Weekly Market Update 5/12/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What is the only alphabetic letter to not be included in any of the 50 U.S. state names?

-

Last weekend was the Kentucky Derby, the first of the Triple Crown races: the Kentucky Derby, the Preakness Stakes, and the Belmont Stakes. How many horses have won the Triple Crown?

Answers at the bottom.

Market News

-

Yesterday President Joe Biden announced his administration's plan to curb food inflation for consumers and offset the impact of Russia's invasion of Ukraine by promoting ways to help farmers keep costs down and increase production. He indicated that his administration will be increasing the number of counties eligible for double crop insurance, doubling funding for domestic fertilizer production, and allowing summertime sales of biodiesel.

-

Stocks are mostly lower today after yesterday's release of April's Consumer Price Index, which showed an inflation rate that came in higher than economists had anticipated. The consumer price index, a broad-based measure of prices for goods and services, increased 8.3% from a year ago. This was a 0.3% increase month-over-month. This comes as investors gauge how aggressively the Federal Reserve will intervene to rein in rising price levels via monetary tightening, including continued increases on interest rates. Fed officials have indicated that interest rate hikes of 50 basis points are likely in the next two Federal Reserve policy-setting meetings.

-

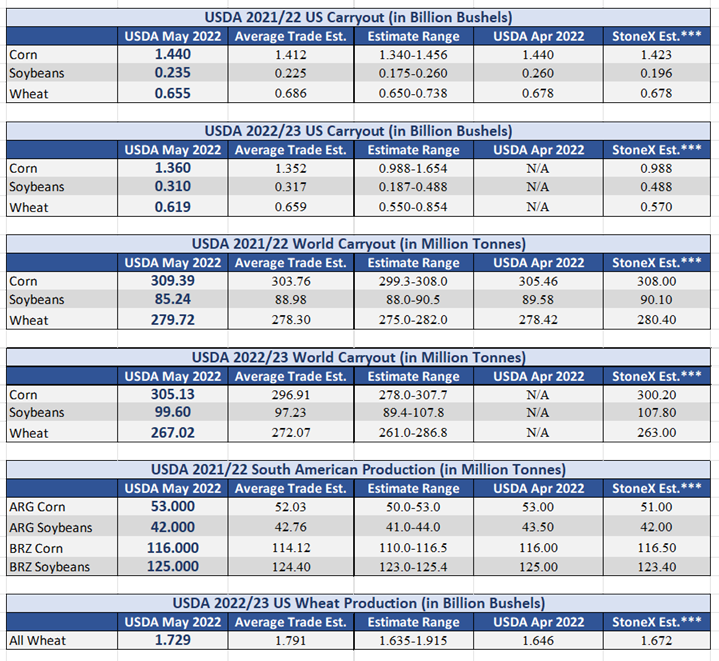

USDA released the May WASDE this morning at 11AM. This was our first look at the 2022/2023 Marketing Year balance sheet. Check out the commodity sections and the below snapshot for more information.

| May WASDE Snapshot |

|

|

Weather

Hot, dry weather dominates the forecast with highs sticking around in the 80s and low 90s, with nighttime lows mostly in the mid to upper 50s. Chances for precipitation look pretty slim in our area over the next 10 days. No big changes week-on-week in the Drought Monitor, with most of western Kansas classified as in either D2 or D3 drought.

