Weekly Market Update 3/4/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

1. Which U.S. state is the leading producer of rice?

2. Sticky rice was added to the mortar that holds together a famous foreign landmark – what is the landmark?

Answers at the bottom.

Market News

|

Top YTD Corn Export Sales |

|

-

China makes up 40% of export commitments, while Mexico and Japan combined sit at 52% of commitments. "Unknown" has a stake in there as well, now under 300 million bushels as 40 million bushels of corn commitments were moved from "unknown" to China.

-

Export sales were quite disappointing this past week with corn at 4.6 million bushels, beans at 12.3 million bushels, wheat at 8.1 million bushels, and milo at -2.1 million bushels.

-

ASF rearing its ugly head in China again with a new strain, though not nearly as fatal as the original ASF strain. Due to the disease, China's pork prices have dropped nearly 30% since August 2019 according to Reuters. However, the growing concern of the new strain of ASF has yet to heavily impact the corn and bean market as China demand remains strong. China's corn usage continues to rise, supporting the market.

-

Stock markets have seen volatility over the past week, as the DJIA has traded an almost 1000 point range, S&P had traded an almost 200 point range, and NASDAQ has traded an 800 point range.

-

WTI Crude is up 5%, taking a sharp upturn as OPEC+ agreed to extend production curbs. This could give WTI oil futures its highest close since 4/2019. Russia and Kazahkstan will be allowed to increase production by 130,000 and 20,000 barrels per day due to consumption patterns for the season. Saudi Arabia did extend its output cut of one million barrels per day through April.

