Weekly Market Update 7/08/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

-

Who is the youngest MLB player to hit a homerun in five straight games?

-

There has only ever been one Vice President of the United States from Kansas. Who was it?

Answers at the bottom.

Market News

-

Hello, weather market. After last week's huge run up following the June 30th Stocks and Acreage Report, commodity markets have plummeted this week following rains and cooler temperatures across the Corn Belt. Extended forecasts are wet across the heart of corn belt as the crop heads into pollination, with the Northern Plains looking to remain hot and dry.

-

Stock markets are down today after another record-setting session yesterday. Today's selloff is broad-based, as the market shows concern about the pace of economic recovery considering the Delta COVID variant, bottlenecked supply chains and labor shortages. Treasury yields are also down today for the fourth day in a row. Minutes from yesterday's Federal Reserve meeting hinted at the Fed reducing asset purchases, but the prevailing mindset was that there shouldn't be any rush and the markets needs to be prepared for any shifts.

-

WTI crude oil hit multi-year highs this week and is up today following big drops in reported U.S. crude and gasoline inventories. However, bears have their eyes on OPEC+ as they indefinitely postponed talks to resolve a disagreement over production curbs. This leaves the market wondering if supply will flood the market at some point.

-

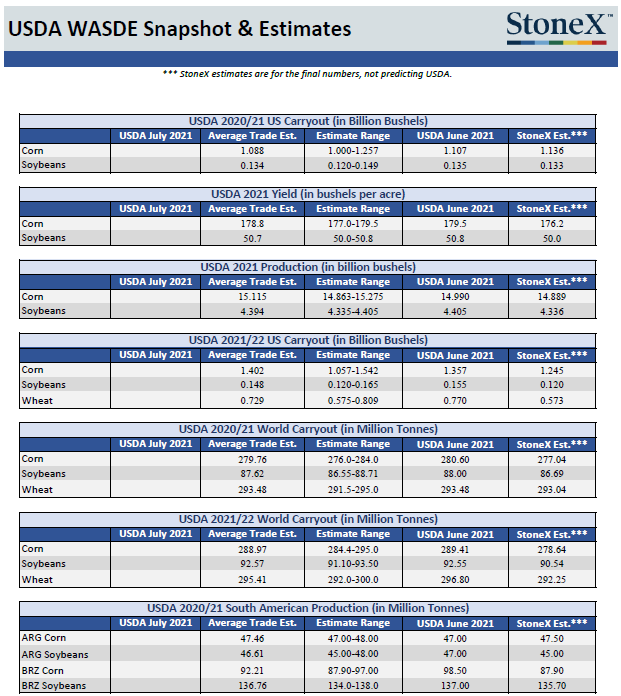

USDA will release the July WASDE on Monday, July 12th at 11:00 AM. There shouldn't be any big surprises after the June 30th report, but much of the trade is expecting some adjustments to yield. It will be interesting to see if USDA decides to make changes or kick the can down the road. You can see trade estimates in the below graphic. With how volatile the markets have been, there's no telling what Monday will bring.

|

July WASDE Estimates Table |

|

|

Weather

Humidity and scattered showers across the region have continued to prolong wheat harvest, but warmer than normal temperatures in the extended forecast could hold promise for wrapping up. Tomorrow has highs around 100, but cools down back in the 80s and 90s for the weekend into next week. Some chances for shattered showers across GCC country are forecasted this weekend and the middle part of next week.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

Corn took a beating and gapped lower over 20 cents after the holiday weekend with wetter weather and promising precipitation in crucial growing areas. Friday’s CFTC report showed funds still 245K long, but that could be short-lived as a seasonal turning point is approached that could trigger some massive sell-off and corn fund longs are sitting well-above 10-year averages. Tuesday’s crop progress report had corn conditions stabilizing at 64% good-to excellent after 4 straight weeks of declining conditions, while Kansas’s corn conditions increased beautifully from 69% good to excellent last week to 75% good to excellent this week. Export inspections this week came in at 48.7 million bushels versus 40.7 million bushels last week and the 69.1 million-bushel 10-week average. Export sales report is delayed until Friday due to the holiday week. Corn spreads are ho-hum as the market will try to find its feet after the June 30th rally followed by a free fall after the holiday weekend. Locally basis stays steady and corn is starting to see some liquidity again.

Wheat

The fireworks were not done on Sunday as you may have believed, but instead of the pretty fireworks in the sky it was the market blowing up in our faces. Rain and forecasts have led to a sharp decline in grain markets across the board. KC wheat gapped open roughly 35 cents down Tuesday after a healthy dose of rain in growing areas. The CFTC report showed funds added 7,871 contracts and bringing the current long to 22,723 contracts. Export inspections showed 9.5 million bushels of wheat shipped, slightly lower than trade estimates. Due to the holiday weekend export sales will be released Friday this week. Crop progress report showed winter wheat at 45% harvested for the U.S., Kansas came in at 62% completed. Locally rain has slowed harvest and made for an abnormally longer harvest. Spring wheat conditions continue to plummet showing 16% good/excellent. July WASDE is on deck for Monday morning, so far nothing earth shattering is expected, but stay tuned..

Soybeans

Soybeans have been under the same pressure seen across the grain complex. Rains and cooler temps across major growing areas have culminated in the fast and furious downtrend. The bean market is looking to regain some of the losses from Tuesday. Soybean funds were sellers of 4,047 contracts, lower the overall long to 76,257 contracts. Export inspections were ho-hum this week at 7.6 million bushels ships right smack dap in the middle of estimates. Soybean conditions dropped 1% this week to 59% good/excellent in the U.S., Kansas increased to 70% good/excellent up from 64% last week. As mentioned earlier, be on the lookout Monday morning for the July WASDE.

Milo

Milo hanging on to corn futures this week as they both free fall to sub $6.00 cash. Tuesday’s crop progress report had milo conditions improving for the US at 72% good to excellent from 70% good to excellent last week. Kansas milo conditions were pegged at 76% good to excellent from 73% good to excellent last week. Export Inspections came in at .1 million bushels versus 1.5 million bushels last week and the 10-week average of 5.0 million bushels. Milo basis stays steady.

Trivia Answers

-

Ronald Acuña Jr. (20 years, 239 days in 2018)

-

Charles Curtis. He served as Herbert Hoover's Vice President from 1929 to 1933.