Weekly Market Update 9/8/22

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Which U.S. President signed an act making Labor Day a federal holiday?

-

What team did the Kansas City Chiefs defeat in Super Bowl IV?

Answers at the bottom.

Market News

-

Headlines out of Russia had yesterday's wheat market on the move, with Russian President Vladimir Putin threatening to curtail the export of grain from Ukraine. Putin accused the West of taking advantage of the deal at the expense of developing-world countries, claiming that Ukrainian grain was not going to the world's poorest countries as originally intended. Putin also criticized Western plans to impose a price cap on Russian crude exports globally, threatening to cut off sales to any nation that would agree to such a limit.

-

Stocks are higher today, after losses following a Q&A session where Fed Chairman Jerome Powell reiterated that the central bank will continue to do what it takes to fight inflation. He signaled that a pause in rate hikes or a pivot to cutting interest rates is not coming soon. Stocks remain in a downward trend overall as concerns about a slowing economy and futher rate hikes from the Federal Resernve are pushing some investors away from riskier parts of the market.

-

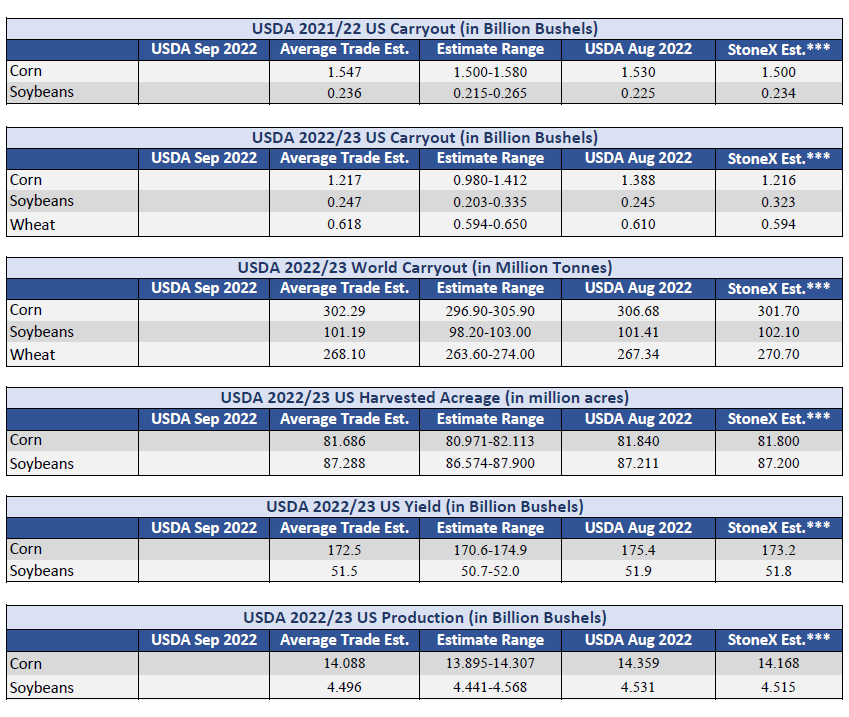

USDA will release the September WASDE on Monday at 11:00am. Corn is the hot ticket item, with the trade keeping a close eye on yield and harvested acres following a ProFarmer Tour that varied greatly from current USDA numbers.

| September WASDE Estimates |

|

|

Weather

Yet again, our area finds itself in a 6-10 day forecast of above average temperatures and below average precipitation. National Weather Service out of Dodge City released an interesting tidbit yesterday - that at their Garden City station, it would take almost 3 times as much as it has rained/precipitated thus far to get to only a normal value for the year. While we all know it's been dry, this definitely highlights how abnormally dry it has been this year. Headed into the weekend, a strong cool front will bring a welcome break from the heat, with highs only in the 70s and some chances for moisture. Next week it's back to normal, with daytime highs in the 90s.

|

|

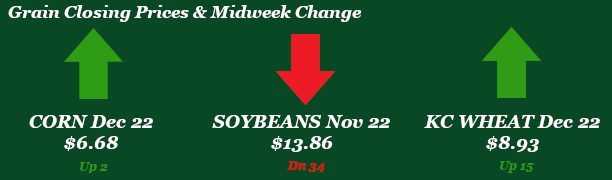

Corn

Corn has been riding the coat tails of wheat this week to find any momentum higher. With little news look for corn to grind out the rest of the week and looking forward to Monday’s supply and demand report from the USDA. Most expect yield and carryout to see reductions. Just how much change is the big question. Yesterday saw a flash sale of 257k metric tons to Mexico which fed the bulls for a short while. Export inspections for corn saw 20.4 million bushels shipped towards the bottom of trade expectations. Mexico and China led the way. Export sales are hopefully back week. Corn crop conditions were unchanged at 54% good to excellent with most traders expecting a 1% drop. Kansas stayed put as well at 22% good to excellent. Managed money were big buyers last week with 39,251 contracts added, raising the long total to 221,467 contracts.

Wheat

Wheat came off the long Labor Day weekend swinging for the fences. News that Putin was upset by the Black Sea deal being unfair along with cheating the world and wanting to revise it hit the headlines Wednesday. This caused a knee jerk reaction with wheat going up 50+ cents at one point but sold off into the close and closed near 20 cents up on the day. We are seeing grains back track today with little headlines to steer the ship higher. We probably won’t see much excitement with the WASDE report coming out on Monday. Spring wheat harvest in the north took a big jump up to 71% complete, a couple more weeks and most should be finished up. Export inspections saw wheat ship out 17.6 million bushels with HRW being the number one variety. Mexico was the number one destination followed by South Korea. Managed money added 3,033 contracts to the current long of 12,458 contracts to KC Wheat reported in last weeks CFTC report.

Soybeans

Bean have moved lower this week, pressured by outside markets, continued Chinese lockdowns, and rains in parts of the Corn Belt. The western Corn Belt does remain dry as pods begin to fill, but the eastern Corn Belt is making up for it. Crop conditions remained steady week-on-week at 57% good/excellent, while Kansas dropped 2% to 25% good/excellent. The crop is reported at 94% setting pods and 10% dropping leaves. Export inspections were up from last week at 18.2 million bushels, but still lower than the 10-week average of 20.2 million. USDA still is not releasing weekly export sales data. Managed money didn’t make any major moves according to Friday’s report, adding only 2,690 contracts to their net long of 101,801 contracts. In other news, Argentina bettered its exchange rate specifically for farmers to incentivize them to sell their crop, which had been selling at a sharply lower rate than last tear. This resulted in Argentinean farmer sales spiking early this week. The bettered rate will last through the end of the month.

Milo

Harvest in the south is progressing and making its way north with Texas at 75% complete and Oklahoma just getting started at 6% harvested. Crop conditions were unchanged at 21% good to excellent. Milo saw 2.3 million bushels shipped out with China taking the majority. Basis has remained strong and firm week over week.

Trivia Answers

-

Grover Cleveland (1894)

-

The Minnesota Vikings