Weekly Market Update 11/04/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

When was the first U.S. dollar printed?

-

What was the first movie directed by Kevin Costner?

Answers at the bottom.

Market News

-

World food prices rose for a third straight month in October to reach a fresh 10-year-peak, according to the Food and Agriculture Organization (FAO). Food price increases have been largely led by increases in cereal grains (especially wheat) and vegetable oils. The October reading was the highest for the index since July 2011, and is up 31.3% since this time last year.

-

Stocks are mixed today, after all major indexes traded fresh record highs earlier in the week. The Federal Reserve announced yesterday that they would start slowing their pace of asset purchases, as part of their plan to bring their COVID-era quantitative easing program to a full stop by mid-next year..The Department of Labor released their jobless claims report this morning, and it was the lowest weekly claim number since March 14, 2020.

-

USDA will publish the November WASDE report next Tuesday (11/9) at 11:00 AM. Reach out to the grain team if you'd like to get any orders working or bushels priced headed into the report.

|

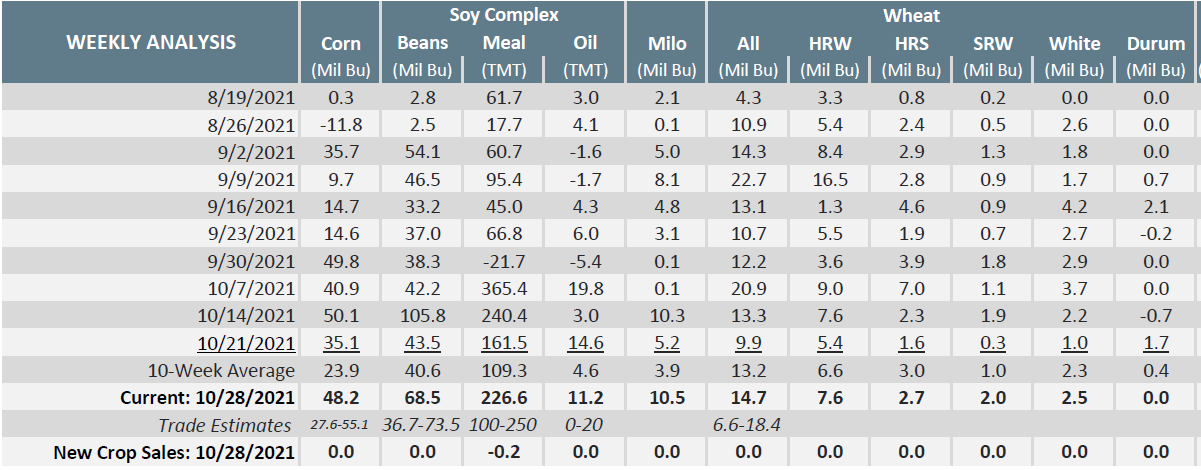

Export Sales Report |

|

|

Weather

Today is a beautiful day after an early week filled with cold, dreary weather. Temperatures are expected to remain pretty pleasant, with highs in the 60s and 70s forecasted into next week. Chances are pretty slim for precipitation in our draw area for the next week and a half, which should be favorable to put a big dent in the last chunk of fall harvest. No big changes week-on-week in the drought monitor.

|

|

Corn

Friday’s CFTC showed some fund buying on corn, gaining 25,222 contracts as specs get into the grain game with inflation driving the market. Friday’s close had December corn at 5.68 ¼. Monday saw decent upside with a high of 5.82. While Tuesday saw highs of 5.86, the day closed down at 5.73 with the weakness continuing into Wednesday, closing at 5.64. Thursday morning saw some upside, but quickly retreated. This week’s export inspections report showed corn exports at a mere 24.4 million bushels versus 25.0 million bushels last week and 41.3 million bushels the week previous. Crop progress pegged corn harvest at 74% for the United States with Kansas at 90%. Wednesday’s ethanol production stayed steady at 1,107 thousand barrels per day. Export sales report this morning was better for corn at 48.2 million bushels versus 35.1 last week and the 10-week average of 23.9 million bushels. The StoneX Crop survey had corn yields for Kansas estimated at 143 bpa. Corn basis in southwest Kansas stays steady for the area.

Wheat

Wheat came into Monday still ready to party and jittery from the Halloween candy sugar rush. KC wheat followed the MGEX running higher, and it was off we go. Worldwide global balance sheet is tight as Paris wheat remains in rationing mode. Tuesday and Wednesday saw the sugar crash. Profit taking took over on technical selling. Export inspections were below trade estimates at 4.2 million bushels loaded for shipping. Export sales were decent and with trade ranges, selling 14.7 million bushels. HRW led the way with 7.6 million bushels sold. The CFTC report from last Friday showed KC Wheat as buyers, extending the long by 5,583 contracts to 52,973 total. Crop progress showed winter wheat planting at 87% complete for the U.S. right in line with the 5-year average of 86% at this point. Kansas jumped to 91% planted also ahead of the 5-year average of 89%.The U.S. winter wheat crop is reported at 45% good-to-excellent, down 1% from the previous week and lagging behind the 5-year average of 53% good-to-excellent.

Soybeans

Soybeans this week have been mixed to steady even though they are sleepwalking through mud today. Little to no news regarding beans this week. We did have a small flash sale Tuesday to China of 132k metric tonnes. Chinese demand is tepid at best, Monday’s inspection report was 83.5 million bushels shipped still on the high end of trade expectations, but still running 5% behind USDA target for this year. South America is ahead of schedule on planting compared to last year. Brazil is up to 52% complete comparted to 42% last year at this time. Rains have been very beneficial for the SA crop and expectation so far is a healthy crop is on the way. Export sales showed 68.5 million bushels sold within trade estimates. Harvest has slowed for the U.S. due to rains and is pegged at 79% completed, behind the 5-year average of 81%. Kansas is 69% competed with harvest almost at the 5-year average of 70% harvested. Soybean funds were buyer as well increasing the long by 5,746 contracts for a total of 23,911 contracts.

Milo

Milo just following the corn cue as futures stay volatile on inflation and the bulls chomp at the bit. Monday’s export inspections for milo were pegged at 3.0 million bushels versus 3.2 million bushels last week and the 10-week average of 2.5 million bushels. This week’s crop progress report pegged sorghum harvest at 80% complete for the U.S. with Kansas at 71% complete. Thursday’s export sales came in better than previous weeks at 10.5 million bushels versus last week at 5.2 million bushels and the 10-week average of 3.9 million bushels. Locally basis stays flat as harvest plugs along.

Trivia Answers

-

1862

-

Dances with Wolves (1990)