Weather

|

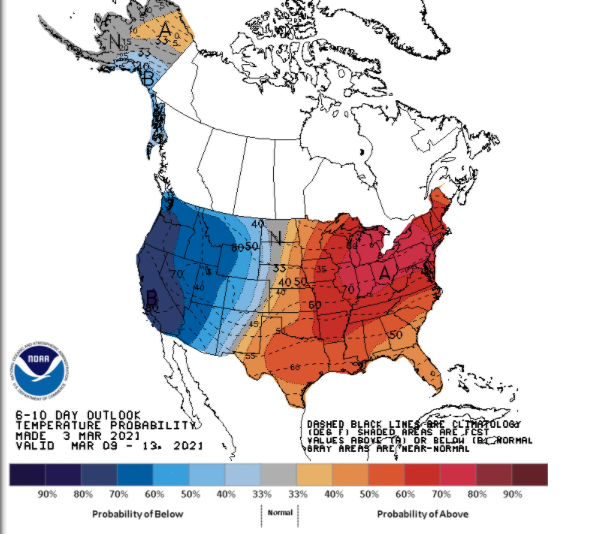

Temperature 6-10 Day |

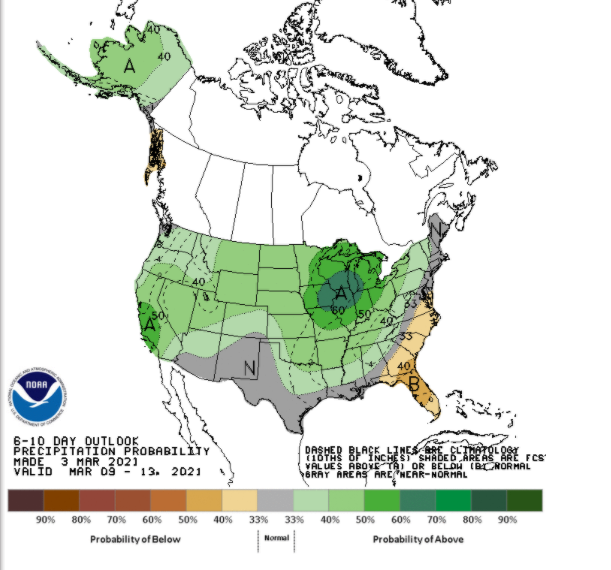

Precipitation 6-10 Day |

|---|---|

|

|

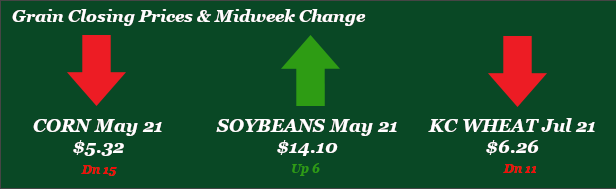

Corn

A week of trading both sides for corn, with May futures down and December futures up on the week. Export sales for corn this morning were poor and well below trade estimates, at 4.6 million bushels for old crop and 1.5 million bushels for new crop. However, export sales are 23% ahead of the pace needed to hit the USDA export estimate. Inspections were a season high 64.4 million bushels, up from the previous week at 49.9 million. Japan and China were the largest destinations. Friday’s CFTC report indicated that the funds reduced their net long by 4,634 contracts to 361,151. Ethanol numbers this week showed a rebound after the cold snap – production was at 849k bpd, up from the precious week at 658k. This is still nearly 10% below consistent production pace from late December to early February and 21% below last year’s same-week production. Eyes remain on South America as rains in Brazil delay the planting of their second crop, while Argentina is still dry. Locally, basis remains strong and steady. Markets look to remain pretty quiet ahead of next Tuesday’s WASDE report.

Wheat

We are seeing wheat operate at its finest with another choppy week on the board. Not a lot of news to run on for wheat this week. The biggest headline came Tuesday with USDA winter wheat crop ratings dropping 3% good to excellent in Kansas to an overall 37% good to excellent. The CFTC report showed funds reduced nearly 4,000 contracts this week, but still sitting with a long position of 53,208 contracts. Exports were within expectations this week with 8.1 million bushels of old crop sales and just under 1 million bushels of new crop sales. Promising weather is in the forecast for late Thursday and into early Friday morning with rain. A nice drink of rain would be welcomed across the growing area to say the least. Wheat is trending higher today piggy backing off big soybean news. Be on the lookout next Tuesday, the UDSA will come out with there March WASDE report.

Soybeans

Soybeans are the leader this week with big news coming in Thursday that Cargill plans to spend $475 million to boost U.S. soy processing per Bloomberg. The world’s largest agricultural commodities trader is spending $475 million to expand its wide network of U.S. soybean processing plants as global economies emerge from the global pandemic. Cargill Inc. is expanding and modernizing soybean crushing facilities in seven states as demand is set to rebound when restaurants reopen, the privately held Minneapolis-based company said in a statement. Record crush came in for the month of January. January total U.S. soybean crush came in at 196.5 million bushels Monday afternoon, above the average trade estimate and up from last month’s 193.7 million bushels, as well as ahead of 188.8 million bushels last year. January crush total came just barely below the all-time record of 196.6 million bushels set back in Oct. 2020. South America weather continues to delay harvest, but there does not seem to be much worry there just yet. Soybeans added nearly 11,000 contracts to the managed funds this week. Overall beans set at a long of 172,364 contracts. This was just shy of expectations. Bean export sales remain strong this week considering supply is dwindling, 12.3 million bushels in old crop sales and 7.3 million bushels in new crop. Beans have been up over 20 cents today and looking to finish the week strong.

Milo

Milo prices remain steady. Export sales were disappointing, with China cancelling 2.1 million bushels in old crop purchases and no new sales in the old crop or new crop slots. Inspections were okay, with 4.8 million bushels headed to China and Kenya. This was in line with last week at 4.9 million bushels. Locally, old crop basis is likely to slip as nearby bids become few and far between. New crop basis remains steady to higher.

Trivia Answers

1. Arkansas. Arkansas produced 99.02 million CWT of rice in 2020, with total U.S. production at 227.58 million CWT.

2. The Great Wall of China. According to the Smithsonian Magazine, this was the world’s first example of composite mortar (mortar containing organic and inorganic matter).