Weekly Market Update 4/14/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Which presidential administration hosted the first White House Easter Egg Roll?

-

What is the birthstone for April?

Answers at the bottom.

Market News

-

Russia's invasion of the Ukraine is ongoing and seems far from a resolution. Yesterday the Biden administration announced a support package for Ukraine including an additional $800 million in weapons and other assistance. This comes as fighting is intensifying in the eastern part of the country. Over the next few weeks, officials expect Russian forces to resupply and reposition with the aim of launching a brutal new offense in Donbas.

-

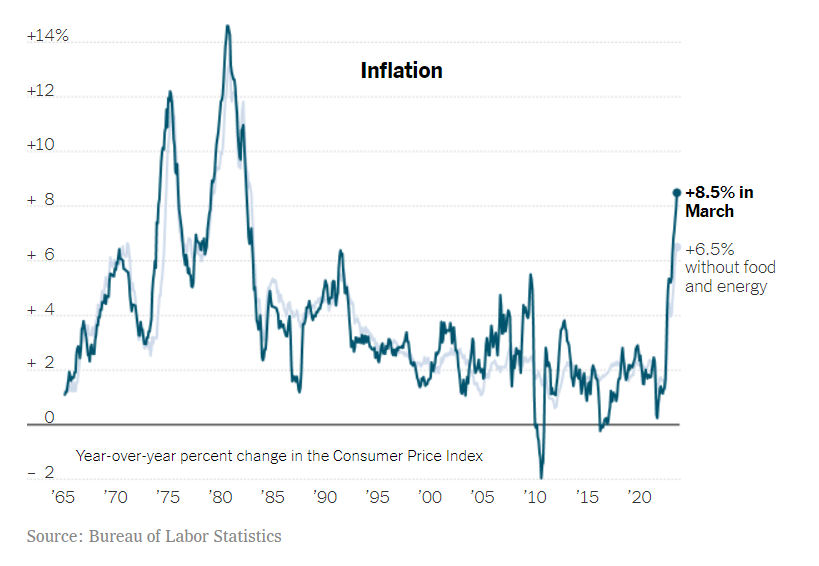

Inflation hit 8.5 percent in the United States last month, the fastest 12-month pace since 1981. The Labor Department largely attributes the jump to big increases in the cost of fuel and food, much of which is the result of the ongoing Black Sea conflict. The Labor Department's latest weekly jobless claims report rose slightly more than expected at 185,000 claims, but still held near a 54-year low set earlier in the month.

-

Our offices will be closed tomorrow for Good Friday. Commodity markets will also be closed after today's session and will re-open for the Sunday night session. We hope you and your families have a really Happy Easter!

| Year-on-Year Changes in Consumer Price Index |

|

|

Weather

After a crazy week of changing weather, it looks like Mother Nature is ready to fall into a pattern for the next week or two. Highs look to remain in the high 50s and 60s, with nighttime lows in the mid-30s - higher than normal for this time of the year. No solid chances of rain exist in the nearby forecast.

|

|

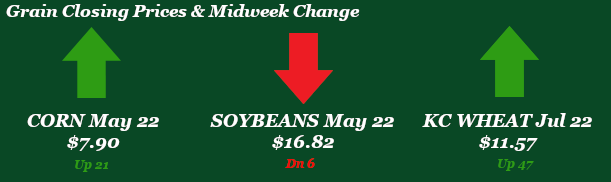

Corn

December corn has seen steady upside to the tune of 19 ¼ cents since last Friday’s close and trading a range of roughly 26 cents. Friday’s CFTC report showed managed money at 362K contracts long. Monday kicked off the week with a flash sale of corn to China totaling 1,020,000 metric tons with 680,000 MT for 2021/2022 and 340,000MT for 2022/2023. Along with flash sales, Monday’s export inspections pegged corn at 55.9 million bushels verses 60.6 million bushels last week and the 10-week average of 55.4 million bushels. Crop progress this week has corn for Kansas planted at about 5% versus 7% last year. U.S. corn planting sits mute at 2% complete for the 2nd week in a row. US corn planting could be stalled out as colder temps and unfavorable weather are on the horizon, leaving planting at a slower-than-average pace. Ethanol stocks took a dip this week on what look to be decent exports, down 1.1 million barrels while production is also down for the third straight week at 995 thousand barrels per day. Thursday’s export sales pegged corn at 52.5 million bushels for the current marketing year versus 30.8 last week and the 10-week average of 41.3 million bushels. NC sales sat at 15.9 million bushels. Locally basis stays steady.

Wheat

Wheat has had a strong week on limited news, but profits are being taken this morning by traders leading us slightly down to start today. Traders are still watching the Ukraine war situation during this short work week. Markets will be closed tomorrow for Good Friday. Winter wheat conditions did improve last week 2% up to 32% good to excellent, still well behind the 5-year average of 52% g/e. Kansas also saw a 2% bump to 34% and has a chance to see more improvement for next week with the rains received this week at least in the eastern half of the state. Export inspections reported 15.1 million bushels shipped, towards the top end of estimates. Mexico and the Philippines were the top 2 destinations. Export sales were once again nonexistent this week for current crop year seeing 3.5 million bushels sold and 8.3 new crop bushels sold. The CFTC report from last week showed KC wheat selling 281 contracts lowering the long to 45,029 contracts. With limited news and a short week with the holiday tomorrow expect a choppy trading session.

Soybeans

Soybeans have been choppier and rangebound for the week. Not big surprises in last Friday’s USDA WASDE report for April. Slow planting progress due to weather delays spurred a rally earlier in the week. Export inspections reported 28.2 million bushels shipped, right in line with projections. Export sales were solid once and again and still out of the normal for seasonal pace. Export sales report 20.2 million bushels of old crop and 16.8 million bushels of new crop sold. We also saw a flash sale to China reported this morning. Soybeans added 7,382 contracts to their long of 163,655 contracts according to the last Friday’s CFTC report. With limited news beans look to close out the short week without much of a fuss.

Milo

Milo export inspections came in slightly disappointing this week at 5.7 million bushels versus last week of 11.2 million bushels and the 10-week average of 9.1 million bushels. Sorghum planting for the U.S. sits at 14%, with no start in Kansas. Export sales this week put milo at .3 million bushels for the current marketing year with no new crop sales to show. Locally milo basis is flat.

Trivia Answers

-

Rutherford D. Hayes (1878)

-

Diamond