Weekly Market Update 11/11/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Which team won 3 Superbowl championships in the 1990's?

-

How long does a solar eclipse last?

Answers at the bottom.

Market News

-

Happy Veteran's Day and a big THANK YOU to all of the service men and women who have selflessly served and sacrificed for our nation.

-

As the U.S. continues to see record inflation the pace of rising consumer prices continues to set records as prices for food, energy, shelter, and transportation changed almost 1% over a month. This is the fastest monthly increase since 1982.

-

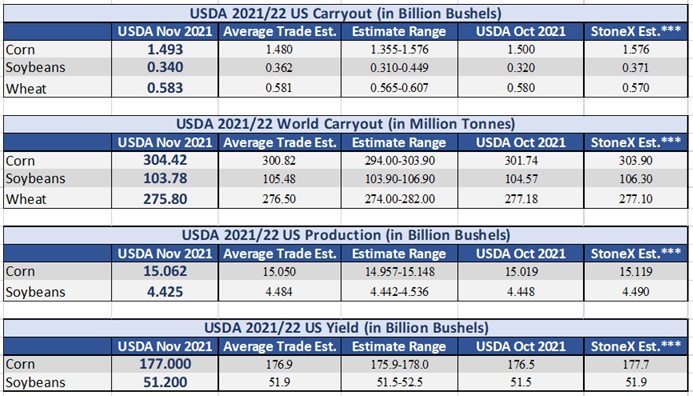

The November WASDE held little in the way of fresh and exciting market news. While corn and bean world carryout left a lot to be desired, wheat was the belle of the ball, taking a 1.3mmt cut that allowed the bulls to lick their lips. Corn and bean production was basically in line with expectations. Corn yield saw a .5 bpa increase, whole bean yield saw a .3 bpa decrease.

|

November WASDE |

|

|

Weather

The weather has been living up to expectations over the past week or so: dry. And it looks like the dryness is set to continue in the 6-10 day forecast with tempuratures near normal for this time of year. While the neutral weather will help top off harvest, it won't be long before winter wheat will need some moisture.

|

|

Corn

It’s turning out to be a relatively quiet day for corn after some big swings this morning and upward movement the previous two days. Tuesday’s WASDE was about as expected for corn, but it has been able to find strength on the coattails of beans and wheat. USDA met the trade’s expectation by raising the yield by 0.5 bushel, which pushed total production up by 43 million bushels. This was more than offset by a 50 million bushel move higher. 2021/22 carryout is down 7 million bushels to 1.493 billion. World stocks are higher month on month with both Brazil and China’s beginning stocks increased. This week’s ethanol report showed production down week-on-week, but it’s worth noting we were coming off of a close to record-breaking week. Funds have been big buyers of corn, reported at buying 79,770 contracts to bring their net long up to 324,560 contracts. Export inspections were on the very low end of estimates at 22.2 million bushels, down from the previous week at 26.4 million. Export sales are delayed until tomorrow. USDA estimates the U.S. corn crop at 84% harvested, up 10% week-on-week. Locally, the last bit of harvest continues to roll on. Basis remains flat and historically strong.

Wheat

December wheat has seen some favorable upside since Friday, gaining just shy of 50 cents. Wheat market driver seems to be world stocks tightening as per Tuesday’s WASDE. Of course, inflation helps as well, as prices to the consumer are ramped up that is not just indicative to a reopening economy. Monday export inspections on wheat were ho-hum coming in at a mere 8.5 million bushels verses the 14.3-million-bushel 10-week average. The crop progress report held winter wheat at 95% planted for Kansas and the US aggregate at 91% planted. Kansas looked to be 80% emerged with the US at 74%. Winter wheat conditions stayed steady at 62% good to excellent for Kansas and 45% good to excellent for the US. With Kansas looing to see a dry, cold winter those conditions could change so watch the market closely. Tuesday’s WASDE was pretty mild, with the only bullish news being world wheat stocks coming in 1.3 mmt lower than October’s USDA. Locally, wheat basis has stayed somewhat flat.

Soybeans

Beans had the highest WASDE sticker shock. The trade was looking for a slight increase in bean yields, but instead USDA printed a 0.3 bushel decrease, pushing production down by 23 million bushels. The decrease in production was more than matched with a 40 million bushel drop in exports and a decrease in seed/residual use. 2021/22 U.S. carryout is increased by 20 million bushels to 340 million, with world carryout down to 103.78 MMT. Despite strength from the report, soybeans are still looking down the barrel of a likely record South American soybean crop that should start coming off in January. That, paired with a stronger U.S. dollar, doesn’t look promising for U.S. soybean exports. Export inspections were reported at 97.3 million bushels this week, which was higher than the previous week. Last Friday’s CFTC report indicated that managed money was a net buyer of beans, raising their net long by 18,770 to 42,681 contracts. USDA reported the crop at 87% harvested on Monday, up 8% from the previous week.

Milo

Corn futures are providing strength to cash prices, while basis remains steady. USDA didn’t make any changes to the milo balance sheet in the November WASDE. Export inspections were reported at 0.3 million bushels, down from the previous week at 3.0 million. Export sales report will be released tomorrow. Milo harvest is on the downhill slope, with USDA estimating the crop at 86% harvested.

Trivia Answers

-

The Dallas Cowboys

-

About 7 1/2 minutes