Weekly Market Update 3/11/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Who scored the most career points in Big 12 men’s basketball?

-

Who scored the most career points in Big 8 men’s basketball?

Answers at the bottom.

Market News

|

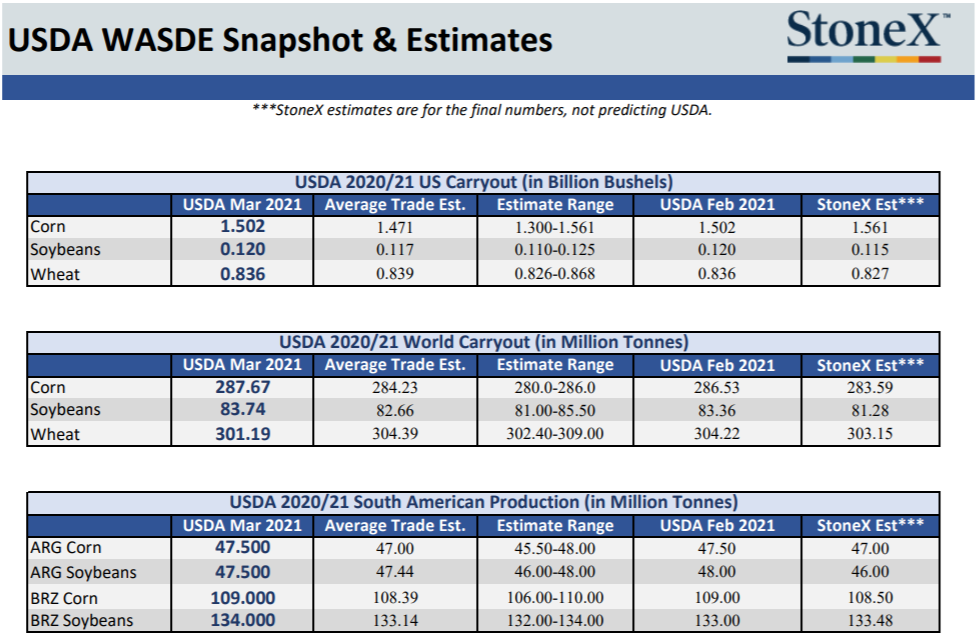

March 2021 WASDE |

|

-

Over the weekend we saw a drone attach a Saudi oil storage yard in Ras Tanura. The oil yard was targeted by Iranian backed Houthi rebels in a recent drone strike. According to the Saudi government, the14 drones and 8 ballistic missiles which were used in the attack were supplied by Iran to the rebel group. The United States committed to defending Saudi Arabia following the attacks. Brent Crude Oil pushed above $70 earlier this week and settling just be there in the $69 range, this is the highest Brent Crude has been since January 2020. WTI has been hanging around the $65-$66 range this week as well.

-

Congress has passed the $1.9 trillion Covid relief package and has been send to President Biden to be signed.

-

We had the USDA March WASDE report this week. It was uneventful with hardly anything changing from last month’s WASDE. The USDA is kicking the can down the road and waiting for acreage and production reports to come out at the end of the month before making any big decisions to the balance sheet in April.

-

Stock market indexes have seen a steady rise this week and looking to finish the week strong. The DJIA is up over 1000 points, S&P up over 100 points, and the NASDAQ over 500 points.

-

We saw the U.S. Dollar increase in strength earlier in the week reaching a high of $92.52, highest it has been since November 2020. The Dollar has back tracked the rest of the week since hitting the high, sitting at $91.60.

-

Sunday marks the spring day light savings time change. We will “spring forward an hour”.

