Weekly Market Update 5/26/22

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What was Memorial Day formerly known as?

-

What flower is traditionally worn as a rememberance of those who have died in war?

Answers at the bottom.

Market News

-

Crude oil saw a sharp upturn today as the EU struggles over a plan to phase out Russian energy imports in response to Russia's invasion of Ukraine. U.S. crude and gasoline inventories falling right before summer are also aiding in the strength in crude oil with oil inventories falling 1 million barrels and gasoline inventories dropping 500,000 barrels.

-

U.S. stocks gained momentum Thursday morning on strong retail earnings, snapping a 7-week losing streak. The S&P 500 is up almost 2%, the DOW is up 1.5%, and NASDAQ is up almost 2.5%. The market was also able to digest a revised U.S. GDP estimate that showed economic activity fell at a 1.5% annualized rate, unemployment backed off to 210,000 for the week ending May 21, and several retailers pulled back their outlooks stating that inflation will likely weigh on profits.

-

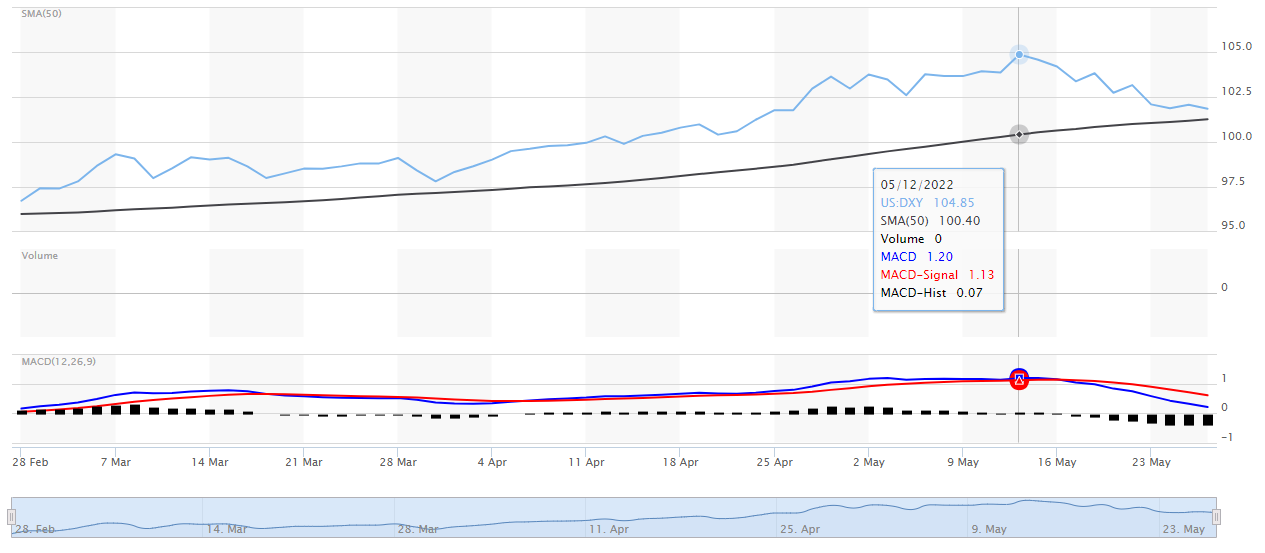

The U.S. Dollar continues to slide off of its nearby highs as minutes from the Federal Reserve's May meeting indicated an additional 50 basis point interest rate hikes in June and July. The Fed did, however, leave some room to slow tightening in the second half of the year. The Fed's may meeting judged that 50 basis point hikes would be appropriate at the June and July policy meetings to combat the inflation that threatens the economy's performance. According to Reuters, "Many of the participants believed that getting rate hikes in the books quickly would leave the central bank well positioned later this year to assess the effects of policy firming." The dollar reached a peak above 105 in mid-May.

| US: DXY |

|

|

Weather

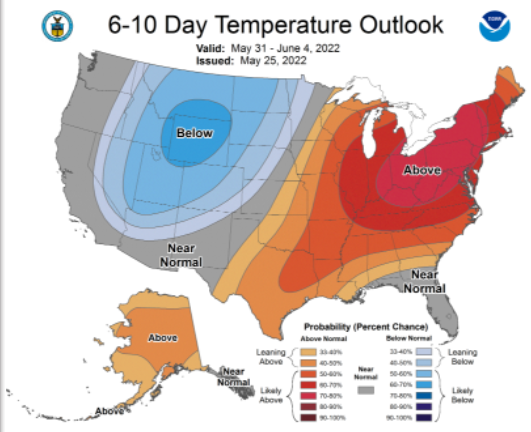

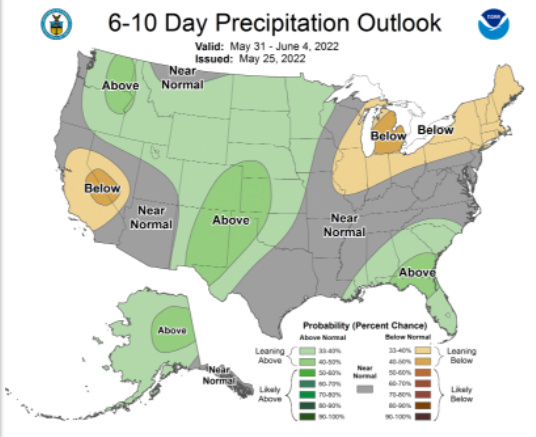

Rains have been nothing short of a blessing in southwest Kansas with the last round producing .50 to 1 inch in the Garden City Co-op coverage area. Temperatures have been below normal over the past week but will start creeping up to normal and higher-than-normal levels. The holiday weekend looks to hold upper 90’s to 100 for temps with little chance of precipitation. After the holiday weekend, temperatures look to drop some to make way for more of the much-needed precipitation with a 55% chance of showers Tuesday into Wednesday. After the next hopeful round of rains, temps look to settle into the 80’s for highs.

