Weekly Market Update 12/8/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Which song, composed in 1857, was supposed to be a Thanksgiving song but is now traditionally sung around Christmas time?

-

Which Hollywood actor played six different roles in The Polar Express?

Answers at the bottom.

Market News

-

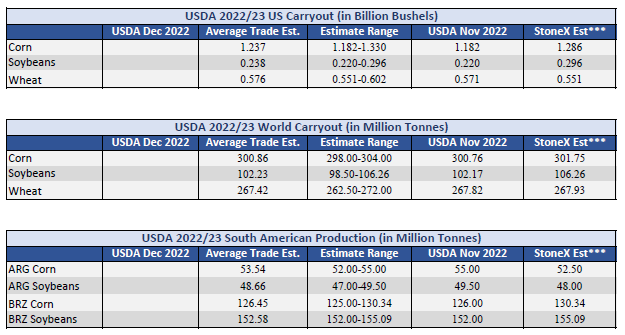

Markets were quiet today ahead of tomorrow's report. USDA will publish the December WASDE tomorrow morning at 11:00. The trade will be closely watching what USDA does with U.S. demand estimates, South American row-crop estimates, and Southern Hemisphere wheat estimates. Check out the graphic below for average trade guesses.

-

In a major policy shift, China has started the process of relaxing their COVID-19 policies that have been effect since the pandemic began almost three years ago. It will no longer be required to show negative virus tests or health codes to travel within the country and allows people with COVID who have mild or no symptoms to quarantine at home. These moves are the strongest sign that the Chinese government is ready to move away from their strict Zero COVID policies and should be friendly towards increased Chinese demand for U.S. products.

-

Stocks are mostly higher today, after five straight days of losses in the S&P 500. The Nasdaq is also higher after its worst week since December 1975. Filings fpr umemployment rose slightly last week, with initial jobless clames at 230,000 for the week ending Decembver 3rd - up 4,000 from the previous week. The market is also awaiting the Federal Reserve's highly anticipated last rate-setting meeting of 2022 next week. They are expected to raise the benchmark interest rate by another 50 basis points.

|

December WASDE Estimates |

|

|

Weather

Another temperature whiplash is headed our way, with temperatures in the 50s and even 60s through Monday, but dipping down in the 30s and 40s for the remainder of next week. Unfortunately, the change in temperatures is also expected to bring on another round of high winds Monday morning through Thursday evening. There aren't any big chances for precipitation hanging out in the 10-day forecast.

|

|

|

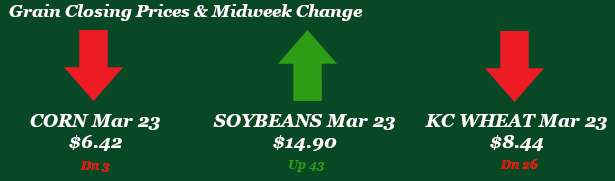

Corn

Corn has been treading water today and is looking forward to the WASDE report for direction. On a brighter note, corn has finished consecutive days in the green. Headlines for corn have been few and far between and exports are still lack luster. Export inspections came in at 20.6 million bushels smack dab in the middle of trade estimates. China and Mexico took the majority of shipments. Export sales still stink and are lagging behind USDA projections, sales totaled 27.2 million bushels. Mexico and China were the top buyers for corn. Managed money added 20,864 contracts to their net long position raising it to 191,631. Tomorrow will dictate what corn does in the near term either rally or having a negative tone and continuing to slide.

Wheat

Strength from Wednesday has faded, and we are back to trading in the red. The KC wheat market is waiting for more information from the December WASDE, which is being released tomorrow at 11:00 a.m. News has been limited for bulls over the past few weeks to get anyone excited and spur a sustained rally. Looks like Wednesday traders found good values to jump in and be buyers leading us to a green finish. Export inspections came in better than anticipated at 12.3 million bushels with white wheat leading the way. The Philippines led the way with 4 million bushels followed by Mexico with 1.8 million bushels shipped. Export sales were a snoozer this week with 7 million bushels sold close to the bottom end of trade estimates. HRW lead the way for sales with 2.8 million bushels sold. China was the number one buyer followed by Iraq & Mexico. Managed money sold of 179 contracts lowering their net long position to 17,129 contracts. Look for the wheat market to remain stagnant until we get to the report tomorrow and the trade has more news to feed on.

Soybeans

Soybeans are the only commodity really feeling the love this week, with March bean futures up more than 40 cents. China loosing COVID restrictions this week has the market looking for stronger Chinese demand for U.S. soybeans ahead of Brazil's next harvest. Add to this that Argentina is incredibly dry, which is delaying some bean planting as farmers await rain. Export sales this morning blew trade expectations out of the water, with old crop sales reported at 63.1 million bushels and new crop sales at 1.1 million. The vast majority of these sales were to China. Export inspections, on the other hand, were somewhat disappointing at 63.3 million bushels shipped, down from last week at 81.8 million. Friday's CFTC report indicated that managed money added 19.696 contracts to bring their net long up to 102,104 contracts. Tomorrow's WASDE shouldn't hold any huge surprises for beans, with the trade looking for a slightly higher U.S. ending stocks number. The average trade estimate is ringing in at 238 million bushels, which would still be the lowest ending stocks number in seven years. World soybeans stocks are expected to be relatively unchanged.

Milo

Export inspections for milo saw a 10-week high of 3 million bushels. China took 2.8 million bushels of the shipment. Milo sales were almost nonexistent with 100k bushels sold. China bought almost 3 million bushels but we saw almost the exact same amount canceled by “unknown”. Export sales are 38% below USDA projections, some change would be expected from the USDA but don’t hold your breath.

Trivia Answers

-

Jingle Bells

-

Tom Hanks