Weekly Market Update 7/15/21

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

-

July is the national month for this juicy summer fruit. What is it?

-

Of all the vegetables, only two can live to produce on their own for several growing seasons. All other vegetables must be replanted each year. What are the only two perennial vegetables?

Answers at the bottom.

Market News

- July WASDE was released Monday morning with nothing earth shattering coming about. More details below in each commodity headline. The markets reverted back to weather in a hurry after the WASDE report. The next few days see some chances for storms, but overall extended forecast are looking dryer and heating up.

- Stocks are mixed today. The DOW is off of lows this morning and currently up 25.24 points on the day sitting at 34,958.47, for the week the DOW is humming along with no big change. The S&P 500 is flirting with lows right now for the day and week at 4,355.11 down 19.19 points. The NASDAQ is also looking at the low of the day at 14,522.05 points down 122.91 points, this is also approaching the low for the week. The U.S. Dollar is currently down slightly .051 points putting it at $92.58, overall for the week the dollar is closer to the top end of $92.825 Tuesday night than lows.

- WTI crude is off lows this morning, but still down 0.83 and stands at $72.30 currently. Crude is also off the high of the week of $75.45. One reason for the downturn came Wednesday after Reuters reported Saudi Arabia and the United Arab Emirates reached a compromise that should unlock an OPEC+ deal to boost global oil supplied.

|

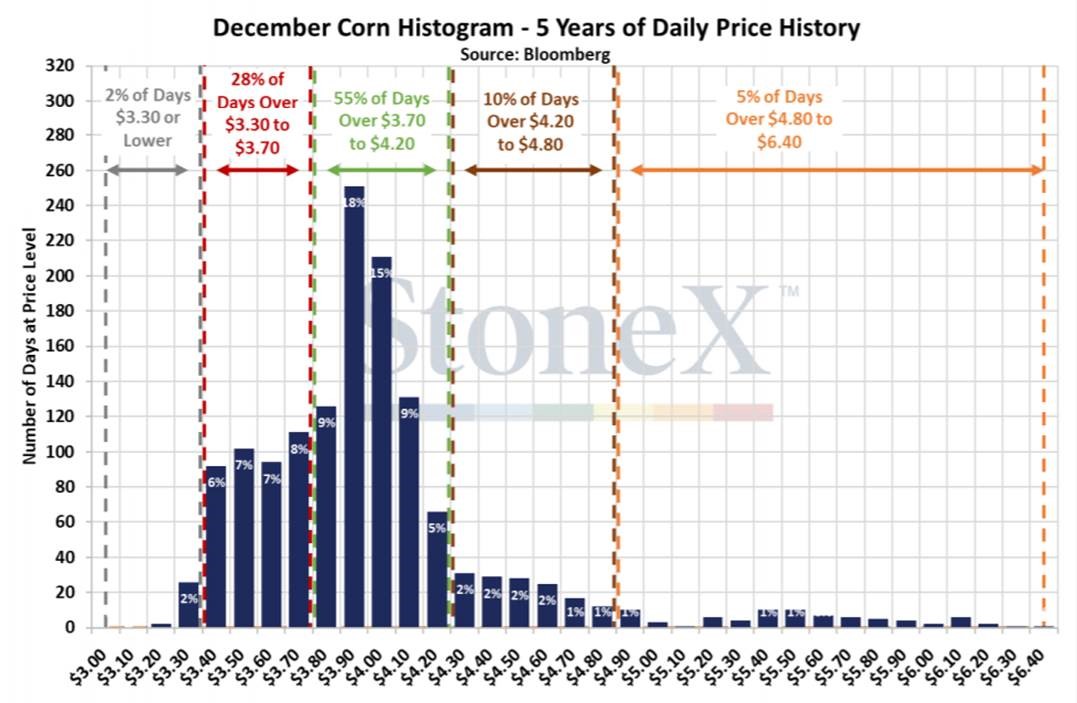

December Corn Histogram - 5 Years of Daily Price History |

|

|

Weather

Chances of scattered showers over the weekend for the GCC area with next week heating up and becoming dryer. The end of next week will see mid 90s and breezy, feeling like an average July day. Extended maps are similar too with most places heating up and chances of rain hard to come by.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

