Weekly Market Update 7/01/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What year did Independence Day become a federal holiday?

- Three presidents who signed the Declaration of Independence later went on to die on July 4th. Who are they?

Answers at the bottom.

Market News

-

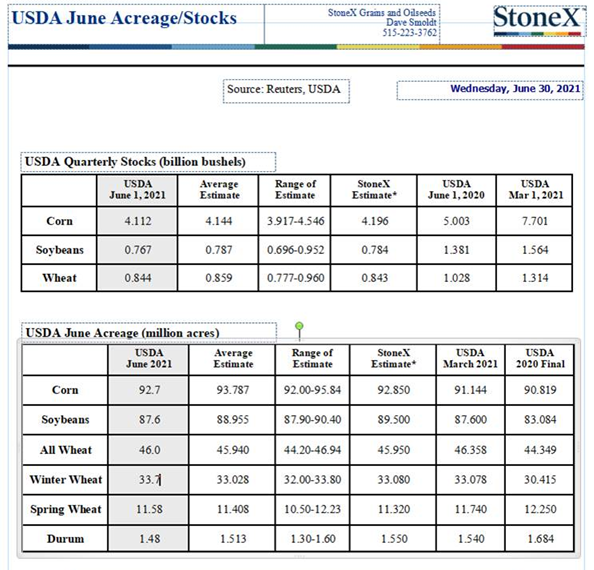

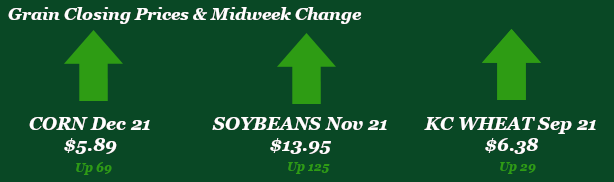

Wednesday was the highly anticipated USDA Stocks and Acreage Report and it sent the markets soaring. Corn and soybean acres were both up from the May estimate, but came in lower than the trade was expecting, putting further pressure on an already tight 2021/22 balance sheet. With the acre numbers printed, weather patterns across the belt will be watched even closer. You can see more detail about the report in the below graphic and by commodity.

-

Stock markets were higher today, with the S&P 500 setting a fresh record intraday and the Dow and Nasqaq both edging higher. A batch of strong economic data helped propel equities higher, with private payrolls growing by a better-than-expected 692,000 in Juneand new jobless claims falling to a new pandemic-era low, with both prints pointing to a potentially strong print in the Labor Department's official June jobs report on Friday.

-

Oil is higher this week, supported by the prospect of stregthening demand and lower U.S. stocks. Crude oil stocks fell for the sixth consecutive week to the lowest since March 2020. Analysts expect U.S. oil demand to increase pace in the second half of the year as travel restrictions continue to be eased.

-

Commodity markets will be closed on Monday, July 5th in observance of Independence Day. Garden City Co-op offices will be open on July 5th.

|

Quarterly Stocks and Acreage Report Summary |

|

|

Weather

Cooler than normal temperatures and high humidity remain in the forecast this week, with chances for scattered showers through the end of the weekend. Big rains in our northern draw last night havwe wheat harvest all but shut down in the Dighton area, with rain reports anywhere from 1-3" overnight. Next week should bring the sun back out, putting high temperatures in the low 90s - making it feel a little more like wheat harvesting weather!

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

Big news this week was USDA’s quarterly stocks and acres report. Stocks and yield numbers moved the corn market this week as corn yield projections took a 1.4 bpa hickey coming in at 175 bpa. Added to the estimated yield decrease, quarterly stocks came in tight at 4.112 billion bushels versus last June at 5.003 billion bushels. In “normal news” CFTC had corn funds long at 243K Friday afternoon. Monday held export inspections at 39.7 million bushels versus last week at 69.9 million bushels and the 10-week average of 71.2 million bushels. Crop progress pegged corn conditions at 64% good to excellent for the US versus 65% last week and 73% last year. Kansas came in at 69% good to excellent versus 71% last week and 53% last year. Wednesday’s ethanol report had stocks, production, and demand up and supply staying fairly steady. Thursday’s export sales were weak with current sales at .6 million bushels while new crop sales came in at 2.7 million bushels. Locally basis stays flat as southwest Kansas receives beneficial rains to boost the corn crop.

Wheat

Report day, report day, report day. Did I mention that yesterday was a report day? The USDA released the Quarterly Stocks and Acres Report Wednesday morning cause the grain markets to hyperdrive. Wheat was more of a follower and has been for the last couple weeks with the issues going on in spring wheat country. Wheat stocks saw a decrease in stocks from the March report as expected, 844 million bushels was reported only slightly below the average trade guess. All wheat acres saw an increase of 300k to 46.7, with winter wheat up to 33.7 million acres. Export inspections this week showed wheat on the low end at 10.5 million bushels shipped, below the average trade estimate. Export sale were also on the low end at 8.3 million bushels sold. This is no surprise considering where U.S. wheat prices stack up to the world. Harvest is attempting to hum along, seems like once things get rolling a little moisture throws a wrench into things. As of Monday, the crop progress report pegged winter wheat across the U.S. at 33% harvested, Kansas was at 41%.

Soybeans

Going to bang on this report drum some more. Soybeans were one of the bigger stories from yesterday’s report. Acres didn't increase like many were anticipating to see, this was one factor why soybeans futures shot up fast and furious. Stocks were also below the average trade guess coming in at 767 million bushels. Beans are staring down a sticky situation with supply. With current USDA numbers beans have a very tight carryout and the U.S. as a whole needs to have a perfect harvest with almost zero issues. Any yield issues could lead to bean rationing or a negative carryout. Export inspections were a snoozer this week at 3.8 million bushels shipped, at the bottom of trade estimates. Export sales were also a non-starter as well with 3.4 million bushels of old crop sold, and 61.4 million bushels of new crop beans sold. The new crop bean sales didn’t catch anyone by surprise with this large number expected. Crop progress for beans reported no change in soybean condition from last week staying at 60% good/excellent.

Milo

Milo is corn’s little whipper snapper along for the volatility ride. While basis has stayed steady on milo, corn futures are being whipped between beneficial corn belt rains and tight USDA numbers. Monday’s export inspections had milo at 1.5 million bushels versus 0.7 last week and the 6.1 million bushel 10-week average. Crop progress held US milo at 70% good to excellent versus 73% last week and 45% last year. Kansas came in at 73% good to excellent versus 74% last week and 47% last year. Thursday’s export sales report has milo at 0.2 million bushels versus 0 last week and the 0.7 10-week average. New crop sales were 0.

Trivia Answers

-

1870

-

John Adams and Thomas Jefferson both died on July 4, 1826. James Monroe died on July 4, 1831.