Weekly Market Update 6/2/22

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Top Gun:Maverick recently hit theaters. In what year was the original Top Gun movie released?

-

Who was the first American in space?

Answers at the bottom.

Market News

-

OPEC+ is planning to meet soon to discuss how they can alleviate the supply gap created by sanctions on Russian energy. Sources say that they are looking to increase output in the range of 600,000 barrels/day for July, higher than the previous monthly increases of 432,000 barrels/day. WTI crude and Brent crude are both trading higher this afternoon after losses this morning.

-

Stocks are mostly higher today, after two straight days of losses in the major indexes. The markets remain volatile amidst record inflation and concerns over the economy as a whole. The labor market remains a bright spot in the economy; this week's jobless claims report showed applications for unemployment insurance unexpectedly fell to 200,000. Mid-afternoon the S&P 500 is up 1.28%, the Dow is up 0.69% and the Nasdaq is up 2.41%.

-

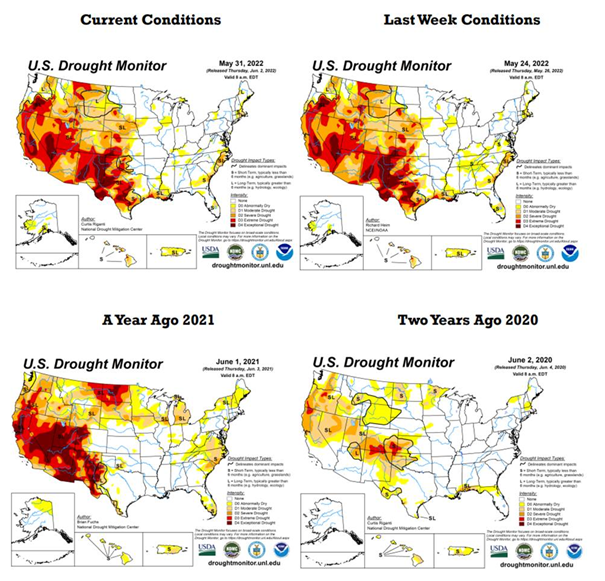

The below graphic shows a comparison of the Drought Monitor over time, giving a good visualization of just how dry much of the Plains are. The key takeaway here is just how critical timely rains will be throughout the summer for the western Corn Belt. Week-on-week didn't have any big changes, with the exception of central Kansas getting some relief.

| U.S. Drought Monitor Over Time |

|

|

Weather

Cooler temperatures are back to stay, at least for awhile. Highs for the next week are mostly in the 70s and 80s, with nighttime lows only getting down to the 50s. Slight chances for thunderstorms are forecasted over the next week, with Tuesday holding the best chance for much-needed rain.

|

|

Corn

Short trading week for grains with no real fundamental support for corn as news out of Ankara about Ukrainian exports pummeled the wheat market and took corn with it. Corn has Friday’s CFTC report showed some sell off as managed money depleted its long position by 48,242 contracts to wind up at 291,469 contracts for the week. Tuesday’s export inspections weren’t much to write home about with corn at 54.8 million bushels versus 69.0 million bushels the previous week and the 10-week average of 58.9 million bushels. Planting progress this week had corn 86% planted for the US with Kansas at 87% planted and have finally reached normal pace after a historically slow start. Corn conditions look to start being released next Monday. USDA did report that 414.731 million bushels of corn was used in April for ethanol production, down 8.5% from March, but was still a 3-year high for the month. December corn is down on the week. Locally basis is firm.

Wheat

Wheat is punching back today after coming out of the long weekend with a black eye. Tuesday saw fund liquidation at month end followed by another round of selling yesterday. This on the heels of the potential of getting a shipping corridor set up in the Black Sea for Ukraine grain to start flowing out into export markets. All reports this week are a day late. Crop progress report shows winter wheat conditions at 29% good to excellent but this late in the growing season we won’t see that improve drastically. Harvest in the south will be slowed by wet weather in the 7–10-day outlook. Export inspections showed wheat with 12.6 million bushels shipped close to the bottom of trade estimates. HRS was the number one variety shipped with the Philippines as the number one destination. Export sales will be released tomorrow due Memorial Day. Managed money sold off 2,244 contracts lowering the long to 44,546 contracts for KC wheat. Wheat needs to have a strong day and close in the green to build some support, otherwise we might be looking at a downturn.

Soybeans

Soybeans have fought off the other grains this week and have been the strongest performer. Beans have found support in demand with more Chinese bookings for new crop and old crop. We had a flash sale to Pakistan reporter this morning to steer the ship higher, 352,000 metric tons total with 297k being new crop. Planting progress bumped up to 66% just under the 5-year average of 67% for the U.S. Kansas showed 56% planted above the 50% average pace. Export inspections weren’t great this week with 13.9 million bushels shipped, close to the bottom of trade estimates. It was split pretty equally between China, Mexico, Egypt, and Germany. Soybeans saw 15,732 contracts added to their current long of 163,067 contracts reported by the CFTC. Bean futures in the nearby month (July) have a chance at reaching $20, but need to finish strong on the day.

Milo

There is not much to write home about in the way of the milo market. Export inspections on Tuesday pegged US milo at 5.7 million bushels versus 7.8 million bushels last week and the 10-week average of 9.8 million bushels. Crop conditions showed sorghum 20% planted for Kansas and 40% for U.S planting. Export sales are delayed until tomorrow. Locally basis is steady.

Guess what? June is sorghum month! Learn about sorghum, sorghum programs, sorghum basis snapshots and more here:

https://www.sorghumcheckoff.com/blog/americans-are-rediscovering-sorghum/

https://www.sorghumcheckoff.com/newsroom/

Trivia Answers

-

1986

-

Alan Shepard (1961)