Weekly Market Update 4/13/2023

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

The first underground railway was constructed in what city in 1863?

-

What is the highest-grossing movie of all time when adjusted for inflation?

Answers at the bottom.

Market News

Russia again threatening to end Black Sea Grain Deal. Reuters reported this morning that Russia has said this week that there would be no extension of the UN-brokered Black Sea grain deal beyond May 18th unless the West removes obstacles to Russian grain and fertizer exports. While Russian food and fertilizer exports are not specifically sanctioned, Moscow argues that other restrictions on payments, logistics and insurance are a barrier to shipments. Headlines out of the Black Sea seem to change by the day - so, at least for now, it seems like the market is content to mostly ignore them.

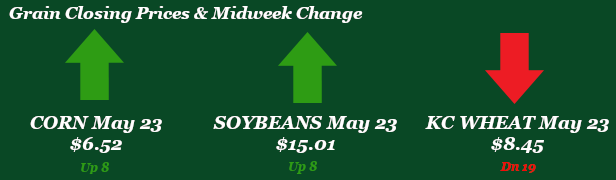

Corn planting is kicking off across the country. USDA estimated on Monday that the U.S. corn crop is 3% planted, 1% ahead of the 5-year average for this point in the season. Texas is handily the furthest along, reported at 61% planted. Kansas is reported at 6%, ahead of the 5-year average of 4%. The U.S. milo crop is reported at 13% planted, with Texas at 48%. Because of the lact of fireworks in the WASDE report (more details below), the market is back to trading weather and planting progress.

South America's drought continues to intensify. Soybeans and soybean meal are moving back toward roughly one-month highs as Argentina's drought effects further intensify. We did see cuts made to Argentine corn and soybean production in this week's WASDE report. Soybean production is estimated at a 23-year low and corn production is pegged at a 5-year low. The trade will continue to closely monitor forecasts for the region, but at this point the crop mostly is what it is.,

Federal Reserve officials are predicting a recession later this year. Federal Reserve documents released yesterday indicated that fallout from the U.S.banking crisis is likely to push the U.S. economy into recession later this year. “Given their assessment of the potential economic effects of the recent banking-sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years,” the meeting summary stated. Despite speculation that the banking issues might cause the Fed to leave rates alone at this meeting, officials decided that more still needed to be done. FOMC officials voted to raise the benchmark borrowing rate by 0.25 percentage points, the ninth increase over the past year.

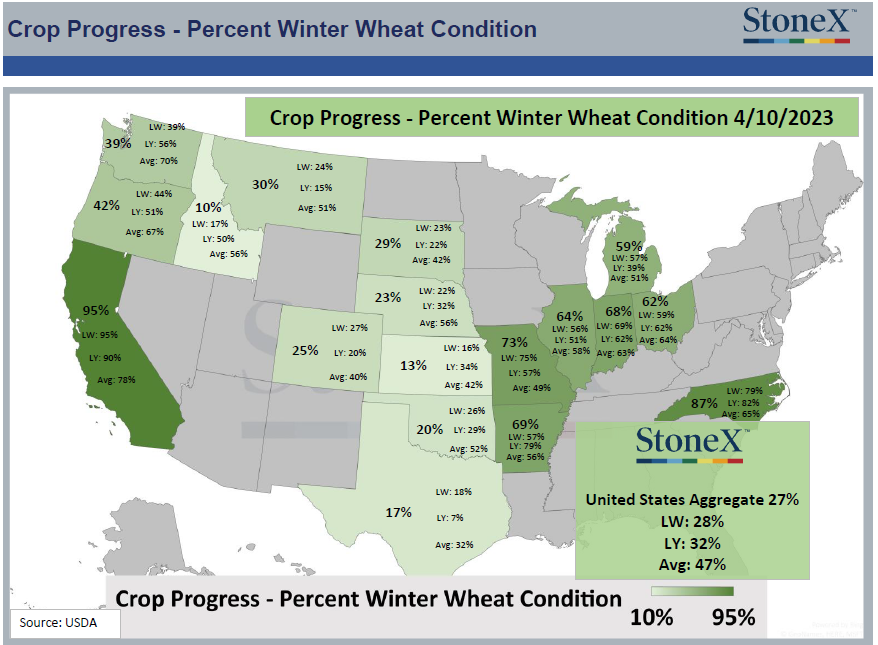

Winter wheat condition falls again. Monday's crop progress report showed winter wheat conditions slipping by 1% from last week, pegged at 28% good-to-excellent nationwide. This is the lowest winter wheat condition score in the last five years. Kansas ratings fell 3% to only 13% good-to-excellent, while Oklahoma was down 6%, Colorado was down 2% and Texas was down 1%. Winter wheat was reported at 7% headed out nationwide and sprng wheat was reported at 1% planted.

