Weekly Market Update 5/27/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

After Alaska, which U.S. state has the longest coastline?

-

Which famous music group was formerly known as the New Yardbirds?

Answers at the bottom.

Market News

-

Stock markets are seeing strength after today's weekly jobless claims came in lower than expected at 406,000, a new pandemic low. DJIA is currently up 97.82 around 34,420, NASDAQ is up 1.38 around 13,739, and S&P 500 is up 3.66 around 4,199.

-

Energy markets are slightly higher as summer driving season begins, despite concerns about Iranian oil hutting the market if a deal is struck between the U.S. and Iran on their nuclear program. WTI crude is currently up .57 to around 66.80, Brent crude up .50 to around 69.37 and RBOB gasoline unchanged around 2.15.

-

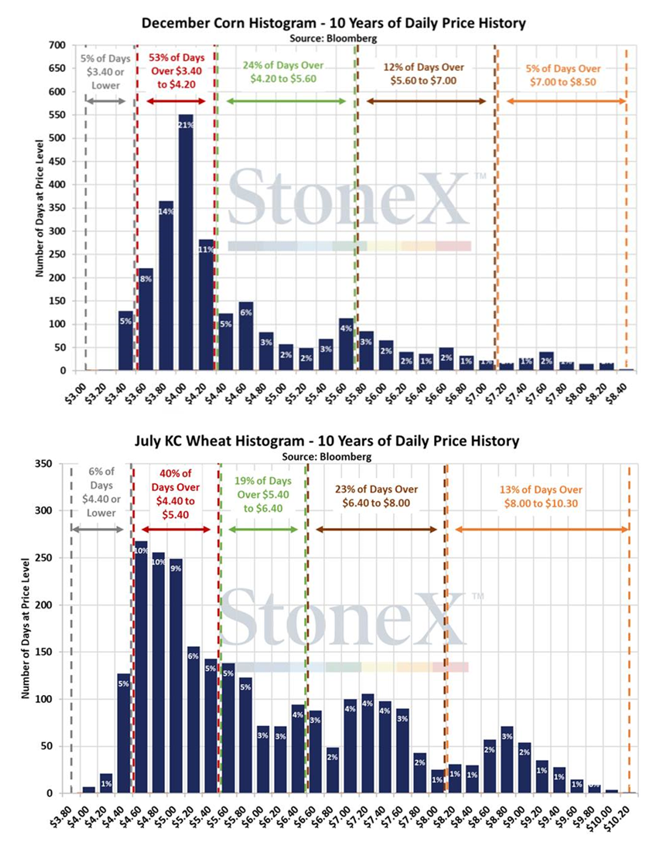

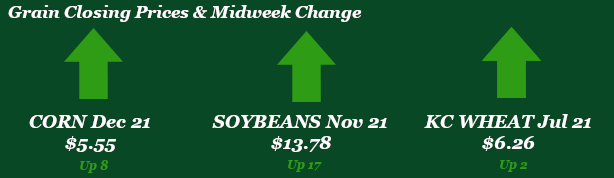

We've included the below charts as some food for thought in considering new crop price levels. These charts show futures levels for both corn and wheat futures over the last 10 years and the percent of days during those years that the market traded the given levels. These charts help to visualize that despite the market's recent cool off, prices are still relatively attractive. As a reminder, milo is priced using corn futures.

-

Commodity markets will be closed during the day session on Monday, May 31st in observance of Memorial Day. Garden City Co-op offices will also be closed on Monday.

