Weekly Market Update 7/28/22

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

-

What is the most popular wood used when smoking meat for BBQ?

-

Which region in the United states has the fewest BBQ restaurants per capita?

Answers at the bottom.

Market News

-

Russia launched a fresh attack today on Kyiv, as well as the northern Chernihiv region with Ukraine stating it was in retaliation for standing up to the Kremlin. Missles were launched from the Black Sea hitting a military unit on the outskirts of the capital. This comes just days after deals were struck between the two countries to get stalled shipments out of the ports.

-

The U.S. Dollar has managed to hold the 105 - 108 range for the month of July, and has managed to trend higher over the past 3 months. NASDAQ managed to scoot up to highs it hasn't seen since June, as did the S&P 500 and the DOW. NASDAQ closed at 12,162.59, S&P closed at 4,072.43, and DOW closed at 32,529.63.

-

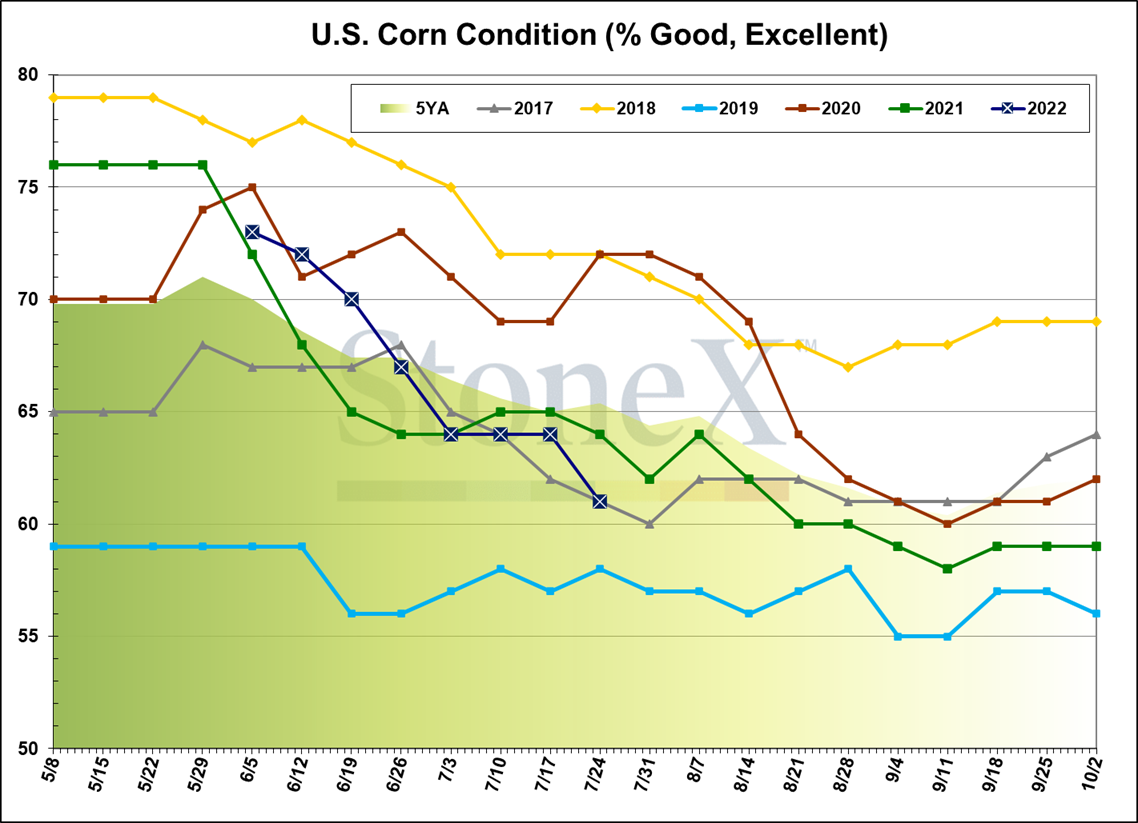

Weather is a big driver of the markets this week as corn conditions took a little tumble. This week ratings dropped 3% on corn, comparable to 2017 and below the 5 year average. With a continued hot and dry forecast for key growing areas, we could see corn hold these levels for a bit. Sorghum ratings dropped 5% and soybean ratings dropped 2%.

