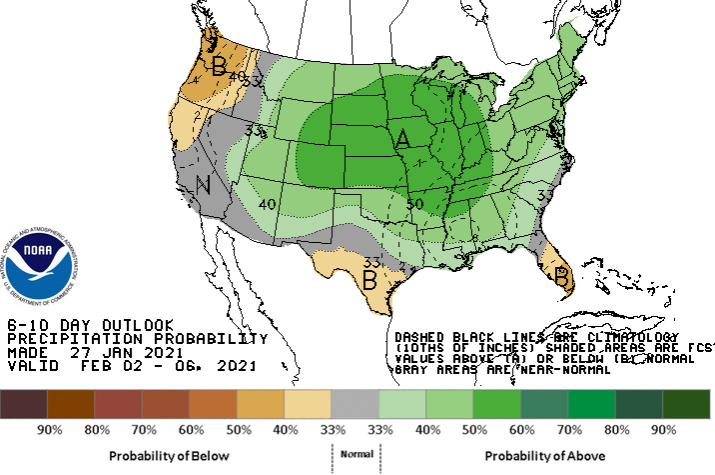

Weather

Much-needed moisture found its way to our area this week in the form of snow – with 2” covering much of our southern territory and as much as 5-6” as you head further north. After a week of colder temperatures, this week is forecasted warm up to high temperatures in the mostly 40’s and 50’s with freezing nighttime lows. It looks to remain mostly dry next week, with chances of rain at the end of next week and headed into the weekend.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

Corn is seeing some volatility this week as China swooped in to buy a record number of ethanol gallons as well as some large corn purchases. China bought 200 million gallons of US ethanol on Tuesday, followed by a total 4 million metric tonnes of corn for the week. Friday’s CFTC report held corn funds long at roughly 349Kcontracts with today’s estimate sitting around 363K long. Wednesday’s DOE ethanol report had ethanol production at 933K bpd versus 945k bpd the previous week and 1.029 million bpd the same week last year. Ethanol demand and stocks are also down. Export sales this morning had corn pegged at 72.8 million bushels versus 56.6 mb last week and the 49.8 mb 10-week average. Corn prices are at attractive levels, hitting 5-year highs for this time of year. Locally, basis has stayed steady on corn.

Wheat

Wheat’s had a volatile week of trade that, although down today, has it up on the week as it mostly follows direction from row crops. Uncertainty remains around Russian export limits and taxes, that has importers considering alternative wheat origins including the United States. Export sales this week were decent at 4.0 million bushels, up from last week’s disappointing 1.1 million bushel number. Notably, there were also 5.2 million bushels of new crop HRW sales, primarily to Nigeria. Export inspections were okay at 3.5 million bushels, down slightly from the previous week at 3.7 million. Friday’s CFTC report indicated that managed money remains buyers of wheat, with the funds adding 3,031 contracts to bring their net long up to 58,093 contracts. Wheat feeding has been a hot topic, with the spread between corn and wheat close to recent lows and corn export demand strong. Locally, we know that a significant amount of wheat has traded into feed rations. Precipitation and cooler temperatures were welcomed across the Central Plains in the last week, but drier, warmer weather is forecasted. This week we got a fresh round of state condition updates, with decreases in good-to-excellent scores in Colorado, Texas, Nebraska, and South Dakota. Kansas was rated as 43% good-to-excellent, down 3%. GCC basis has firmed slightly in both the old crop and new crop slots. Continue to consider what cash levels make sense for your operation.

Soybeans

Like the other commodities, soybeans have had their share of volatility this week, down today after gains made earlier in the week. South American weather remains the same old song and dance, rain is hitting some areas and missing others. Harvest should get fired up around the first of February – at the moment it is too wet to cut in northern Brazil and too dry in southern Argentina. At this point, weather is just holding the crop steady. Export sales this week were at 17.1 million bushels for old crop and a huge 57.5 million in the old crop slot, with China the bug buyer in both. Export inspections were within estimates at 72.7 million bushels. Funds were sellers of beans this week, reducing their net long by 14,587 contracts to 151,898 contracts. Next week we begin the spring planting insurance window, so the market will be closely watching price action.

Milo

Milo is riding on the corn roller coaster, as well as gaining its own basis strength. Bids remain very firm, as farmer selling seems to be waning. Export sales came in at 7.3 million bushels for the week versus 11.6 mb last week and the 6.9 mb 10-week average. Milo, like corn, is at very attractive levels with almost unprecedented highs heading into the new crop year.

Trivia Answers

1. The Kansas City Chiefs were originally based in Dallas, Texas and known as the Texans. Owned by Lamar Hunt, they were one of the eight founding franchises when the AFL came into existence in 1960. They were relocated to Kansas City and renamed the Chiefs in 1963.

2. The Kansas City Stockyards closed in October 1991 after 120 years in business.