Weekly Market Update 3/3/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What Kansas flower is native to North America and wasn't exported to the rest of the world until the 1500's?

-

Who led the Royals in home runs in 1985, the same year as their very first world championship title?

Answers at the bottom.

Market News

-

The big headline over the past week has been Russia invading Ukraine. The war has added some to the strength of the U.S. Dollar and sent the Ruble tumbling. The Ruble is currently worth about .9% of the U.S. Dollar as imposed sanctions sent Russians in a panic and to the bank. Russian currency plunged about 30% against the U.S. Dollar after moves were made to block Russian banks from the SWIFT international trade payment system, with Russians worried sanctions would cripple the economy. They could also face payment issues with using Apple Pay, Google Pay, and Samsung Pay as sanctions have affected electronic payments as well.

-

WTI Crude prices have surged as commodity markets continue to see disruption following last week's Russian invasion of Ukraine. Prices topped $116/bbl on Thursday, levels not seen since 2008. Following the spike in crude, the market backed off and started to settle around either side of $110/bbl. The market retreat was on headlines suggesting talks between Iran and other global powers to reactivate Tehrans 2015 nuclear deal that could free the Islamic Republic from U.S. sanctions on oil.

-

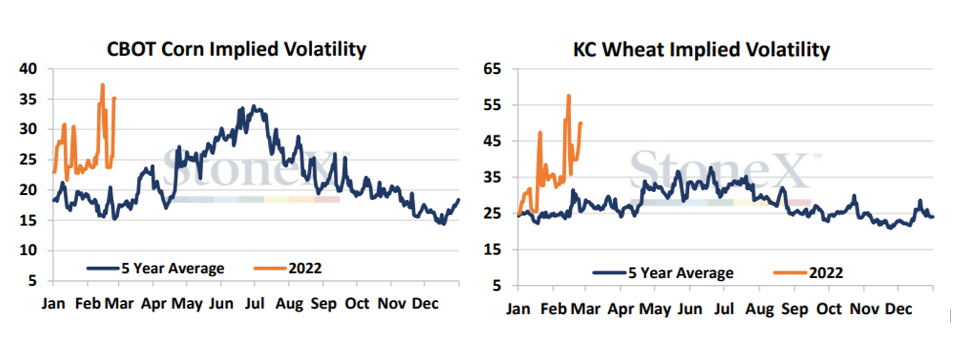

The current market volatility is severely abnormal, especially for this time of year, as the Russo-Ukrainian war looks grim in the way of any peaceful resolve. Compared to the 5-year average, volatiity is out of season and makes the 5-year average look something comparable to a hilly road rather than a mountainous trek. Russia and Ukraine's market absence is sending wheat and corn into a tizzy, and wheat importers continue to cancel tenders with little to no players in the market and soaring prices.

| Implied Volatility CBOT Corn and KC Wheat |

|

|

Weather

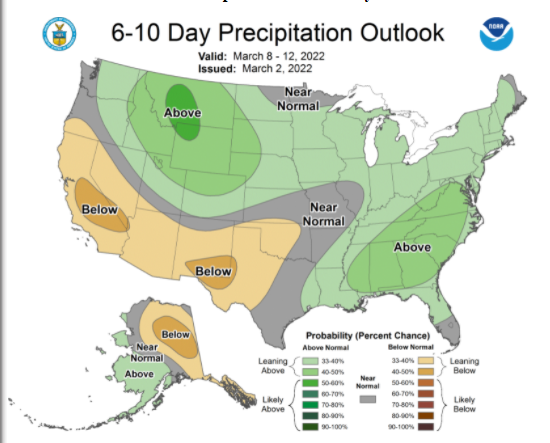

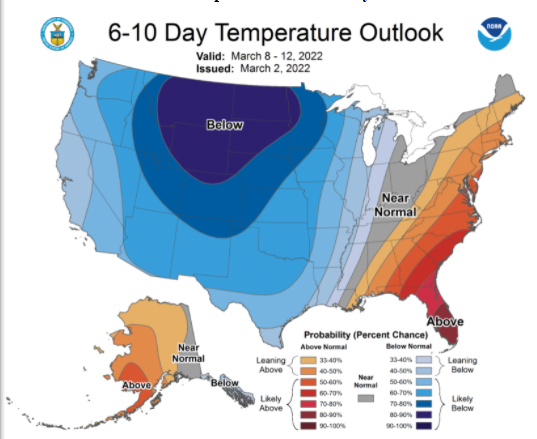

Who ordered summer? Southwest Kansas has seen some warmer temps this week, but they won't hang around for long. Temps look to trend below normal in the coming days as a cold front rolls through, though SWKS has little chance in the way of precipitation. Precipitation looks like it will stay north through the weekend and into the 6-10 day forecast. |