| 7.25.22 Corn Conditions |

|

|

Weather

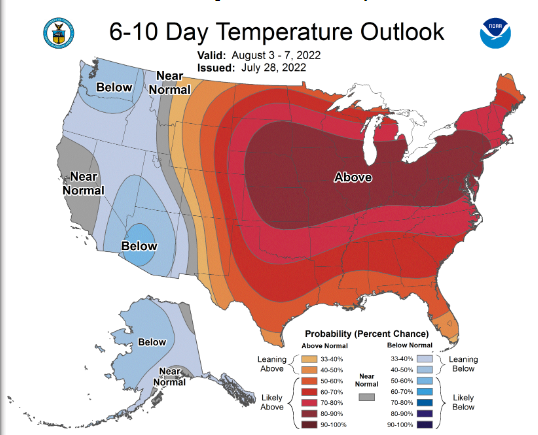

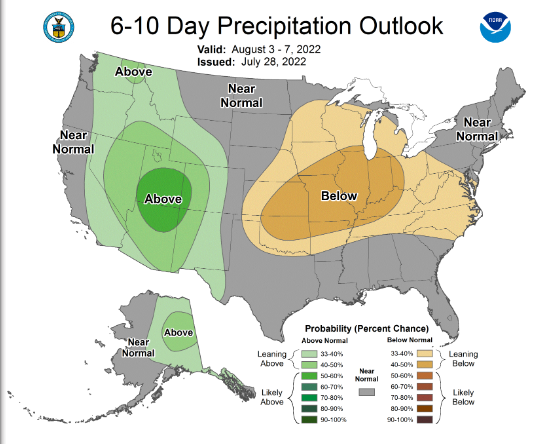

Headed into the weekend, rains look to hit some critical areas in southwest Kansas as the milo and corn crops are in dire need of some water. Forecasts are predicting anywhere from 4-8 inches of rain in drought-ridden areas. However, the 6-10 day forecast leaves much to be desired as the hot and dry theme comes back to take center stage with temperatures creeping back up into the high 90s.

|

|

Corn

Corn has shot up this week and overall is up over 30 cents on the week. Things got started Sunday night and carried over into Monday with Russia bombing ports in Ukraine over the weekend after an agreement was thought to be struck between the countries to allow shipments in the Black Sea on Friday. Tuesday saw a strong day again with corn crop ratings taking a bigger hit than expected and lowering 3% to 61% good to excellent, combine those number with the forecast outlook for August being hot and dry and we have a recipe for a sustained rally. Kansas saw a sizable drop in crop condition down 8 percentage points to 39% good to excellent. Relief seems to be on the way with very favorable rain chances over the next few days and much cooler temps through the weekend. Export inspections this week were bland with 28.5 million bushels shipped, close to the low end of projections. Mexico was the number one destination followed by China. Export sales were nothing special this week with 5.9 million bushels of old crop sold and 7.6 million bushels of new crop. Mexico again was the number one buyer. Last Friday the CFTC report showed managed money reducing their long by 25,871 contracts bringing the long to 125,303 contracts. With forecast in the corn belt remaining above average for heat and little moisture in the near term many are starting to worry about heat stress. Corn looks to finish the week strong and in the green with weather forecasts steering the car.

Wheat

The wheat market is up today, after a volatile week of following headlines and the direction of row crops. Last Friday it was announced that the United Nations and Turkey had brokered deals with both Ukraine and Russia to export grain trapped in Ukrainian ports on the Black Sea. However, less than 24 hours after the deals were finalized, two Russian missiles struck the port in Odessa. Despite the Russian attack, the agreement remains intact and reports are that grain could begin to flow in the coming weeks. This will be important to watch as the situation develops. HRW export inspections this week were solid at 6.6 million bushels, up from the previous week at 3.6 million. Export sales were also up from last week, with 5.3 million bushels sold. Last week’s report indicated the funds were again net sellers, reducing their net long by 4,519 contracts to 11,868 contracts long. USDA pegs the winter wheat crop at 77% harvested. Spring wheat conditions were down 3% week-on-week to 68% good-to-excellent, but are still way ahead of the 5-year average of 52%. The spring wheat tour is happening this week and early reports are higher than expected yields. Rain is expected across the plains in the coming days, which is critical as the time approaches to begin planting winter wheat.

Soybeans

Beans are climbing this week, finding support from extended forecasts and strong export sales. While most of the Corn Belt is currently receiving rain and cooler temperatures, August is forecasted to be hot and dry. The coming month is a critical time for a soybean crop that is currently estimated at 64% blooming and 26% setting pods. Cooler, wetter weather will be necessary for the crop to be close to trendline yields. Crop conditions were down 2% this week to 59% good-to-excellent. Export sales this morning were higher than expected, with 27.5 million bushels sold in the new crop slot. Export inspections were within estimates at 14.3 million bushels shipped, down from the previous week at 16.1 million. Nearby Chinese bean demand has been mostly filled by Brazil, but demand is expected to come back to the U.S. in the new crop slot as their swine breeding herd continues to grow. Perhaps demand will be able to get back on track following destruction from their ongoing Covid lockdowns. Friday’s CFTC report showed managed money sold 7,879 contracts, reducing their net long to 87,832 contracts. This market will continue to be heavily influenced by extended forecasts, so keep an eye on weather across the Corn Belt.

Milo

It has been a quiet week for milo, export inspections reported 2.9 million bushels shipped. Well below the 10-week average of 5.9 million bushels. China was far and away the number one destination. Overall, for the year milo is well above USDA’s seasonal pace. Export sales for old crop were nonexistent with 100,000 bushels sold and 2.6 million of new crop. China was again the number one buyer, Mexico bought half of the old crop bushels. Basis remains firm for milo heading into August.

Trivia Answers

-

Oak

-

New England