Weekly Market Update 9/1/22

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Who are the five pitchers in AL/NL history to strike out 11 or more batters in a game at age 42 or older?

-

When was the very FIRST charter granted to form the Garden City Cooperative Equity Exchange?

Answers at the bottom.

Market News

-

The U.S. Dollar jumped to a 20-year high this morning giving the Fed room to agressively raise interest rates to help curb inflation and slow the labor market. The weekly umemployment claims report showed that less individuals applied for benefits than estimated for the week. For the week ending Aug 27, initial claims came in at 232,000 while economists polled by Reuters had forecast 248,000.

-

The stock market is continuing to see pressure as may investors are preparing for continued aggressive interest rate hikes from the Fed as well. To start September, the S&P was down 1.2%, DJIA was down 0.9%, and the NASDAQ fell 1.8% by mid-morning. Into the afternoon, DOW has seen some recovery while NASDAQ and S&P continue to tread water.

-

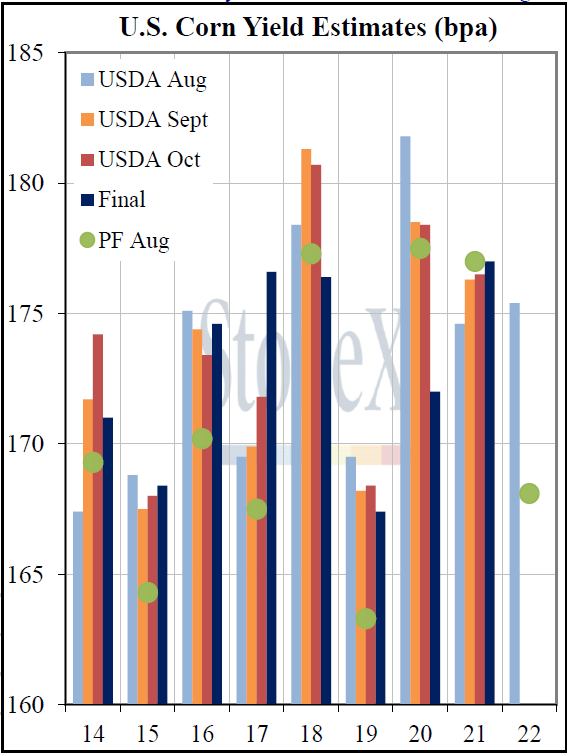

On Friday, Pro Farmer came out with a 168.1 bpa yield estimate after their Midwest crop tour. This comes in 7.3 bushels below the USDA's August estimate. This estimate is the furthest that Pro Farmer has come in compared to the USDA in the last 10 years. That estimate also puts production 600 million bushels below the USDA at 13.759 billion bushels.

