Weekly Market Update 2/9/23

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What team has played in four Super Bowls but never held a lead?

-

The Kansas City Chiefs were originally known by what team name?

Answers at the bottom.

Market News

-

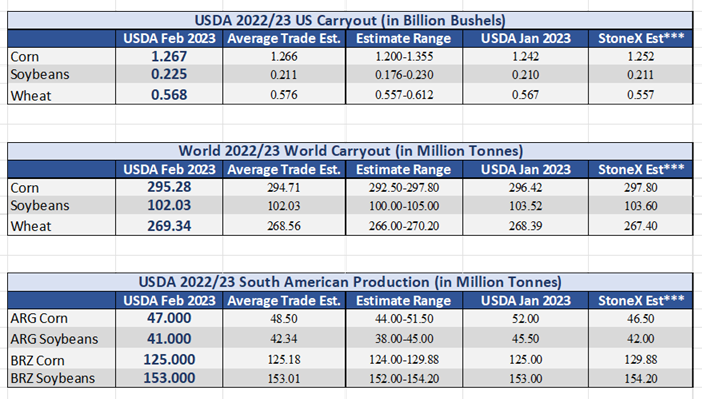

Markets moved lower today after a mostly uneventful WASDE report had commodities in the green in yesterday's session. While the report was a snoozer, we did see some changes made on the demand side of the balance sheet for corn and soybeans. Argentina production of corn and beans was also lowered with continued drought in the country. Check out the graphic and the commodity sections for more specific information.

-

Stocks are lower today, giving up gains as concerns over future moves by the Federal Reserve on monetary policy offset excitement around the latest batch of corporate earnings. The Fed earlier this month hiked interest rates by 25 basis points and on Tuesday, Fed Chair Jerome Powell said that inflation is cooling but there is still a long ways to go. The Dow and S&P 500 were both down 0.7%, while the Nasdaq was down 0.9%.

-

Petroleum futures settled in the red today as oil infrastructure in the Middle East showed little damage following Monday's earthquake. A 7.5 magnitude earthquake hit the Middle East Monday, which initially sent oil prices up. Crude transport infrastructure and pipelines in the region have not been as damaged as anticipated, which pushed prices down at settlement. Builds in crude and refined products in the U.S. for the week ended Feb. 3 also kept pressure on prices, according to data released by the EIA Wednesday. Crude stocks have not risen to these levels since June 2021. WTI crude March futures fell 41cts to settle at $78.06/bbl. RBOB March futures fell 1.53cts to $2.4475/gal. ULSD March futures dropped 7.79cts to $2.8154/gal.

-

The alleged Chinese Spy Balloon that was hovering over U.S. airspace got the headlines chattering over the last several days. The U.S. State Department has indicated that the balloon was equipped with multiple antennas and solar panels large enough to produce massive power, which may have been capable of collecting certain communications. The balloon reached altitudes up to 60,000 feet. It was eventually shot down by the U.S. military off the Carolina coast. While China faulted the U.S. for destroying what they are saying was a weather balloon, the U.S. is hoping to salvage data from balloon remnants.

-

We hope that you will join us next week for our Grain Marketing Meetings! We will be in Ulysses Tuesday, Garden City on Wednesday and Dighton on Thursday. All meetings start at noon. More info is available here.

|

February WASDE Snapshot |

|

|

Weather

Weather today here in the southwest part of Kansas is windy and a slightly cooler compared to the previous weather we’ve been experiencing, but warmer temps are anticipated. At the end of this week we are looking forward to clear skies and highs near mid 50s and lows in the 30s with some promising moisture with 50% chance of rain/snow showers midweek. Wind to also be expected to come with the moisture throughout the week, around 15-20 mph.

