Weekly Market Update 3/24/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Tuesday was National Ag Day. The National Ag Day Program and The Agriculture Council of America were both started in what year?

-

Which Kansas City Royals batter had the most strikeouts in one season?

Answers at the bottom.

Market News

-

Today marks one month since Russia's invasion of the Ukraine, and we seem no closer to a solution than when the conflict first began. World leaders are meeting in Brussels today for three summits - NATO, the G7, and the European Union - working to solidify their stance against Russia as concern is rising among Western leaders that Putin could turn to unconventional weapons as their advance falters. NATO has agreed to provide Ukraine with equipment and training to deal with any possible Russian attack using chemical, biological or nuclear weapons.

-

Energy markets are mixed today with WTI crude oil hanging out around $113/bbl. Today's AAA National Average Gas Price is pegged at $4.236/gallon. The market has a keen eye on the aforementioned meeting of world leaders to see if additional sanctions will be placed on Russia, as well as what implications the current outbreaks of COVID in China will have on oil demand.

-

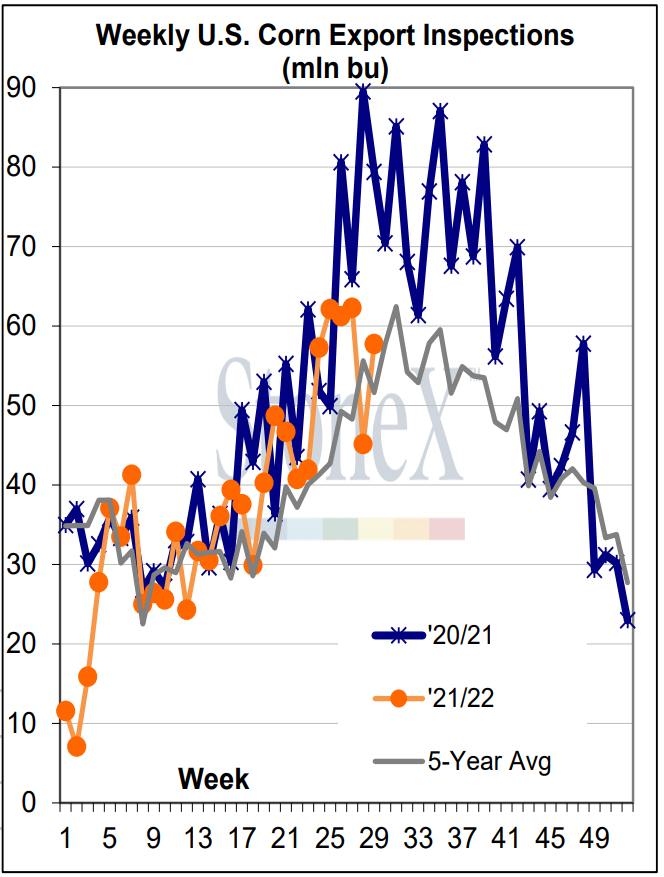

21/22 U.S. corn export inspections are well off pace and look to be fairly close in line with the 5-year average. For the week ending 3/18 export inspections came in at 57.7 million bushels, up from last week's 45.1 million bushels, but still under recent highs of 60-62 million bushels. Year over year inspections look to see a decline of 253 million bushels. However, as global concerns loom for corn and wheat export availability, the United States could see an uptick in dim inspection numbers. Currently export inspections sit 190 million bushels off of last year's pace.