|

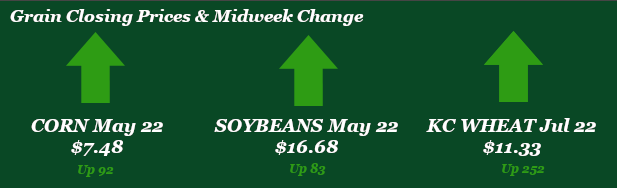

Corn

Corn has been following wheat higher, but to the degree and extreme volatility of wheat. Something to keep in mind with the Russia/Ukraine conflict is Ukraine’s corn crop. Ukraine planting period for corn is the same as the U.S. and it is coming into question whether, they will be able to get anything in the ground and have a corn crop this year. Ukraine accounts for 16% of the world’s corn. This will be a big impact on the global supply and put more pressure on the U.S. to produce a successful fall crop. Export inspections was on the high end of trade estimates for a consecutive week with 60.8 million bushels of corn shipped. Japan was the number one destination with 18 million bushels, followed by China with 13.6 million bushels and Mexico with 12.6 million bushels. Export sales for corn were underwhelming this week at 19.1 million bushels sold coming in below trade expectations. New crop sales reported 8.8 million bushels. Japan was the top buyer for both. U.S. sales should increase since the ports in the Black Sea are closed. CFTC report showed funds adding 28,922 contracts to the existing long of 354,436 contracts. Quick South America update – crop areas are seeing rain this week after an extended round of hot, dry weather. The StoneX office in Brazil released their crop production estimates and they have total corn production at an estimated 114.4mmt which is basically unchanged from last month’s estimates.

Wheat

Another day of limit up is how Thursday is shaping up. We are still at expanded limits in wheat at 75 cents, this makes for large swings. I’m not going to sit here and bang on my drum and give you a long-drawn-out answer. This is all solely the war with Russia and Ukraine. Until some sort of stability and peace talks happen this will remain a very volatile market with high upside. This is completely a headline driving market at the moment. If we can get back to trading weather the current crop condition in the plains could see wheat remain at high values, but not at the current highs. Weekly export inspections totaled 14.9 million bushels, below the previous three weeks, but still above the 10-week average. Mexico led destinations with 2 million bushels of HRW. Export sales reported 11 million bushels sold, this was towards the bottom end of trade estimates, but still ahead of the 10-week average. HRW led the was with 4.4 million bushels sold. We also saw 2.6 million bushels of new crop wheat sold. Last Friday the CFTC report showed funds as buyers of 4,730 contracts bringing the net long to 40,780 contacts. Tomorrow’s report will have KC wheat as net buyers again. If you are thinking about getting some new crop wheat priced it would be worth calling your local originator/merchandiser to lock in some of these high prices or to get a working order out there as well. It’s also worth noting that with these high prices you want to be careful to not overextend yourself with too much forward contracting and get yourself in a pickle come June/July.

Soybeans

Beans are being buoyed more by Russia/Ukraine than South America crop size reductions still to come not much of an acreage switch right now in beans. We are approaching the time to start looking away from South American weather and focusing on the U.S. and planting progress. Export inspections were decent at 27 million bushels shipped, right in line with trade estimates. Export sales for beans were also in line with trade expectations reporting 31.5 million bushels of old crop and 50.9 million bushels of new crop sold. Manage money added 4,962 contracts to the current long of 180,334 contracts. This was to be expected with the swift upswing in prices across the commodity markets. Early this week insurance pricing for planting wrapped up, and we are going to have the highest value this millennium.

Milo

Pretty quiet week on the milo front. Export inspections for milo were reported at 5.8 million bushels shipped. The lowest in the last 3 weeks and below the 10-week average. Export sales were also slow for milo with 4 million bushels sold, also below the 10-week average.

Sugar

With WTI Crude hitting 13-year highs and bolstering ethanol prices, it could prompt Brazil's sugar mills to divert more cane crushing into ethanol production than sugar production. This sent sugar prices up 1.56% on Thursday. However, larger sugar crops in India and Thailand could offset reduced Brazil production and keep a cap on the market.

Trivia Answers

-

Sunflower

-

Steve Balboni