Weekly Market Update 7/7/22

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

On this day in 1930 construction of this dam began with 21,000 men working to complete it. It would be the largest dam of its time. What dam is it?

-

This future U.S. state was annexed on this day in 1898 but was not made a state until 1959. What is this future state?

Answers at the bottom.

Market News

-

June Fed Meeting minutes were realeased Wednesday afternoon. Many members agreed that policy may need to go to a more restrictive stance, and a bigger basis-point move could be seen at the end of the month. Many also agreed that inflation risks were "skewed" and revised the inflation forecast higher with the PCE price index ending 2022 at 5.0%. There was no real focus on any recession talk.

-

The U.S. Dollar saw the highest levels in 20 years this past week, pushing through 1.07 and up 11%. With the strength in the US Dollar, commodities have weakened. Natural gas is down 40%, wheat is down 27%, and cotton is down 28% to just name a few.

-

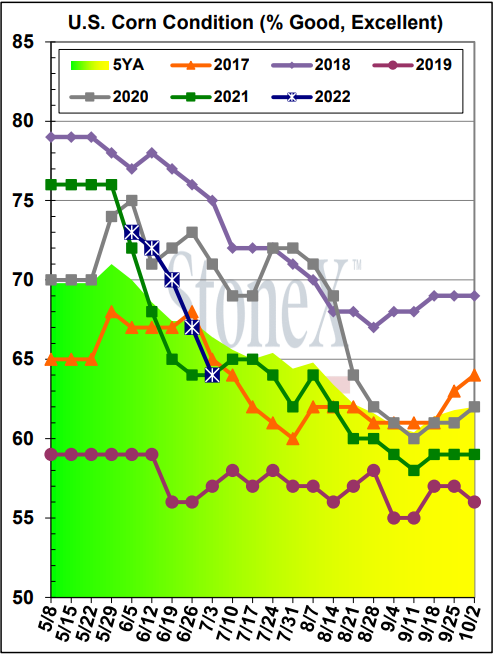

U.S. corn condition ratings fell by more-than-expected this week for the 4th consecutive week. Corn conditions were down 3% to 64% good to excellent, and down 9% from the initial 73% on June 6th. Many states conditions fell 2-5%, but the northern states were able to hang in there with Minnesota up 4% and North Dakota was up 7%. 64% g/e rating is in line with both the 2017 and 2021 crops at this point in the growing season.

|

Corn Condition |

|

|

Weather

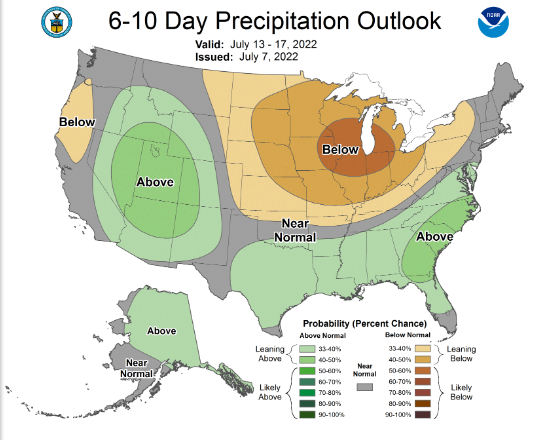

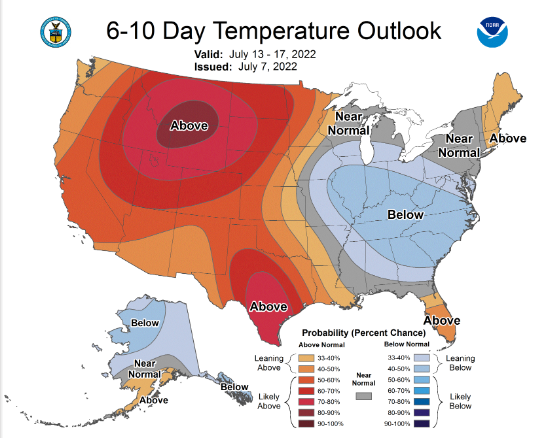

Southwest Kansas saw 1.5-2" of rain over the holiday weekend, stalling out harvest but giving fall crops a much-needed boost. Scattered storms look to stick around heading into the weekend. As wheat harvest starts to wind up, temps look to creep back up into the 100's for Saturday, Sunday, and Monday and Tuesday looks to offer some relief with a 65% chance of rain and highs in the 80s. The 6-10 day forecast looks to hold above normal temperatures and stay mostly dry.