Corn is seeing some recovery after its plummet last week, up almost 40 cents. On Friday CFTC funds showed some sell off of 26K contracts, leaving corn funds long at 219K. Monday morning export inspections were pegged at 39.1 million bushels, down from 48.7 million bushels the previous week, and much lower than the 10-week average of 66.3 million bushels. Monday also held the July WASDE which was pretty bland after June’s quarterly report. Carryout for corn was right in line with expectations, 1.082 million bushels for US carryout and 279.86 million tonnes for world carryout. South American production showed ARG corn at 48.5 million tonnes, up from June’s 47 million tonnes, while BRZ took a 5.5-million-tonne hit coming in at 93 million tonnes. Crop progress showed some declining conditions for corn in Kansas at 70% good to excellent, down 5% from last week. US corn conditions overall saw a 1% improvement at 65% good to excellent. Wednesday’s ethanol stocks were steady with production and demand down and supply up. Export sales this morning were also down, pegged at 5.5 million bushels versus 6.8 million bushels last week and the 7.9 million bushel 10-week average. Locally basis stays steady.

Wheat

Wheat is running up this week, supported by continued issues with the spring wheat crop in the north. The spring wheat crop is all but a train wreck, with USDA leaving the crop rating unchanged from the previous week at only 16% good-to-excellent. Wheat caught a supportive WASDE report on Monday, with the 2021/22 carryout lowered to 665 million bushels, down from 770 million in June, and production lowered to 1.746 billion bushels based on declining yields. HRW and SRW crops both rose, but the spring wheat crop came in below the estimate range and well below the average trade guess. Global carryout also declined for both 2020/2021 and 2021/2022. Export sales came in solid this week at 6.7 million bushels of HRW – the highest number in the last ten weeks. Inspections were also good at 6.1 million bushels, up from last week at 4.5 million. USDA estimates that the winter wheat crop is 59% harvested. Locally, we are on the tail end of harvest after it seemed for a while that it might not ever end. With the volatility in the wheat market, sell orders could be a great way to get instore bushels priced. 2022 wheat prices are also worth some consideration.

Soybeans

Weather still the driver of the soybean market, as dryness continues across the northwest Corn Belt. The new 7-day forecast from NOAA leaves a big chunk of the belt dry, begging the question of how long it will stay this hot and dry. Monday’s WASDE left soybeans largely unchanged – with U.S. carryout, yield and production left even with the June estimates. 2020/21 world carryout was increased by 3.5 MMT, partly due to reduced Chinese imports and crush. 2021/22 world carryout also increased by about 2 MMT. Export sales this morning were reported at 0.8 million bushels of old crop and 10.7 million of new crop. Inspections were even with the 10-week average at 7.4 million bushels. This afternoon we got June NOPA crush numbers and they were dismal at 152.4 million bushels, more than three million below even the lowest trade estimate and down 11.1 million bushels from May. Crop conditions were unchanged this week, holding at 59% good-to-excellent. Kansas conditions were down 8% to 62% good-to-excellent. Expect weather to remain the sole focus as we head into critical points in the growing season.

Milo

Milo prices are still desirable even with corn futures volatility. Local basis is historically high and holding steady. Export inspections on Monday were 2.9 million bushels, up from .2 million bushels last week. Crop progress report has milo conditions declining in Kansas and the US overall. Kansas came in at 70% good to excellent versus 75% last week and the US came in at 73% good to excellent versus 76% last week. Export sales this week were less than ho-hum, coming in at 0.

Trivia Answers

-

Watermelon

-

Asparagus & Rhubarb