| WEEK ENDING 3-18-22 US CORN EXPORT INSPECTIONS |

Weather

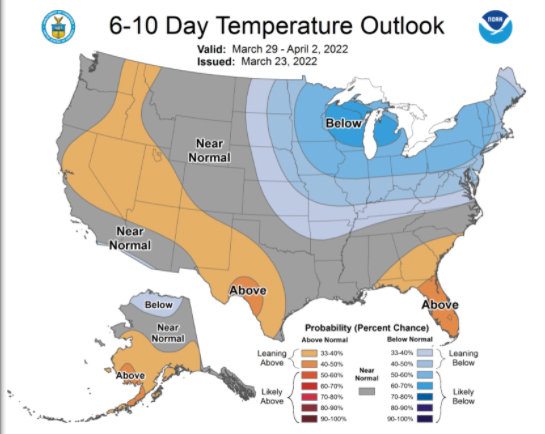

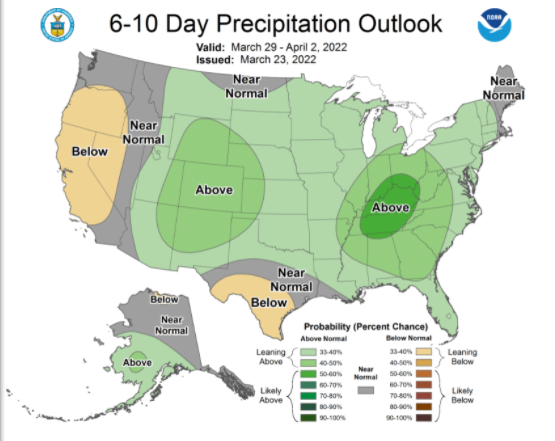

April showers bring....July wheat? Southwest Kansas looks to have normal temps paired wtih an increase in precipitation chances as it heads into April. Temps into the weekend look to be ticking up into the 70's and maybe 80's with slightly cooler weather precipitation chances into the middle of next week.

|

|

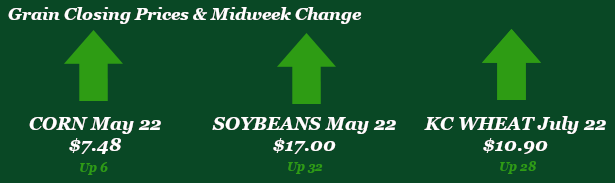

Corn

Corn is sliding lower today, after a week of mostly continuing its low volume rangebound trade. December corn did trade new contract highs yesterday at $6.80 ½. This week has been mostly void of fresh headlines, as the Russia/Ukraine conflict continues with no definitive end in sight. Supporting the market is remaining uncertainty as to how much corn will actually be planted in Ukraine this spring. Export inspections were reported at 57.7 million bushels. Export sales weren’t enough to keep the bulls fed, coming in on the lower end of trade expectations at 38.6 million bushels of old crop and 0.2 million bushels of new crop. This week’s ethanol report indicated a nine-week production high of 1,042K barrels/day, using 108.3 million bushels of corn. Managed money were net buyers of corn in last Friday’s report, adding 4,125 contracts to bring their net long up to 372,909 contracts. Planting has begun in the South, while the central Plains and Corn Belt have received precipitation this week.

Wheat

Wheat is up for the week but has been moving in more of a sideways pattern than rallying. This is due to lacking new support for money to chase and with the recent increase in margin requirements this has discouraged funds from pushing money into wheat. Export inspections this week was a non-starter with 12.1 million bushels shipped. This was close to the trade estimate lows and below the 10-week average of 14.8 million bushels. Export sales were also sluggish at 5.7 million bushels sold; new crop was decent with 13.5 million bushels sold. Japan was the leading buyer this week. Friday’s CFTC report showed KC wheat funds decreasing their current long by 470 contracts, lowering the long to 44,236 contracts. Not surprised to see the low volume of contracts traded due to the above-mentioned margin requirements and crazy volatility due to the war sidelining many traders. Next week we will have crop conditions published weekly.

Soybeans

Beans have steadily trended upward this week though are receiving a little downward pressure today. We are seeing soybeans follow the energy markets with the switch for food into fuel continuing to be profitable. Beans are similar to other commodities with the war headlines guiding futures and low volume of trade cause high volatility. Pinch me if I am sounding like a broken record. You can expect much of the same in the near future with the war raging on. Export inspections were solid again this week close to the high end of trade expectations at 57.7 million bushels shipped, above the 10-week average of 50.7 million bushels. Export sales were letdown at 38.6 million bushels sold and a little bit of new crop sales of 200,000 bushels. Nothing earth shattering or market moving for bulls to hitch their ride too. CFTC report pegged fund sellers of 1,024, but still carrying a long position of 170,690 contracts. Next week we will have a quarterly stock report and predicted acres from the USDA on Thursday. This has historically been a market mover.

Milo

Little movement in milo cash prices – corn futures remain rangebound and basis is mostly flat for both old and new crop slots. New crop cash prices are relatively attractive and are worth some thought depending on your operation's situation. Export inspections this week were the highest of 2022 at 13.2 million bushels, up from the previous week at 10.3 million. Meanwhile, export sales were disappointing with a net cancellation of 0.3 million bushels.

Trivia Answers

-

1973. Both were started to increase awareness of agriculture's role in society

-

Jorge Soler. He had the most strikeouts (178) and the most home runs (48) in the 2019 season.