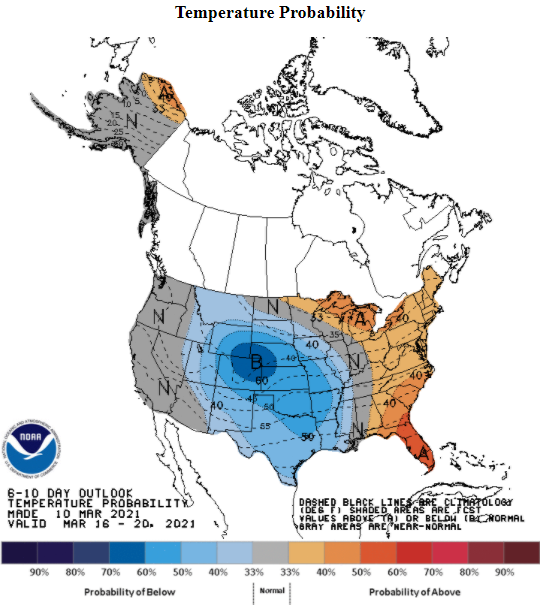

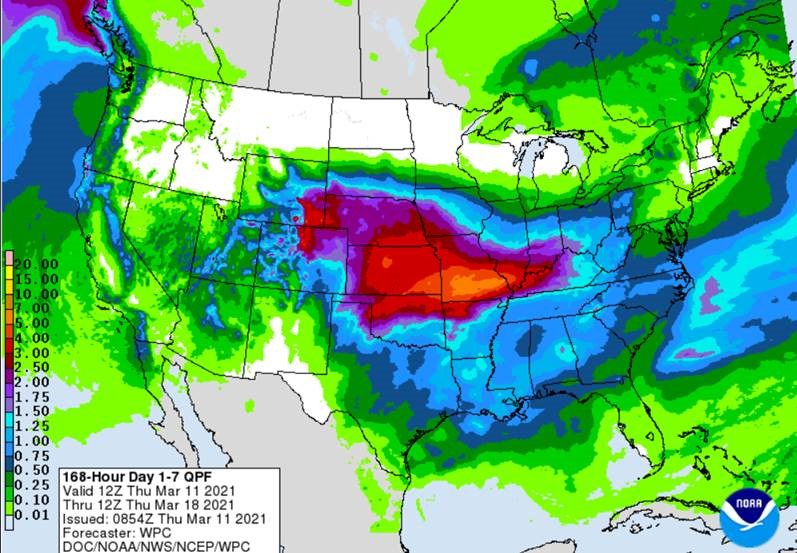

Weather

What has been dry, windy, and warm weather to begin this week looks to end cooler and wet. Weather maps have shown chances of up to 2-3 inches of moisture with temps mid to low 50s.

|

Temperature 6-10 Day |

Precipitation 1-7 Day |

|---|---|

|

|

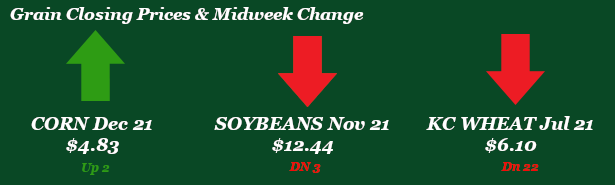

Corn

Over the past week CK has weakened roughly 8 cents while CZ has stayed fairly flat. Friday’s CFTC report held managed money longs at 348K. Monday’s export inspections report came in at 60.8 million bushels which was better than the 10-week average of 52.5 million bushels, but still below last week’s at 80.6 million bushels on a massive revision. South American weather is still offering some support as rains in Brazil are still affecting the second-crop corn planting. Brazil corn is only 73% planted versus last years pace of 98% planted and the 5-year average of 91% planted. Argentina, on the other hand, is seeing warm and dry conditions with their crop being affected. Buenos Aires Grain Exchange has their crop rated at 25% good-to-excellent versus 50% good-to-excellent last year. Tuesday’s USDA report was ho-hum for corn as US carryout was within the range of traders’ estimates while world carryout was slightly above the range of traders’ estimates. Wednesday’s ethanol report had stocks down and production up for the week, as well as demand up and supply down. Ethanol is still about 10% behind in production versus pre-covid levels. Export sales this morning was disappointing as corn came in at 15.6 million bushels versus the 10-week average of 66.5 million bushels. Many are looking for 5.00CZ futures heading into summer. Locally, corn basis stays flat.

Wheat

Selling in grains and optimistic forecasts across the Southern Plains have put pressure on wheat this week, with the July contract down over 20 cents since Monday. Front and center this week for grains was the March WASDE, which didn’t hold any big surprises or changes for the wheat complex. The domestic balance sheet was left unchanged, with small by-class changes for carryout between HRW and WW. World carryout dropped to 301.19 MMT, down from 304.22 MMT last month - Chinese feed demand more than offset a 3.4 MMT increase in production, primarily in Australia. All in all, a snoozer for wheat. Export inspections were on the high side of estimates for all wheat, with HRW at 3.3 million bushels. Export sales were strong, at 5.6 million bushels of old crop, up from last week at 3.2 million and above the 10-week average of 3.4 million. There was also a dab of new crop HRW sold. The latest round of state condition updates had Kansas and Texas both down 1%, with Oklahoma up a big 7%. This comes ahead of significant precipitation forecasts headed into the weekend. Wheat conditions across our draw area vary but get better as you head north. Basis remains steady and slightly better than historical averages.

Soybeans

Slight recovery today after yesterday’s big selloff. USDA kicked the can down the road in the March WASDE, leaving the domestic balance sheet mostly unchanged. US carryout remains at a tight 120 million bushels. World carryin, production, and carryout were all slightly up for 2020/2021. World carryout was pegged at 83.74 MMT, compared with 83.36 MMT in February. Notably, the Brazilian bean crop was increased by a million tonnes and Argentina’s was down half a million. Weather in South America is a broken record, with Argentina still dry and hurting good yield potential and Brazil still wet enough to delay harvest. Export inspections were within estimates at 21.6 million bushels, but lower than last week’s 36.9 million. Export sales were at 12.9 million bushels of old crop and 7.8 million bushels of new crop, on the high side of estimates. China is still in the driver’s seat for demand of US soybeans, especially with supply concerns in South America, so all eyes are on rising reports of ASF within their hog herd. This could mean bad news if cases continue to climb, so will be important to watch moving forward. Planting will begin in the deep south shortly, so we should start seeing state updates this month. USDA will resume Monday crop progress reports in April.

Milo

Milo has been pretty quiet. Export inspections came in at 7.5 million bushels for the week versus last week at 4.8 million bushels and the 10-week average of 6.5 million bushels. Export sales came in at 2.4 million bushels. Versus -2.1 million bushels last week and the 10-week average of 3.3 million bushels. USDA made little to no change to sorghum S/D. Locally, nearby milo basis has weakened.

Trivia Answers

-

Buddy Hield – Oklahoma 2,291 Points

-

Danny Manning – Kansas 2,455 Points