|

|

|

Corn

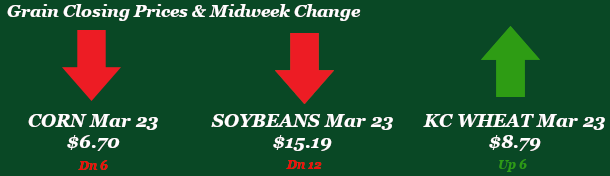

With the WASDE in the rearview mirror, corn seems content to be back to trading the sideways range its had for a couple of weeks – hovering in the neighborhood of $6.75 on the March board. In yesterday’s report, USDA slightly increased 22/23 U.S. corn carryout, trimming ethanol usage by 25 million bushels. It should be noted that with the current pace of usage, this cut could be just the start. USDA left export demand unchanged for now, despite the fact that we are currently 13% behind the seasonal pace needed to hit their current estimate. I would expect to see some type of revision lower in coming reports. World corn carryout was lowered by about 1 MMT to 295.28 MMT. Argentina corn production was cut by 5 MMT due to dryness and Brazil was left unchanged. If current estimates hold, Argentina will see a 5% reduction year-on-year and Brazil will see an 8% increase. Overall, this report wasn’t a big mover and we are back to watching South American production, export demand, and ethanol demand. Export inspections were below even the lowest estimate at 18.9 million bushels, much lower than the 10-week average of 25.8 million bushels. Export sales were on the higher side of estimates at 45.7 million, which is a pretty decent number historically for this time of year. It’s worth noting that sales continue to out-pace inspections, showing just how far behind we are on getting these grain sales physically shipped. Local basis feels weaker, with the feed market able to find the corn it needs at relatively cheap values.

Wheat

Yesterday was WASDE day and what the WASDE giveth the funds taketh away. All gains from yesterday gave the funds an opportunity to sell and take a profit. Russia and Ukraine news still in headlines but the market isn’t nearly as reactionary with this news as in the past. The WASDE report for wheat was very quiet with a slight increase to U.S. carryout, up 1 million bushels to 568 million. Export inspections for wheat were strong with 19.7 million bushels shipped, above trade expectations. White wheat was the leader with 6.4 million bushels shipped followed by HRS at 5.1 million bushels. The Philippines and Mexico were the top destinations. For the year wheat is ahead of the USDA’s export pace by 3%. Export sales were not so bright for wheat coming in just above trade estimates at 4.8 million bushels with 700k of new crop sales. HRW led the way for sales. Mexico took the lion’s share of sales. Export sales are behind USDA projections by 6% currently. We will see if the USDA end up adjusting their projections or sticking with status quo.

Soybeans

Beans continue to tread water, not getting to excited to make a move one way or the other. Yesterday the USDA cut soybean crush by 15 million bushels and added it back to carryout. The other newsworthy note from the WASDE was South America production. We say Argentina bean production lowered to 41mmt from 45.5mmt. Something interesting to note, Rosario Grain Exchange currently sits at 34.5mmt. With the dry weather persisting in Argentina the USDA could be rolling that 41mmt back quite a bit more in the coming months. Brazil production was unchanged at 153mmt and has continued to receive favorable weather. With current USDA projections South America is looking at a 9% increase in soybeans YoY. Soybean inspections were in line with trade estimates at 67.2 million bushels shipped. China was far and away the top destination. Soybean sales were not strong coming in at 16.9 million bushels sold, we did see some new crop sales totaling 6.8 million bushels. China was the number one buyer followed by Spain.

Milo

Milo has seen ups and definitely seen some downs trying to stay relevant and struggling at that, with very poor export demand. WASDE showed little changes for milo, with exports decreased by 10 million bushels and ethanol increased by 10 million bushels for a net effect of 0 on carryout. Export sales coming in at 2.1 million bushels, all going to China. Sales still aren’t cutting it by the USDA standards, with sales still trailing behind the pace needed to hit their current estimate. Export inspections this week reported at 0.1 million bushels, with Mexico as the primary destination. Basis feels flat to weaker – the absence of flashy exports means it’s left to the ethanol and feed markets locally.

Trivia Answers

-

Minnesota Vikings

-

The Dallas Texans. The team moved to Kansas City after the 1962 season.