|

10 Year Price Histograms |

|

|

Weather

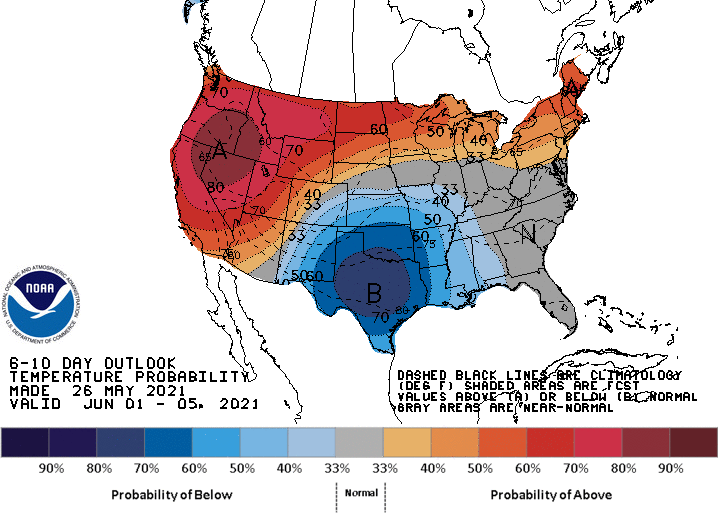

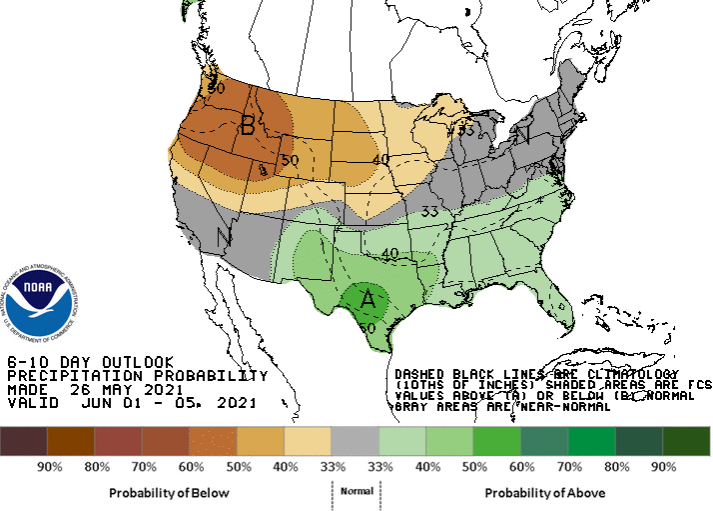

Cooler than normal temperatures look like they want to stick around, with highs in the 60s and 70s for the next week and nighttime lows in the 50s. More chances for rain on the way, with several rounds of showers forecasted Saturday through Monday. This time of year can often lead to volatile and severe weather. Be sure to pay attention to your surroundings and updated forecasts, especially when in fields or other rural areas.

|

Temperature 6-10 Day |

Precipitation 6-10 Day |

|---|---|

|

|

Corn

Corn has seen some pressure this week, trading a 42-cent range. Decent upside came only this morning after a 42-cent drop since Monday. Why? Simple, because rain makes grain, and the US has some seen some very beneficial rains in crucial growing areas. Funds also seeing some selloff, adding to the market pressure. Monday’s export inspections were decent for corn at 68.0 million bushels. Crop progress for corn came in at 90% complete for the US versus 80% last week and 87% last year. Kansas is coming in at 76% complete versus 67% last week and 85% last year. Ethanol stocks continue to pull lower as production wanes some from last week and demand increases. Production, however, has finally broke through the “post-COVID-new-norm” levels. Export sales this morning had the 20/21 marketing year at 21.9 million bushels while new crop sales came in at a whopping 224.1 million bushels. The corn market just loves China right now. In southwest Kansas heavy rains and hail have washed away recent plantings and some farmers are being forced to replant. Locally, basis has stayed steady for both nearby and new crop.

Wheat

Have we found the bottom to this current downturn in the wheat market? July wheat is looking to finish in the green for the first time in 11 trading days. Wheat is finding support this morning from extreme dryness in the Northern Plains and Pacific Northwest, also storms with large hail hit the central plains yesterday. Export inspections were inline with trade estimates at 21.1 million bushels. Export sales were ho-hum as well, 1.1 million bushels and 13.7 million bushels of new crop sales. The CFTC report saw KC wheat sell off 5,899 contracts bringing the current long to 26,100 contracts. Winter wheat crop conditions rating dropped 1% to 47% good to excellent, this is mainly due to the conditions dropping in the Pacific Northwest due to dryness. Kansas saw a bump to 55% good to excellent.

Soybeans

Not many newsworthy storylines for soybeans, having been steady to lower this week but getting a jump start today to regain losses from earlier in the week. Soybean planting jumped to 75% complete ahead of last year’s 63% and 5-year average of 54%. Kansas progressed up to 51%, but with rains across the state planting has been slowed. The state is right inline with last years progress of 50%, but still ahead of the 5-year average of 36%. Soybean emergence is also well ahead of last year, sitting at 41%. Inspections were as expected at 7.1 million bushels. Export sales were also a snoozer with 2.1 million bushels and 9.1 million bushels of new crop sold. Beans also saw a sell off 25,238 contracts bringing the net long to 152,584 according to the CFTC report.

Milo

Milo is on the playground slide right next to corn as prices dropped early in the week. Monday’s export inspections for milo were decent at 6.4 million bushels. Crop progress for sorghum was pegged at 33% for the US versus 27% last week and 38% last year. Kansas plantings came in at 12% complete versus 7% last week and 14% last year. Export sales today came in pretty sad for the 20/21 marketing year at -3.2 billion bushels while new crop sales were at 6.5 million bushels. Locally new crop basis has stayed flat while the nearby has weakened.

Trivia Answers

-

Florida, with a coastline about 1,350 miles long.

-

Led Zeppelin