|

|

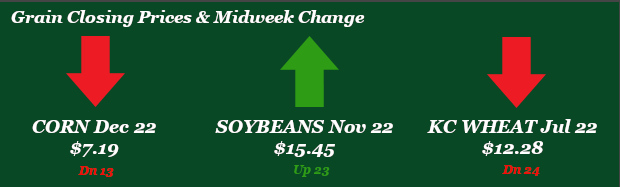

Corn

Corn has been steady to lower for the week. Monday started the week off in the green but that changed once Monday afternoon’s crop progress report came out. Traders anticipated to see a jump to 68% planting complete, but farmers in the U.S. have been busy and 72% of the corn crop has been planted through Sunday. We are still behind the 5-year average of 79% but this was good progress. Kansas jumped to 76% percent planted matching the 5-year average. With the jump in planting and rains through the Midwest and corn belt the higher than anticipated export inspections number could bring the market into the green. Inspections were strong at 66.9 million bushels shipped more than 25 million bushels more than the previous week. China was the number one destination with 31.2 million bushels. Export sales were very poor this week with 6 million old crop and 2.3 million new crop bushels sold. We also saw news that China signing an agreement with Brazil to start importing Brazilian Corn. This news had a large negative impact on corn futures. Then news of Russia opening ports to allow grain shipments out of Ukraine. With the reaction from the market, it seems that Russia is not bluffing with this move. Last Friday’s CFTC report showed managed money in corn as modest buyers of 1,149 contracts, adding to the long of 339,771 contracts. Look for this to reverse as we have seen some risk off this week from the funds.

Wheat

Thin trading and changing headlines has spelled volatility for wheat this week, while risk-off selling and weakness in the corn market have added to the pressure. Sources have indicated that the EU could send warships to protect Ukraine grain shipments, while others indicate that Russia may be willing to allow Ukrainian vessels carrying food to ship from Black Sea ports. However, Russian officials have said that they would only provide a corridor for vessels in exchange for the lifting of some Western sanctions. These headlines will be important to watch as they continue to evolve. Friday’s CFTC report indicated that managed money bought 3,877 HRW contracts to bring their net long up to 46,790 contracts. Export inspections were in line with estimates at 4.1 million bushels of HRW shipped. Export sales were disappointing, but expected, with net cancellations of 0.1 million bushels of old crop and 2.4 million bushels sold in the new crop slot. Export demand remains quiet as US wheat is expensive relative to the world market. HRW conditions were up 1% this week to 28% good-to-excellent, with better conditions in Kansas, Nebraska, and South Dakota while Oklahoma and Colorado conditions fell. Planting of spring wheat remains a struggle in the northern plains, with the crop only 49% planted versus the five-year average of 83%.

Soybeans

Beans have been yo-yoing the last few days but look like they’re going to be able to squeak out a modest gain in a week void of major headlines. Conducive planting weather was reflected in a 20-point gain week-on-week in planting progress, with USDA reporting on Monday that the crop is 50% planted and 21% emerged. Weather this week looks a little less promising, with rains across the Corn Belt causing some flooding and cooler weather not doing much to help dry it out. The big question that is lingering is what will happen with acres as we quickly approach crop insurance deadlines for corn in some states. Do corn acres switch to beans? Do farmers take prevent plant? Do they plant corn anyway? Only time will tell. The trade is also keeping an eye on Chinese demand for beans amidst continuing COVID lockdowns. Last Friday’s CFTC report indicates that the funds were net buyers of beans, adding 16,674 contracts to stretch the net long to 147,335 contracts. Export inspections were reported at 21.2 million bushels this week, down from the previous week at 29.5 million. Export sales were alright this morning with 10.2 million old crop bushels reported and 16.3 million bushels of new crop.

Milo

Milo has had a very quiet week. Export inspections were ho-hum with 7.8 million bushels shipped, below the 10-week average of 10 million bushels. China was the number one destination taking 7.7 million themselves. Export sales saw net negative from cancellations. Local basis with milo remains flat with little action. Crop progress pegged milo at 33% planted just below the 5-year average of 35%. The recent moisture should accelerate milo planting.

Trivia Answers

-

Memorial Day was originally known as Decoration Day, a time when our nation decorated the graves of those that gave their lives in war. Memorial Day did not become a more common name until after WWII and was not declared the official name by federal law until 1967.

-

The red field poppy. In war-torn battlefields the poppy was one of the first plants to grow.The practice of wearing poppies to honor the fallen was inspired in 1915 by the poem In Flanders Fields written by Lt. Col. John McCrae.