Weekly Market Update 5/20/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What was the first AC/DC album released after the death of lead singer Bon Scott?

-

What was the first feature-length animated movie ever released?

Answers at the bottom.

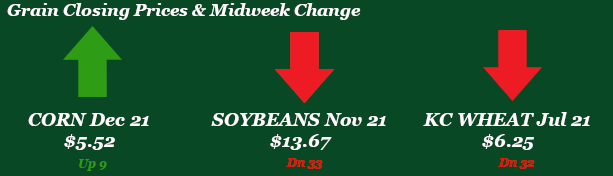

Market News

-

The US Dollar index is down on the week, currently trading around 89.80. Treasury yields rose yesterday after the release of minutes from the Federal Reserve's last policy meeting, in which officials hinted at the possibility of tightening monetary policy. This week's US Department of Labor jobless claims report could be pointing towards recovery, posting a new low of unemployment claims since March 14, 2020 at the beginning of the pandemic.

-

Energy markets are also down on the week as rumors float of a return of Iranian supply, with WTI crude oil down today around 62.09, Brent crude around 65.16, and RBOB gasoline around 2.0554.

-

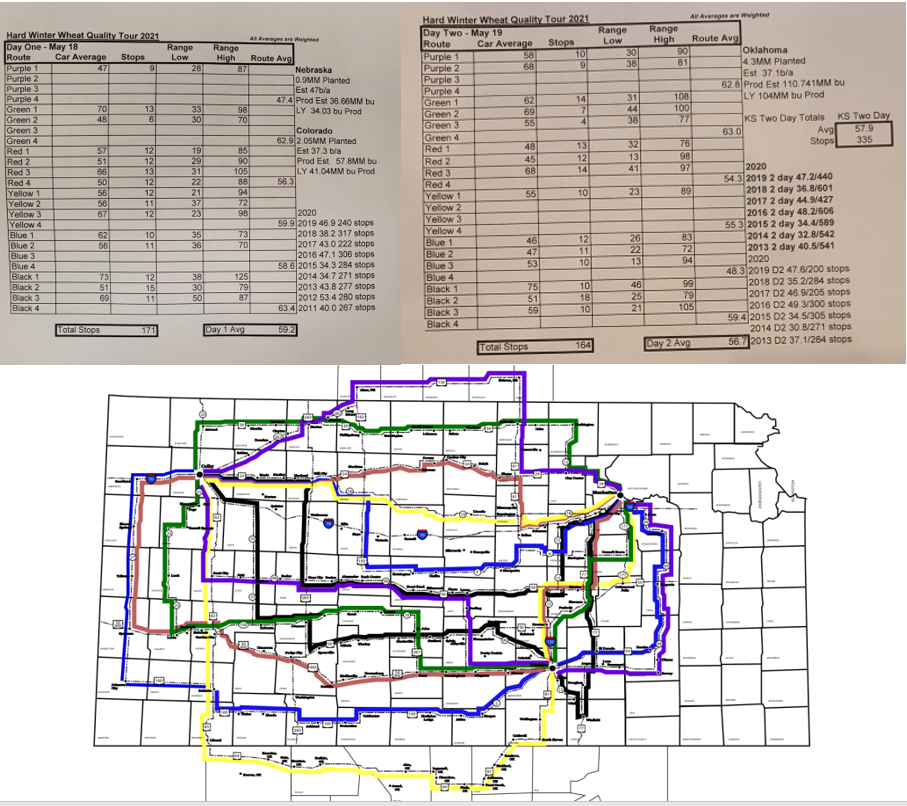

The Kansas Wheat Tour is publishing record winter wheat yields on their state-wide tour, ending today. Check out the specifics in the below graphic and the commodities section. If you're interested in more information or photos from their travels, the tour can be followed on social media using #WheatTour21.

