Weekly Market Update 10/6/22

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Who was the first First Lady to decorate the White House for Halloween?

-

What song was Loretta Lynn's first hit to make it on the Billboard Hot Country Songs chart?

Answers at the bottom.

Market News

-

Brent crude oil is up more than 10% this week after OPEC+ announced its largest supply cut since 2020 ahead of the European Union embargoes on Russian energy. The cut of 2 million barrels a day has also intensified concerns over soaring inflation and has widened the diplomatic rift between the Saudi-backed bloc and Western nations. The White House has criticized the move by OPEC+ as shortsighted and stated that they would continue to assess whether to release strategic oil stocks to lower prices at the pump.

-

Major stock indexes are lower today, as traders weigh sharp swings in stocks and rates to start the month. Investors are anxiously awaiting the Friday jobs report, which will show how the labor market performed in September. On Wednesday, data from ADP showed that the labor market remained strong among private companies in September, when businesses added 208,000 jobs, beating Wall Street estimates. But on Thursday, jobless claims were higher than expected, signaling there may be some labor market weakness.

-

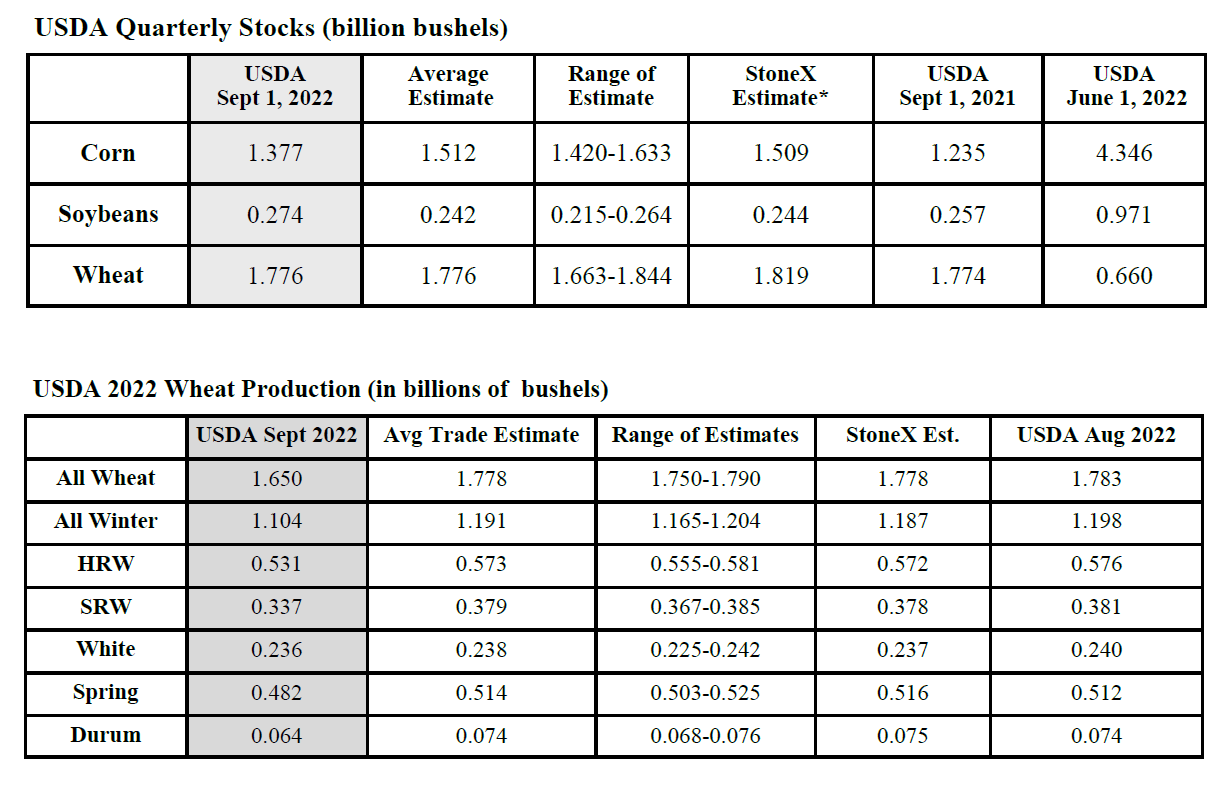

USDA released their September Quarterly Stocks and Small Grains Summary Reports on Friday. USDA showed corn stocks in all positions at 1.38 billion bushels through September 1. That is 12% higher than year-ago levels of 1.235 billion bushels but well below trade estimates of 1.512 billion bushels. Soybean stocks in all positions moved 7% higher from a year ago to 274 million bushels as of September 1. That’s a bit higher than the average trade guess of 242 million bushels but still well below June totals of 971 million bushels. All-wheat stocks shifted slightly higher, moving to 1.78 billion bushels through September 1. That’s less than 1% above year-ago totals.

