Weekly Market Update 7/14/22

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

The 38th president was born on this day in 1913. What is his name?

-

This famous outlaw was shot by Sheriff Pat Garrett in New Mexico on this day in 1881. Who was this outlaw?

Answers at the bottom.

Market News

-

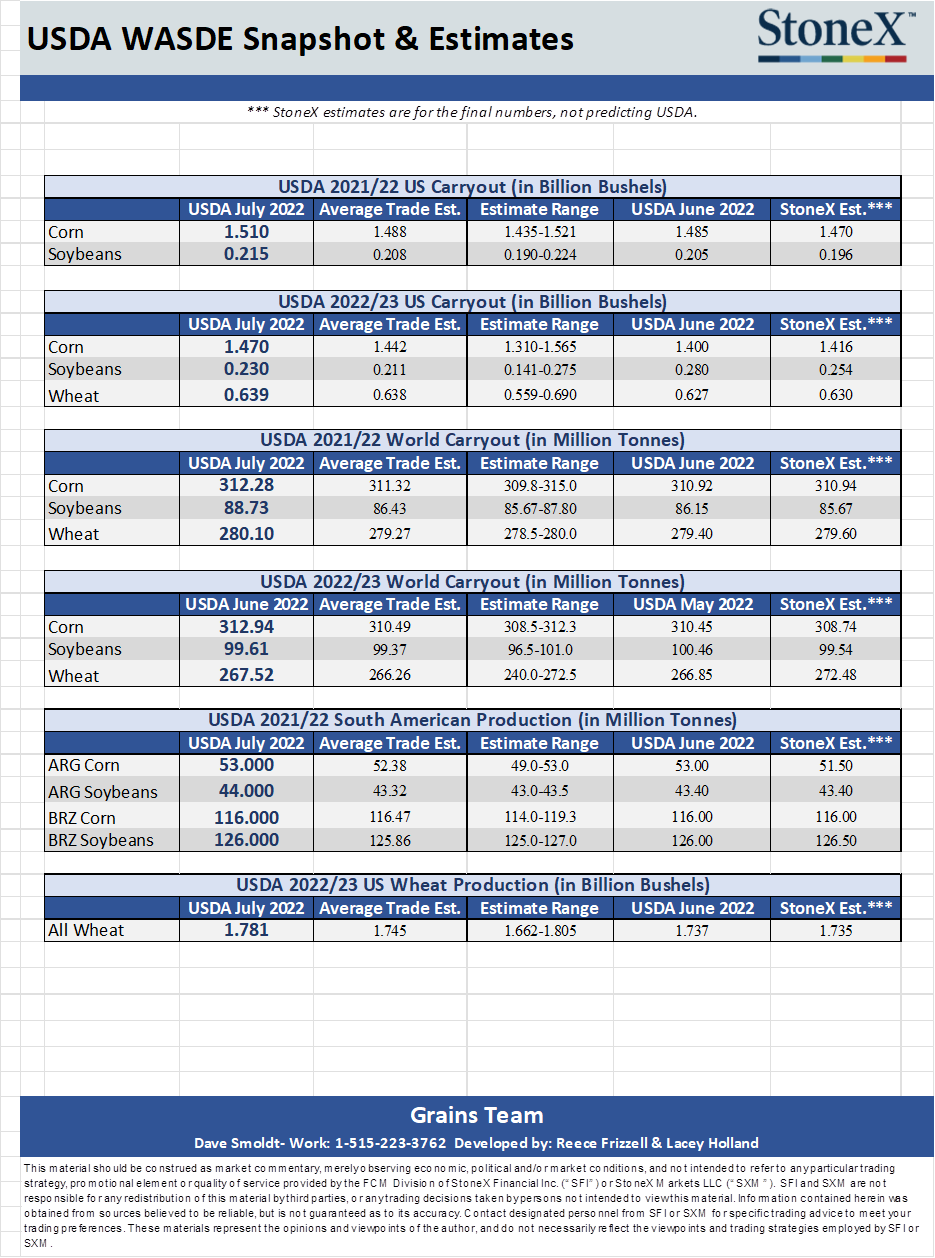

The July WASDE was released on Tuesday with surprisingly bearish tones. More breakdown of the report in commodities.

-

Inflation has hit a 40-year high. The Consumer Price Index in June set another record high dating back to 1981. Inflation in June rose 1.3% during the month. Higher than the expected 1.1% and above May’s 1.0% increase. The annual figure came in at 9.1% vs 8.8% expected and 8.6% in May.

-

The DOW closed down 142.62 points on the day at 30,630.17 and overall, for the week is down from the high of 31,467. The NASDAQ closed in the green up 3.60 points at 11,251.19 but still off the high for the week at 11687.65. The S&P 500 closed down 11.40 points at 3,790.38. For the week the index is well of the high of 3,917.27. The U.S. Dollar index closed up slightly on the day at 108.515. For the week it has remained near the high.