| Pro Farmer vs USDA vs Final |

|

|

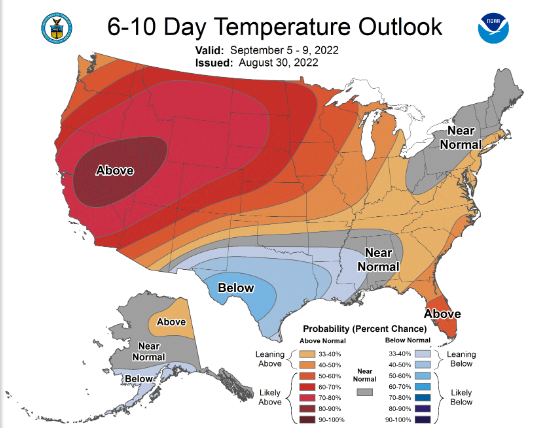

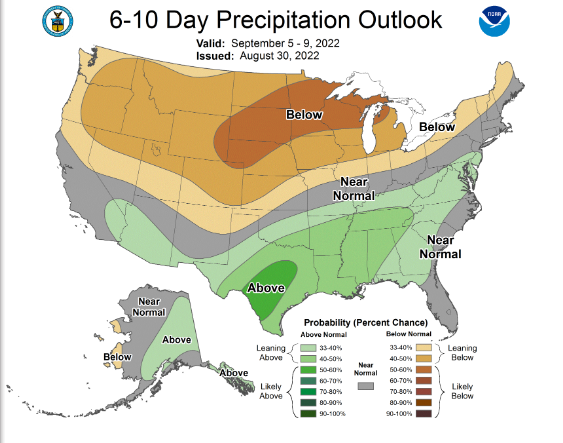

Weather

The forecast for Southwest Kansas looks to remain warmer than normal with below average precipitation for this time of year. This brings some concern as wheat planting will soon be upon the area. Temperatures look to stay fairly steady with highs in the 90s and lows in the 60s into the holiday weekend and next week.

|

|

Corn

Corn is weaker today, giving back some of the gains made last week and Monday due to lower-than-expected ProFarmer Tour results. ProFarmer pegged U.S. corn production at 13.759 billion bushels, 4.2% lower than the August WASDE number, and yield at 168.1 bu/acre vs. USDA at 175.4. Friday’s CFTC report showed that funds added 28,376 contracts to bring their net long up to 182,216. This report is on a week delay, so the net long is expected to be larger in tomorrow’s report after last week’s rally. Export inspections were in the middle of the range of estimates at 27.1 million bushels, down from the previous week at 32.2 million. Ethanol data showed that demand jumped higher this week while production was down slightly, causing stocks to decrease by 274,000 barrels. Crop conditions fell 1% nationally this week to 54% good-to-excellent, while Kansas dropped 4% to only 22% good-to-excellent. Locally, old crop and new crop bids are beginning to merge as we edge closer to harvest. Bids remain very high historically headed into a disappointing short crop.

Wheat

Wheat has been treading water all week, if we have a positive day, we give it back the next and today is no different. Month end is causing some profit taking from managed money leading wheat lower. Very little in the headlines for wheat so we will see wheat being a follower for momentum. Spring wheat harvest was reported at 50% complete for the U.S., the crop conditions have remained much better than winter wheat with crop progress reporting 68% good to excellent. Export inspections saw a decent flow for wheat with 19.1 million bushels shipped. Mexico was the number one destination followed by China. KC wheat managed money were buyers of 1,905 contracts raising the long position to 9,425 contacts. Export sales will not be reported until September 12th, reported by the USDA.

Soybeans

Soybeans have taken a hit this week and have been the big loser in commodities. It started Monday with the trade digesting Friday’s numbers from the ProFarmer tour which report yield at 51.7 bushels just slightly below the USDA’s projection of 51.9 bushels from August’s WASDE report. Also, ProFarmer reported a record 4.535 billion bushels for the soybean crop this year which was slightly above the USDA’s projection. These were bearish numbers to say the least and the market acted accordingly and has since been on a slide. Throw in on top of that a rising dollar index value and this is a mixer that bears love. Even reported bean sales to China this week haven’t put the brakes on the market. Crop progress showed soybeans unchanged this week at 57% good to excellent. Kansas saw a drop to 27% good to excellent. Export inspections were pathetic at 16.1 million bushels shipped, below trade estimates. Mexico, Indonesia, and China were the top destinations. Managed money for beans were buyers of 5,135 contracts raising the long to 104,471 contracts. Look for the pain to continue today with no supporting news for a rally to start.

Milo

Milo has been along for the ProFarmer ride in corn futures, while basis creeps higher. Basis movement has been more a function of the strength in local corn basis than of anything particularly exciting happening for it on its own. Export inspections were disappointing at 0.9 million bushels, much lower than the 10-week average of 3.7 million. Crop conditions fell 4% this week to 21% good-to-excellent, while the Kansas crop was rated at 19% good-to-excellent, down a whopping 7% from the week before.

Trivia Answers

-

Nolan Ryan (26 times), Randy Johnson (twice), Gaylord Perry (twice), Roger Clemens and Rich Hill

-

The charter was initially granted on July 6, 1915 with 20 stockholders. The group disbaned in 1917 after some difficult times. Once the realization of the cooperative necessity was noted, a new charter was granted on August 16, 1919.