Weekly Market Update 11/10/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

This educational TV show debut on this day in 1969, teaching children the alphabet and how to count among other things. What is the name of this show?

-

The first long distance telephone call without operator assistance took place today in what year?

Answers at the bottom.

Market News

-

CPI data was released this morning. The Consumer Price Index surprised markets with October prices rising just 7.7% vs. the expectation of 7.9%. The monthly inflation figures came in lower too at just 0.4% vs the estimated 0.6% rise in prices for the month. Core inflation was equally as good, coming in at just 6.3% vs the 6.5% median estimate and a monthly reading of just 0.3% vs 0.6% the month prior.

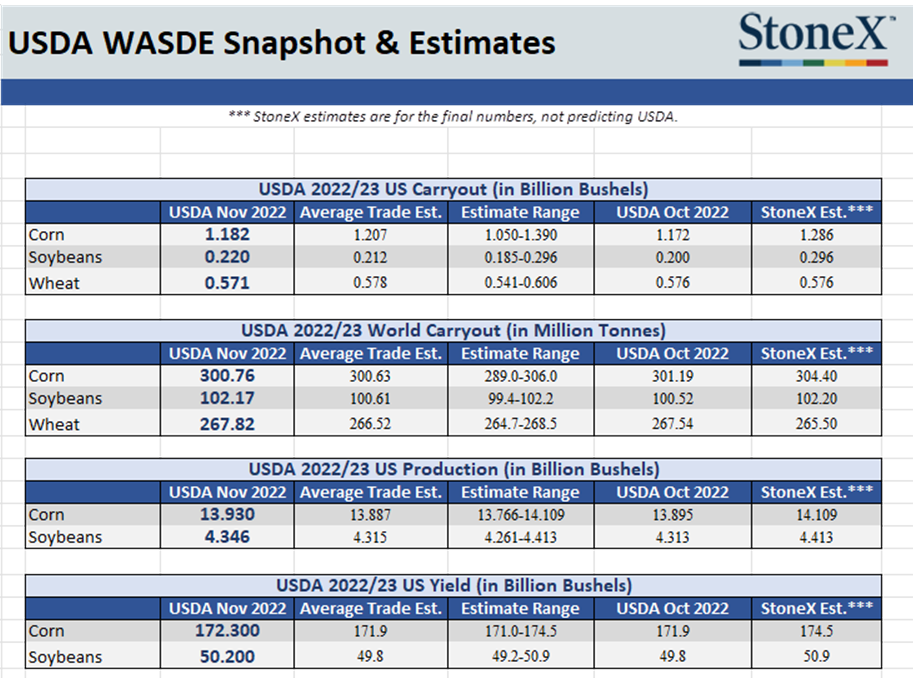

- November WASDE was released yesterday with little news for bulls to feed off of and run higher. More information below within each commodity.

- Most major indexes are up today with the DOW up over 850 points on the day. The US Dollar index is taking a big hit this morning and is down over 2000 points. A little surprised to see grains not get a lift from this move.

|

USDA November WASDE Snapshot |

|

|

Weather

We have been expierencing lots of wind and above average temps to start this week, but we will soon be seeing that fall weather move in. Tempatures will be dropping starting tonight and the forcasted next week looks to be 40s for the high most days. As always we remain dry with no moisture in the near forecasted future.

|

|

|

Corn

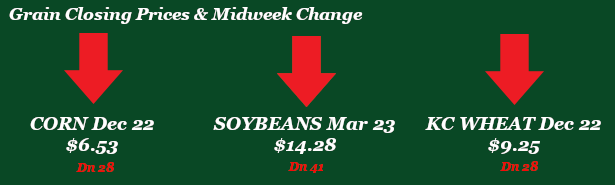

Corn is grinding lower in a week devoid of any major headlines outside of the November WASDE yesterday. USDA raised the corn yield by .4 bpa to 172.3 bpa, raising the crop to 13.93 billion bushels. This was offset by an increase in feed demand, while USDA left ethanol and exports unchanged – obviously hoping that export sales will pick up. Overall, the net effect to the USDA balance sheet was a 10 million bushel increase to US carryout at 1.182 billion bushels. World balance sheet didn’t see any major changes, with carryout lowered slightly due to some production shifts. Overall, the report was mostly a snoozer. Export inspections were reported at 9.1 million bushels in Monday’s report, the poorest week this year and lagging behind the 10-week average of 21.0 million. Export sales were also below the range of estimates at 10.4 million bushels, highlighting that we are still a high-priced export in the current global market. Friday’s CFTC report indicated at funds continued to add to their net long, bringing it up to 271,960 contracts. Harvest is wrapped up in GCC country, while USDA pegs the U.S. crop at 87% harvested and the Kansa crop at 93%. Locally basis remains flat but high, with corn imported via rail from the east keeping the local market satisfied, putting a cap on basis at least near-term.

Wheat

With last week’s Russia headlines in the rearview mirror, wheat has been content to move lower. December KC wheat is down about 30 cents on the week. November WASDE was pretty much a non-event for the wheat complex. Surprisingly, USDA did raise feed demand by 7 million bushel and lowered seed demand by 2 million. The net effect was a 6 million bushel reduction to 571 million bushels, the smallest since 2013. Global carryout rose by 0.3 MMT, with production rising by 1.3 MMT and demand increasing by 1.0 MMT. Export inspections this week stunk at only 0.9 million bushels of HRW shipped, much lower than the 10-week average of 5.5 million. Export sales were reported at 4.3 million bushels, which is higher than last week at 3.1 million but still a small number. Friday’s CFTC report indicated that managed money reduced their net long by 1,218 to 23,408 contracts. Recent rains in parts of the country resulted in USDA raising their good-to-excellent category by 2% to 30% good-to-excellent nationwide, still significantly behind the 5-year average of 51%. Kansas was also up 2%, but still is only reported at 26% good-to-excellent.

Soybeans

Soybeans are taking a decent hit today after chopping around for the first half of the week. The USDA pretty much punted to the end of the year report to make any significant changes to soybeans. They bumped soybean yield slightly by 0.4bpa, but increased demand to offset most of the supply gain. Brazil’s soybean crop remains large and has been getting plenty of beneficial rains as of late. Will be interesting to see if the USDA will lower export projections if China chooses to start buying soybeans from there. Export inspections were above trade estimates with 95.2 million bushels shipped. China was the number one destination. Even with the slightly higher number than trade estimates soybeans remain 3% behind inspections progress. Export sales were “meh” to say it best with 29.2 million bushels sold. China bought the majority of soybeans. Soybean harvest hit 94% complete according to the crop progress report. Kansas hit 88% harvest ahead of the 5-year average of 79%. Managed money found a buying opportunity to add 25,918 contracts raising the long position to 101,329 contracts.

Milo

Milo is slipping along with corn futures; local milo is not moving into the export market but is staying in domestic feed and ethanol markets – keeping basis steady. No big moves for milo in the November WASDE. Yield dropped 1.6 bpa to 43 bpa for a total production pegged at 236 million, down 9 million from October. Exports were also lowered, resulting in a net carryout 1 million bushels higher at 24 million. This is the tightest milo carryout since 2020/21. Export inspections were lacking, reported at only 0.2 million bushels. Export sales were reported at 1.2 million bushels, which wasn’t exactly stellar but is still much higher than last week’s 0.5 million.

Trivia Answers

-

Sesame Street

-

1951