Weekly Market Update 5/13/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Where was the first airplane factory located in the United States?

-

During the Civil War, what Union state suffered the highest rate of fatal casualties?

Answers at the bottom.

Market News

- The Colonial Pipeline is back up and running after a cyberattack starting last Friday. The pipeline is responsible for moving 100 million gallons per day of gasoline, diesel, and jet fuel. Nearly half of the East Coast’s supply. It will take several days for full recovery along the pipeline.

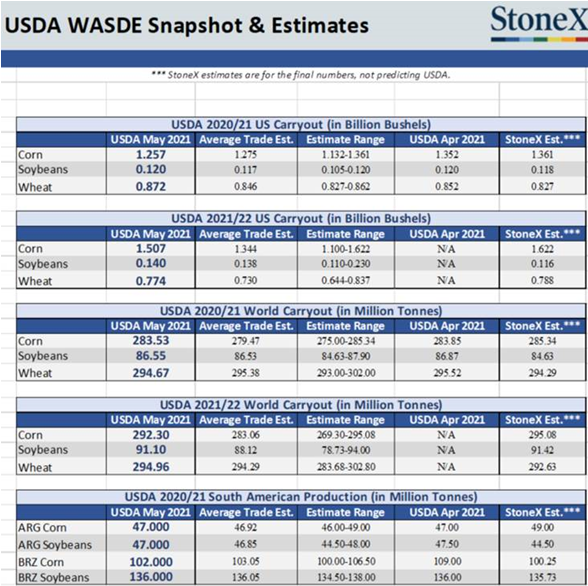

- The USDA released the May WASDE yesterday causing weakness across the board, more info below.

- The DJA is off highs from Monday this week, topping out at 35080.5. Looks to be trying to rebound off overnight lows of 33590.59. the S&P 500 has a similar trend, peaking on Monday at 4235.65 and rebounding off lows of 4057.1 this morning. The NASDAQ has steadily trended lower all week but is seeing a bounce this morning. High for the week was Monday at 13586.73, low at 13033.17 coming off the overnight.

|

May WASDE Spreadsheet |

|

|

Weather

Much need moisture hit the majority of growing areas earlier in the week. Temps have been cooler but steady this week. Look for the weekend to heat up with chances of more thunderstorms Sunday through Thursday on the extended forecast.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

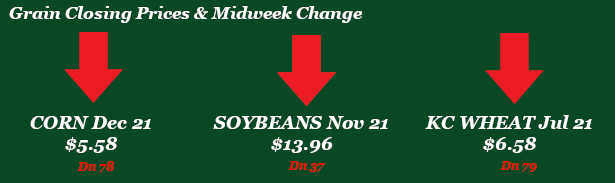

Corn

Corn seeing some significant downside over the past week. Corn exports saw cancellations of 20/21 shipments from China, however there were 21/22 bookings added. Export sales came in at -4.5 million bushels for the current time frame, but new crop export sales came in at 82.0 million bushels. The crop progress report on Monday showed corn for the U.S. at 67% planted versus 65% planted last year and the 52% average. Kansas came in at 54% planted versus 58% last year and the 55% average. Wednesday’s ethanol report had stocks down, production up, and demand up significantly with demand hitting close to post-COVID highs. Yesterday’s WASDE was pretty ho-hum with little surprise to drive the market. World carryout saw almost no change from April’s report for corn at 283.53 million tonnes. South American production saw no change on the Argentina corn crop while the Brazilian corn crop was cut by 7 million tonnes to 102 million tonnes. Thursday’s market saw corn limit down for a time, losing over 70 cents from last Friday’s high. Look for more volatility as planting progresses and as new crop demand looks to stay steady. Locally, basis is staying historically strong.

Wheat

Wheat is singing the blues this week, feeling pressure from widespread precipitation across the southern Plains and bearish numbers in yesterday’s WASDE report. While the trade was expecting a slightly lowered 2020/2021 US carryout number, USDA increased the carryout from the April estimate to 872 million bushels. The 20 million bushel increase is largely due to a 20 million bushel decrease in exports. The number a lot of the trade was watching was feed use, but USDA left it unchanged. 2020/2021 world carryout came in slightly lower than the average trade estimate at 294.67 MMT, a decrease from the April report. This report was our first look at 2021/2022 carryout estimates, which came in higher than the trade was expecting at 774 million bushels. World carryout was estimated at 294.96 MMT for 2021/2022. Export sales were reported this morning at a net cancellation of 0.60 million bushels of old crop and net sales of 3.1 million bushels for new crop. Monday’s Crop Progress showed a 1% increase in condition, with the U.S. aggregate reported at 49% good-to-excellent. Montana and Oklahoma conditions were improved, while Colorado and Kansas conditions fell. With widespread moisture forecasted again this weekend across parts of wheat country, expect wheat to struggle in absence of any strength in row crops.

Soybeans

Beans are sharply lower today following gains earlier in the week. The May WASDE didn’t hold any huge surprises for beans, with the old crop balance sheet unchanged from April leaving carryout at a tight 120 million bushels. New crop carryout came in right around expectations at 140 million bushels. Old crop world carryout was slightly lower than April at 86.55 MMT, with new crop higher than expected at 91.10 MMT. Argentina’s soybean crop was lowered by 0.5 MMT and Brazil’s was left unchanged. Huge demand is still forecasted for China, as they seem unfazed by ASF and expect their hog herd to continue to expand. Export sales this morning were reported at 3.5 million bushels of old crop and 3.8 million bushels of new. Sales are currently 6% ahead of pace needed to hit the USDA Export Estimate. USDA pegged soybeans at 42% planted on Monday, up 18% week-on-week and well above the 22% 5-year average.

Milo

Milo continues to ride the corn futures rollercoaster while basis, like corn, stays historically strong. This week’s crop progress report had milo at 22% planted for the U.S. versus 27% last year and the 28% average. Kansas is at 3% planted versus 5% last year and the 2% average. Export sales for milo came in at 2.8 million bushels with new crop showing no sales.

Trivia Answers

-

Wichita

-

Kansas