|

|

Corn

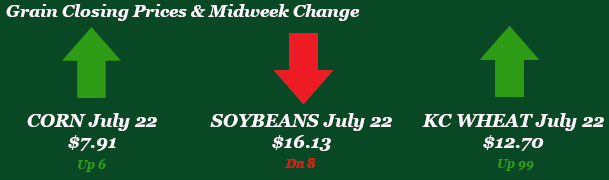

USDA surprised the market today, adding a 177 bpa corn yield to the 2022 crop. 21/22 U.S. carryout is unchanged from April at 1.440 billion bushels. 21/22 world carryout came in a little higher than expected at 309.39 million tonnes, above the range of analysts’ estimates. No changes to the South American crop for corn. While carrying some bullish components, the overall report for corn felt somewhat bland. Friday’s CFTC has corn funds hanging onto that long position at 353,518 contracts, letting off the gas some heading into the growing season, and looking to make room for another round of buying. Headed into Monday export inspections for corn were shown at 54.8 million bushels, down from last week’s 66.8 mb and the 10-week average of 58.8 mb. Crop conditions pegged Kansas corn at 46% planted with U.S. plantings at 22%, still lagging well behind last year and the 5-year average. Wednesday’s ethanol report showed stocks and production both up with demand waning some. Export sales this morning put corn at a sad 7.6 million bushels vs 30.8 mb last week and the 10-week average of 42.2 mb. New crop sales came in at 1.8 million bushels. Dec corn futures have managed to gain almost 33 cents on the week and hit a high of 7.55 1/2 today. Locally corn basis feels strong.

Wheat

KC wheat is up on the week but is not feeling to motivated this morning to go either way. The market seems content to wait for the 11 o’clock WASDE report where we will get a first look at 22/23 projections. We saw the market move higher earlier in the week due to crop conditions for HRW and wet weather in spring wheat areas. Crop progress for winter wheat saw a slight increase 29% good to excellent well below the 5-year pace of 50% good to excellent certainly not what traders were looking for. Kansas got a bump up to 28% good to excellent well behind last year’s pace and the 5-year average. Export inspections were middle of the pack for wheat at 8.7 million bushels shipped. HRW led the way with 4.4 million with destinations including Japan, Nigeria, and Mexico. Export sales for old crop wheat were nonexistent at 500k bushel, new crop carried the wheat sales with 4.6 million bushels sold. Last week’s CFTC report showed KC wheat managed money selling 5,458 contracts dropping the long to 39,949 contracts. The market will trade the WASDE numbers today, but overall wheat is in a weather market right now with dry/hot forecast controlling the narrative and you can throw in supply issues domestic and global on top of that. The WASDE numbers showed wheat carryout for 21/22 at 655 million bushels towards the lower end of trade expectations and a reduction from the April WASDE. The 22/23 carryout showed wheat at 619 million bushels below the average trade estimates. Overall bullish numbers for wheat and the reason why we are seeing the jump in futures today.

Soybeans

Beans started off the week down with dry weather in the forecast, planting is determined to pick up the pace and make up ground in a hurry. Then when will the next rain come? Extended forecasts remain dry and will be something to monitor. So far today soybeans are treading water waiting for the USDA’s supply and demand numbers. Demand for beans remains nonexistent with China still in lock down over Covid. Inspections were nothing to bat an eye at with 18.5 million bushels shipped, the lowest amount in the last 10-weeks. Export sales were also the low end of trade estimates with 5.3 million bushels of old crop and 2.8 million bushels of new crop sold. Crop progress pegged planting at 12% complete, expect this number to get a good bump in next week’s crop progress report. The fund were also sellers in Friday’s CFTC report with 20,224 contracts trimmed from the 153,253 long contracts. Expect more of the same on tomorrow’s report. Soybeans saw a decrease in 21/22 carryout from April coming in at 235 million bushels but still above the average trade expectations. Carryout projections for 22/23 were below trade guesses at 310 million bushels leading to slightly bullish numbers. World carry out is where we saw the biggest discrepancy for 21/22 carryout, 85.24mmt were report well below the lowest trade estimate. With momentum from the WASDE numbers and other grains going higher look for beans to finish strong.

Milo

Milo riding on corn futures, gaining almost 33 cents since last Friday’s close. Monday’s export inspections looked decent at 10.6 million bushels versus last weeks 8.6 mb and the 10-week average of 9.6 mb. Export sales for milo this week were a mere 1.1 million bushels. Crop progress has sorghum at 2% planted for Kansas with the U.S. average at 22%, in line with last year’s planting pace and close to in line with the average. Locally basis stays flat.

Trivia Answers

-

The letter Q

-

13 horses have won the Triple Crown: Sir Barton (1919), Gallant Fox (1930), Omaha (1935), War Admiral (1937), Whirlaway (1941), Count Fleet (1943), Assault (1946), Citation (1948), Secretariat (1973), Seattle Slew (1977), Affirmed (1978), American Pharoah (2015), and Justify (2018).