-

In social media news Twitter is suing Elon Musk for his attempt to back out of the $44 billion purchase that was announced earlier this summer.

|

July WASDE |

|

|

Weather

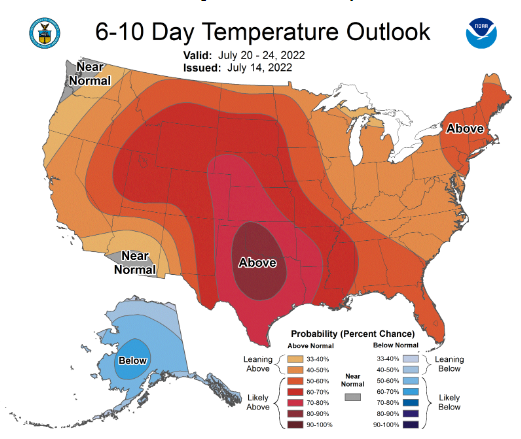

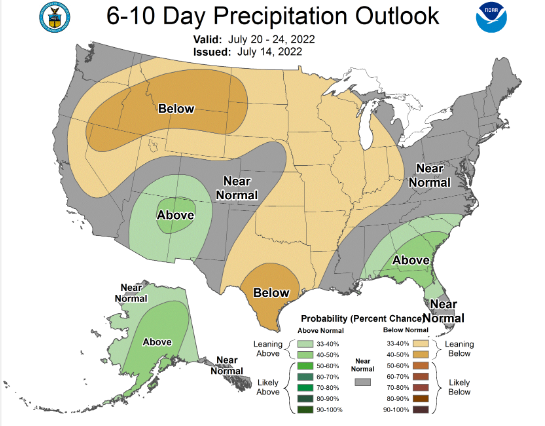

Brace for some heat. The 10-day forecast shows the majority of days over 100 degrees over the next week. It will also remain dry with no rain in sight over the next 10-day outlook.

|

|

Corn

Since last Friday’s close, December corn has lost 22 ½ cents and closed at 6.01 today. Futures are 1.65 off the contract’s lifetime high of 7.66, and 1.48 off the 1-month high of 7.49. Since 1992, December corn price action for the last half of July has seen mostly pressure with the exception of 9 years that managed to gain some upside: 1997, 1999, 2002, 2009, 2010, 2012, 2017, 2018, and 2021. The July WASDE S&D showed no major balance sheet changes to US or world carryout, but numbers did offer a bearish tone with a 25 million bushel cut to feed use and rolled in acreage from the June report. US 21/22 carryout stood at 1.510 billion bushels while 22/23 was pegged at 1.470 billion bushels. US wheat production came in at 1.781 billion bushels. South American production remained virtually unchanged. Friday’s CFTC report showed another good chunk of sell off that totaled 55,748 contracts leaving corn managed money with a 172,867 contract long. Export inspections for corn were a squeak better than last week at 36.8 million bushels versus last weeks 34.5 million bushels. Export sales were better than last week’s cancellations at 2.3 million bushels Crop conditions for the week stayed flat at 64% good to excellent which hovers around last year and is just 2% under the average. This week’s ethanol report showed stocks and demand up and production down. Locally basis has softened due to rail corn and the roll.

Wheat

Volatility has been the name of the game as wheat continues its slide down. September wheat is currently down almost a dollar on the week. The big-ticket item this week was the July WASDE, which was neutral to bearish wheat. 2022/2023 US carryout was increased by 12 million bushels to 639 million. New crop export demand was raised by 25 million bushels on optimism of potential demand, and production rose slightly for HRW at 585 million bushels. Old crop world carryout was increased to 280.10 MMT, while new crop carryout was up at 267.52 MMT despite a slight cut to production. Export inspections this week were within expectations but still behind pace at 4.1 million bushels of HRW. Export sales were a huge 8.9 million bushels. Friday’s CFTC report indicated that the funds were sellers of wheat, bringing their net long down 2.819 contracts to 22,037 contracts long. Hot, dry weather maps across the country are somewhat supportive winter wheat as we get closer to planting. USDA estimates the crop at 63% harvested, while Kansas is all but done at 95% complete. In other news, Ukraine and Russia met for the first time in weeks to have discussions with the U.N. regarding safe grain exports out of Ukrainian Black Sea ports. While negotiations are ongoing, U.N. Secretary-General Antonio Guterres said that the meetings were “a critical step forward.” These headlines will be closely followed by the market in the coming days.

Soybeans

Beans are on the same downward spiral of the other commodities, further fueled by outside pressure from crude oil, a strengthening dollar, inflation and decreased Chinese demand from continuing Covid lockdowns. U.S. bean exports to China in June were down 23% from June 2021. July WASDE saw 21/22 bean carryout up 10 million bushels. New crop carryout was decreased 50 million bushels to 230 million, with decreases to exports and crush, but lower production. Old crop world carryout was up 2.6 MMT on mostly on lower global crush, while new crop carryout fell 0.8 MMT largely because of a decline in U.S. production. Overall, a mostly bearish report with carryout numbers coming in on the high side of estimates. Export inspections this week were below expectations at 13.1 million bushels. Export sales were a drag with net cancellations of 13.3 million bushels in the old crop slot and net sales of 4.2 million bushels of new crop. The funds were net sellers of beans, with Friday’s report indicating that their net long was reduced by 19,450 contracts to 105,048 contracts long. Hot, dry U.S. weather will remain in the forefront, with the 10-day forecast less than promising. Soybean conditions were down 1% this week at 62% good-to-excellent, but still right in line with the 5-year average.

Milo

Milo has been fairly quiet and locally basis is uneventful. Export inspections on Monday were pegged at 7.2 million bushels versus last weeks 3.1 million bushels while export sales this week showed some cancellations. Crop conditions on milo came in at 40% good to excellent, down 2% from last week.

Trivia Answers

-

Gerald Ford

-

Billy the Kid