Weekly Market Update 7/29/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What is the hottest pepper in the world? Bonus: How hot is it in Scoville Heat Units (SHU)?

-

Four events are debuting for the first time ever at the Olympic Games this year in Tokyo - what are they?

Answers at the bottom.

Market News

-

USDA confirmed yesterday that there were positive tests for the deadly African swine fever in samples from pigs from the Dominican Republic. This is the first detection of the disease in the Americas in about 40 years, and the proximity is fueling concerns about the disease creeping closer to the United States. Three years ago, African swine fever spread rapidly in China and wiped out half of the country's hog herd.

-

The Federal Open Market Committee concluded its two-day meeting this week and said in its post-meeting comments yesterday that it has made some progress towards the economic goals it hopes to achieve before tapering back bond purchases. The Federal Reserve held its benchmark interest rate near zero. The U.S. dollar is making multi-week lows, breaching key support level 92.00 yesterday.

-

Stocks are generally higher today, with the S&P and Dow reaching record levels this afternoon. This market move comes despite a disappointing second-quarter economic growth reading - U.S. gross domestic product was lower than expected - and higher than expected unemployment claims. U.S. stocks seem to be focused on progress on the infrastructure bill. A bipartisan group of Senators agreed on a roughly $1 trillion infrastructure spending plan and the Senate voted to begin work on the bill.

-

Dozens of locations along the U.S. Pacific Coast, Nevada, and the Rocky Mountains have seen delayed or canceled flights thanks to no commercial or general aviation fuel on sight at regional airports this month. Part of the problem is the shortage of tank truck drivers needed to deliver fuel, as well as the fact that pipelines shifted away from carrying jet fuel last year when travel was restricted due to COVID. The outages are expected to worsen, especially if persistent wildfires continue into August, because some of the region's supply is being re-directed to fuel planes fighting wildfires..

|

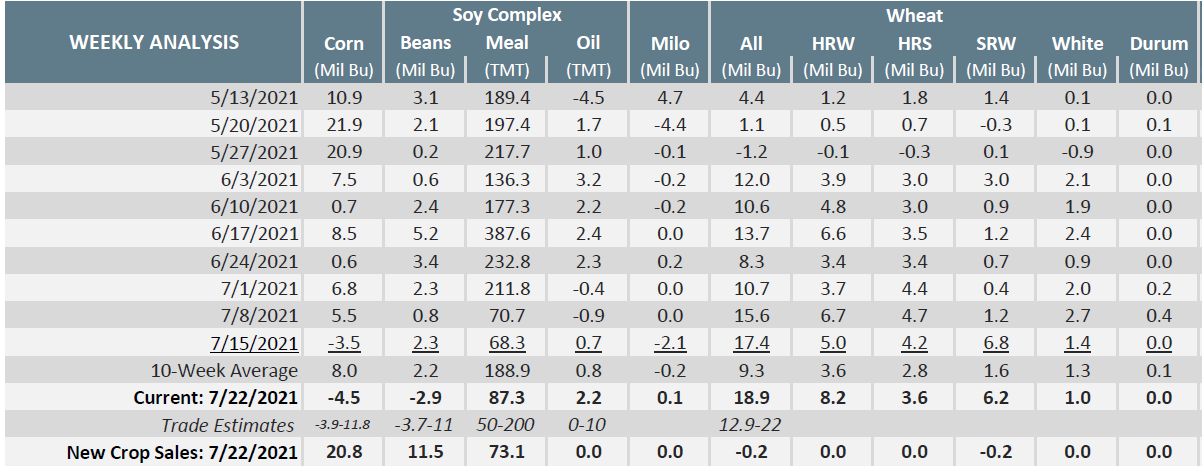

Export Sales for Week Ending 7/22/21 |

|

|

Weather

Some relief from the heat is in sight, as this weekend and next week bring cooler-than-normal temperatures. Highs are forecasted in the 80s for the weekend and early next week. There are chances for rain over the weekend, which would be welcome with fall crops needing a drink.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

Corn is tagging along this week while wheat is on the spicy train. Not too much to write home about this week, as we are trading nothing but weather. Friday’s CFTC report showed corn managed money adding 14,503 contracts to the existing long position, longs totaling 223K contracts. Monday’s export inspections report was neutral with corn at 40.8 million bushels versus 42.4 the previous week and the 10-week average of 59.1. Crop conditions Monday afternoon did offer some market support as trade expected no change and conditions were found declining. Corn was pegged at 64% good to excellent versus 65% last week and 72% last year. Kansas was seen at 69% versus 74% last week. Ethanol on Wednesday pegged stocks up and production down with demand up also. Export sales this morning showed cancellations for nearby corn of 4.5 million bushels while new crop sales were pegged at 20.8 million bushels. China looks to auction off 202K tonnes of US imported corn and 50K tonnes of Ukraine imported corn on July 30th. Cooler temps and moisture expected across key corn growing areas into the weekend. Locally, corn basis has a weaker feel to it.

Wheat

Hot & spicy is a good way to describe the wheat complex this week. We saw some weakness on Monday from rains over the week, but the tune quickly changed mostly due to spring wheat issues persisting. The Wheat Quality Council Tour is underway in North Dakota this week bringing realization to the drought issues in the north. Average yields have been 24.6 bushels per acre compared to 40.8 on the same route last year. With all the issues in spring wheat it has caused the KC wheat board to shoot higher. Global concerns with Russian wheat production are feeding the market as well. Wheat export inspections this week were decent showing 17.6 million bushels shipped, HRW led the way with 11.4 million bushels. Export sales were solid this week at 18.9 million bushels sold. KC wheat funds reported 6,078 contracts bought this week, making the overall long 27,745 contracts.

Soybeans

Soybeans have hitched their trailer to the spring wheat issues and are riding higher today. Forecasts are showing cooler and wetter conditions in growing areas over the next week to 2 weeks. Will be curious to see how accurate the weather prediction is. Rain will gladly be appreciated. Something to keep an eye on is Asian Swine Flu has been confirmed in the Dominican Republic. Bean export inspections this week were right inline with trade estimates at 8.9 million bushels shipped. Export sales were a little surprise for old crop, having a net negative due to cancellations. New crop was on the lower end of trade expectations at 11.5 million bushels sold. Soybean crop conditions dropped 2% this week to 58% good to excellent. CFTC showed soybean funds adding to their long 13,101 contracts bringing the total to 95,874 contracts.

Milo

Milo has a weaker tone to it overall between corn futures hanging on by a thread and a weakening basis. Monday’s export inspections for milo were decent at 3.6 million bushels versus 2.5 million bushels last week and the 10-week average of 3.4 million bushels. Crop progress report had milo in at 66% good to excellent versus 68% last week and 53% last year. Kansas conditions were pegged at 67% good to excellent versus 71% last week. Export sales this morning came in at .1 million bushels with 0 on the books for new crop.

Trivia Answers

-

Carolina Reaper at 2,200,000 SHU

-

Skateboarding, surfing, sport climbing and karate.