|

USDA September Quarterly Stocks Report Snapshot |

|

|

Weather

It's a nice change to see Kansas covered in green on the precipitation outlook, with chances for much-needed rain across our draw area Friday and Saturday. Fall temperatures might be here to stay, next week's forecast has daytime highs in the 70s and the evenings dipping down into the 40s.

|

|

|

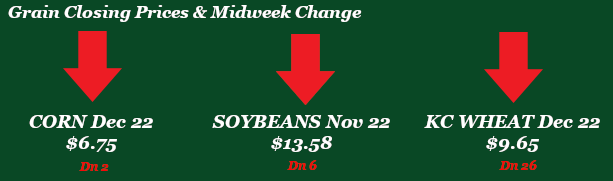

Corn

Limited headlines and news this week for corn. We saw some follow through with momentum from last Friday’s stocks report but have been grinding through the week since. Today the market is experiencing some pressure due to poor overnight volume and a bad sales report. Harvest is chugging along and picking up steam. The crop progress report pegged the U.S. at 20% complete up from 12 last week. Kansas saw a jump to 50% complete running just ahead of last year’s pace of 49%. Export inspections were in line with trade estimates this week coming in at 26 million bushels shipped. China was the number one destination with 17.6 million bushels followed by Mexico. Export sales as mentioned before were poor with 8.9 million bushels sold well below the trade estimates. Some of this can be credited to issues on the Mississippi River and very few bushels able to get to the Gulf. Managed money were sellers of 10,055 contracts from last Friday’s CFTC report. This lowered the net long to 237,854 contracts.

Wheat

Wheat is grinding lower this week driven by slow exports, rain chances in the Southern Plains, and traders selling recent highs. Export sales were slow this week, with HRW reporting only 2.1 million bushels of sales - trailing behind the 10-week average of 3.1 million. Export inspections came in at 4.8 million bushels, down from last week at 6.5 million. Friday's CFTC report indicated that managed money was once again a buyer of wheat, adding 4,846 contracts to bring the net long up to 23,905 contracts. Headlines out of the Black Sea continue to vary and push the market around, with questions regarding the validity of Russia's annexations of parts Ukraine, Putin threatening nuclear weapons, a deadly missle attack just today, and continuing conflict on the frontlines. Meanwhile here at home, USDA estimates that the winter wheat crop is 40% planted, which is slightly behind pace as farmers wait for rain and balance fall harvest. Kansas is estimated at 30% planted and 6% emerged. Local basis remains mostly steady, while our neck of the woods anxiously crosses their fingers that the wheat gets rained in this weekend.

Soybeans

Soybeans saw the surprise in the quarterly stocks report on Friday seeing stocks increase from the September report, with most in the trade anticipating a decrease. This caused Friday to sell off and be a hard down day. Monday and Tuesday saw a slight rebound after Friday harsh day in the red. But today and Wednesday are back tracking and are at the lows for the week. Limited news same as other commodities is apart of this. Most news from the Black Sea and macro economics have been the captains directing the ship this week. Export inspections were middle of the road at 21.1 million bushels shipped, closer to the higher end of trade expectations. Germany was the number one destination followed by Algeria and Mexico. Export sales were subpar with 28.6 million bushels sold towards the lower end of trade estimates. Mexico was the number one destination followed by China. Issues on the Mississippi river are affecting exports out of the Gulf. There were reports of a barge line miles long near one of the low spots near Lake Providence, LA. Last Friday’s CFTC report pegged soybeans as sellers of 9,860 contracts lowering the long to 94,831 contracts. Harvest is progressing and was reported at 22% complete for the U.S. on Monday. This is just behind the 5-year average of 25%. Kansas bumped up to 19% ahead of the 5-year average of 11%. CONAB which the equivalent of the USDA here in the U.S., released estimates for the 22/23 Brazilian soybean crop at 152.35mmt vs 125.55mmt last year with acres up 3.4%. The Brazilian crop size will be something to monitor as we go through winter.

Milo

Export inspections were almost nonexistent with 200k shipped, all of it going to Mexico. Export sales came in at a big ZERO, putting sales far behind USDA pace. Basis has remained firm and strong especially with entering the thick of harvest. Crop progress report milo harvest at 34% complete for the U.S. just below the 35% 5-year average.

Trivia Answers

-

Mamie Eisenhower (1958)

-

"I'm a Honky Tonk Girl" (1960)