April WASDE Recap

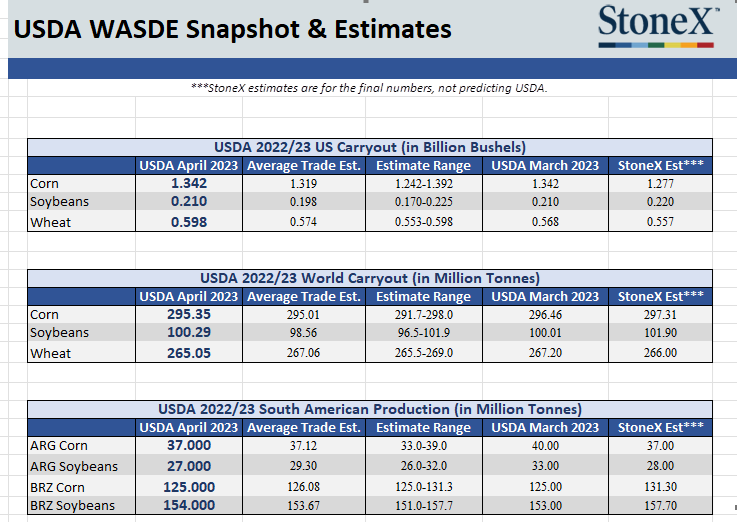

The USDA did not throw any surprises into the April WASDE, and the trade got what it was expecting. With that said very little was changed which made for an overall very quiet report day. Corn: U.S. corn carryout remained the same from last month at 1.342 billion bushels, slight decrease to world carryout showing 295.35 million tonnes reported. Argentina had a decrease of 3 million tonnes, lowering total production to 37mmt, Brazil stood pat at 125mmt. Milo: No changes in the milo balance sheet. Soybeans: Steady as she goes for U.S. carryout with no change from the March number of 210 million bushels. World carryout saw a slight increase to 100.29mmt despite the decrease to Argentina’s production of 6mmt to 27mmt overall. Soybeans and corn fall into the same boat of the trade going back to weather and planting as we await 23/24 balance sheets that will be released next month. Wheat: U.S. carryout saw an increase of 30 million bushels to 598 million bushels overall. This increase comes from 25mln bushel reduction in feed usage and 5mln bushels of imports. World carryout saw a decrease to 265.05mmt. Overall nothing earth shaking from this WASDE with most attention looking to the release of the 23/24 balance sheets for next month.

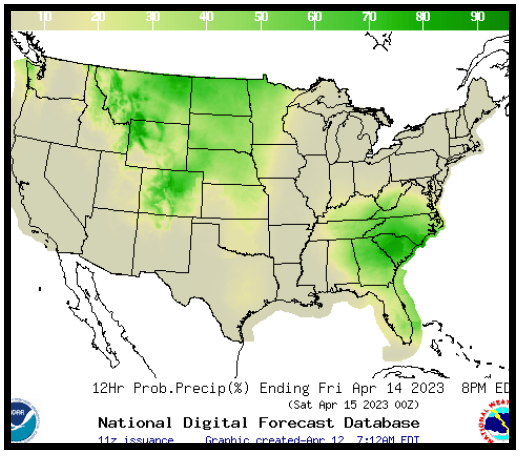

Weather

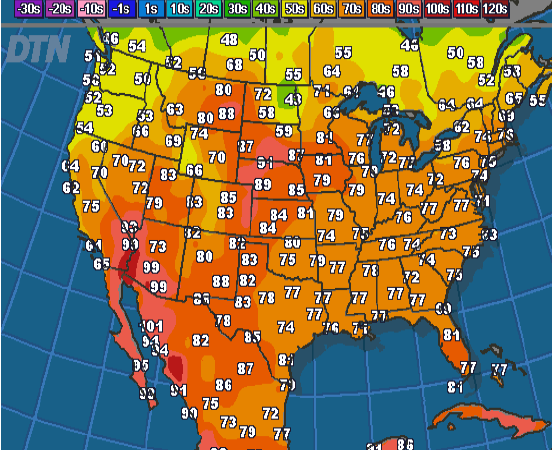

Weather this week is going to be much warmer with temperatures in the upper 80s and lows in 40s. It’s going to remain moderately windy with speeds between 15-25 MPH heading into the weekend. There is a small chance of thunderstorms this evening, so here’s to hoping mother nature comes through. Outside of that, there aren’t any chances in the nearby forecast.

|

|

Trivia Answers

-

London

-

Gone with the Wind