|

Kansas Wheat Tour Day One and Two Results and Route |

|

|

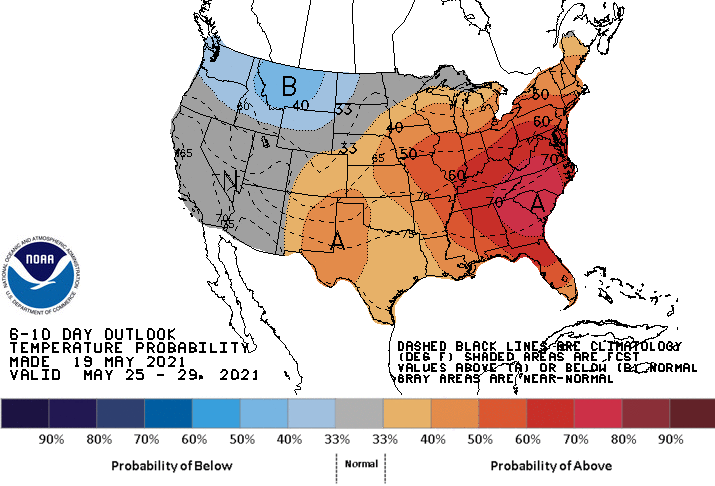

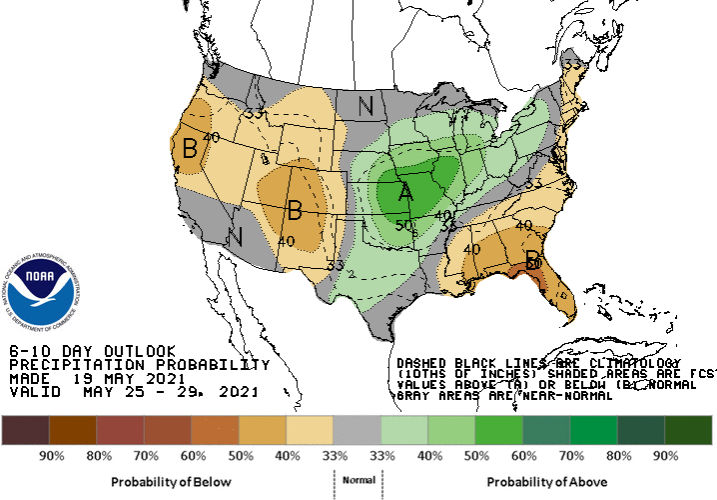

Weather

A few chances for rain are in the forecast this weekend and into next week, after much-needed rains fell across the majority of our territory in the last week. We report rain totals anywhere from 2-5" since last Friday. Temperatures are forecasted to remain steady in the next week, with highs in the upper 70s and 80s and lows in the 50s and 60s.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

Significant downside on corn the past couple weeks, even with China buying 21/22 corn 9 days in a row. This week CZ has managed to maintain some sort of dignity around the 5.40-5.50 level. Friday’s CFTC showed some sell off of roughly 56K contracts, leaving corn funds at 316K contracts long. Corn funds currently seeing more sell off, estimated at 226K long this morning. Monday’s export inspections came in decent at 74.5 million bushels. Since Friday, China has bought 5.644 MMT of corn from the U.S. for the 21/22 marketing year. Mexico bought some corn this week also at .128 MMT. This week’s export sales report wasn’t anywhere near shiny for the 20/21 marketing year, coming in at 10.9 million bushels. However, export sales for the 21/22 marketing year hit big numbers at 159.9 million bushels. Monday’s crop progress report pegged corn plantings at 80% for the U.S. versus 67% last week and the U.S. average of 68%. Kansas came in at 67% planted versus 54% last week and the average of 69%. Locally basis remains steady at historically strong levels. Much-needed rain in the southwest Kansas plains has made many planting fall crops hopeful.

Wheat

Wheat has been a downer to say the least this week. The market has been on a downtrend due to favorable rains and a possible production bump. The Kansas Wheat Tour has been making their way through Kansas the past couple of days, the 2-day average is sitting at 57.9 bushels per acre. Yesterday SW Kansas wheat yields averaged 56.7 bushels per acre according to the tour, up from 47.6 bpa in 2019 and the five-year average of 42.7 bpa. The 56.7 bpa is the highest yield average ever recorded for this portion of the route. Some of these numbers can be taken with a grain of salt, but above average harvest overall is expected at Garden City Co-op. Crop conditions for winter wheat fell a point this week to 48% good to excellent for the U.S, while Kansas improved a point up to 54% good to excellent. Export inspections this week for wheat were strong and above the top of trade estimates, 24.2 million bushels were shipped. Export sales were right in line with trade guesses at 4.4 million bushels and 11.7 million bushels of new crop sold. For the week ending 5/14/21 the CFTC report showed KC wheat as sellers. KC wheat sold off 2,001 contracts bringing the long to 31,999 contracts.

Soybeans

Soybeans are looking to rebound today from down week. Soybean crush was weaker than expected and has been a contributing factor for the down bean market this week. Crush came in at 160.3 million bushels, well below the average trade estimate and even 2.5 million bushels below the most pessimistic trade guess, and down from 178 million bushels last month and 171.8 million bushels last year. Cumulative inspections of 1389 million bushels are still up 25 million from last year’s eight-month pace. U.S. soybean planting rose from 42% to 61% done, with emergence doubling to 20% as of Sunday night. Export inspections were strong for beans at 11.3 million bushels shipped, above the average trade estimate. Export sales were in line with trade estimates at 3.1 million bushels and 3.5 million bushels of new crop sold. The CFTC report showed beans as buyers of 3,023 contracts extending the long to 177,822 contracts. Something to keep an eye on in South America there has been a labor stoppage due to a port worker strike and water levels on the Parana River creating logistical issues.

Milo

Milo still tagging along beside corn while corn futures do what they do. This week’s export inspections for milo came in at 2.4 million bushels. Export sales for milo were pretty ho-hum for both the 20/21 and 21/22 marketing years with 20/21 sitting at 4.7 million bushels and 21/22 at 2.1 million bushels. Monday’s crop progress report pegged sorghum plantings at 27% for the U.S. versus 22% last week and the 32% average. Kansas plantings came in at 7% versus 3% last week and the 4% average. Locally basis for milo is fairly flat.

Trivia Answers

-

Back in Black

-

Snow White and the Seven Swarfs (1937)