|

|

Corn

Corn is seeing a bounce today and has filled the gap coming out of the long weekend. Most of the downside pressure has come from a large fund sell off the last 10 days or so along with favorable forecasts for the corn belt the first half of July. We have regained all losses from Tuesday which is a sight for sore eyes and healthy for the market to see a rebound. Much of today’s action is attributed to a buying opportunity for funds with fundamentals basically unchanged. Due to the holiday weekend all reports this week are delayed a day, so no export sales info. Export inspections for corn were dismal with 26.6 million bushels inspected to ship, well under trade estimates. Mexico was the number one destination with 12.4 million bushels headed there. U.S. corn export inspection progress is still behind USDA projections and needs multiple strong weeks to catch up. Crop progress pegged corn crop conditions down 3% to 64% good to excellent, this helped bounce the market Wednesday and give it enough strength to finish in the green. Kansas dropped 2% to 57% good to excellent just behind the 5-year pace of 58% good to excellent. CFTC report from last Friday had corn as net sellers of 36,649 contracts lowering the current long to 228,615 contracts. So far this week corn has continued to be sellers. Basis remains very firm for corn in the area with little change week to week.

Wheat

Today’s gains are a nice change from the recent blood bath across the wheat complex. September wheat is down over two dollars in the last three weeks, feeling the same pressure as the rest of the commodities from higher crude, a strengthening dollar, pressure from favorable Corn Belt weather, and a massive exodus of managed money. StatsCan released expected higher-than-expected Canadian wheat acres this week, fueling the fire to the downside. Export inspections were pitiful with only 2.1 million bushels of wheat shipped, down from the previous week at 5.2 million. Export sales won’t be until tomorrow. Friday’s CFTC report showed what we already expected – that the funds sold off their positions, bringing their net long down 7,738 contracts to 24,856. Spring wheat conditions jumped considerably this week, up 7% to 66% good-to-excellent. USDA pegs the winter wheat crop at 54% harvested and Kansas at 83% finished. Wheat harvest is all but wrapped up across our territory. Yields were variable but mostly disappointing. Despite today’s rally, wheat feels weaker. It’s worth considering what levels make sense to let go of your wheat crop.

Soybeans

Beans are up today in what has been an extremely volatile week with large daily price swings. Bean conditions were down 2% this week to 63% good-to-excellent, with the Delta headed into a week of hot, dry conditions amid rain forecasts in the northern Corn Belt. Drops in the price of bean oil has put pressure on the market, as the price of palm oil is falling with more Indonesian product being released. The market is also facing headwinds of a rising US dollar and fears of Chinese demand due to continuing Covid lockdowns. The market will continue to keep a sharp eye on China. Export inspections this week came in even below the lowest trade estimate, at only 13.0 million bushels – lower than last week at 17.5 million and lagging behind the 10-week average of 19.8 million bushels. Friday’s CFTC report showed that managed money was a large seller of beans last week, reducing their net long by 29,915 contracts to 124,498 long.

Milo

Export inspections for milo this week were almost nonexistent with 400,000 bushels shipped. Mexico was the number one destination with 300k. Crop progress had milo at 97% planted up from 90% last week. Crop condition drop 1% to 42% good to excellent from the previous week. Kansas saw a 1% bump to 55% good to excellent, still behind the 5-year average of 64% good to excellent.

Trivia Answers

-

The Hoover Dam

-

Hawaii