Weekly Market Update 1/19/23

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

Which animal can be seen on the Porsche logo?

-

What is the most consumed manufactured drink in the world?

Answers at the bottom.

Market News

-

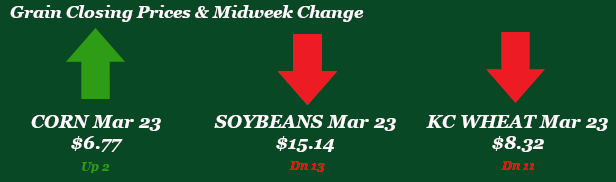

Export inspections were strong this week for corn and soybeans, both coming in above the range of trade estimates. Corn was reported at 30.5 million bushels, almost doubled from the previous week. Soybeans were reported at 76.3 million, up from last week at 53.5 million. HRW was reported at 3.4 milion bushels, ahead of last weeks 2.0 millon. Corn was largely headed to Mexico and China, while the vast majority of beans were Chinese shipments.

-

South American weather continues to be closely monitored by the trade. Argentina has gotten some decent rain the past couple of days and has more on the way in the 10-day forecast. However, general sentiments are that the rain is too little, too late and the damage is already done. Rains should at least make the bulls take a breather for the time being.

-

NOPA released the December soybean crush report this week, coming in at 177.5 million bushels. This was well below the average trade guess of 182.9 million bushels and trails behind 186.4 million December last year. Cumulative Sep Dec crush stands at just under 700 million bsuhesl, now down just over four million behind last year's four month pace, with the USDA still looking for a 40+ million bushel year-over-year bean crush increase for 2022-23.

-

Managed money was largely a seller of commodities according to Friday's CFTC report. Funds sold 46,865 corn contracts to bring their net long down to 149,605 contracts. The soybean net long was broguht down 11,290 contracts to 131,704. KC wheat sold of 9,780 contracts and is actually now net short 8,023 contracts. It will be interesting to see what tomorrow's report will bring with a stronger market week last week.

-

The number of Americans filing new claims for unemployment benefits unexpectedly fell by 15,000 last week to a seasonally adjusted 190,000, signaling that the labor market is resilient even in a slowing economy. This doesn't bode well for interest rates as the Fed has attempted to cool demand for workers.

-

Federal Reserve policymakers indicated this week that they will push on with more interest rate hikes, with several supporting a top policy rate of at least 5%. The Fed's benchmark lending rate currently sits in a target range of 4.25% to 4.50%. Investors expect the Fed to raise that rate by a quarter of a percentage point during their meeting at the end of the month. CNBC reported today that JP Morgan CEO Jamie Dimon believes that interest rates could go even higher than the current Federal reserve projection of 5%, maybe even up to 6%.

|

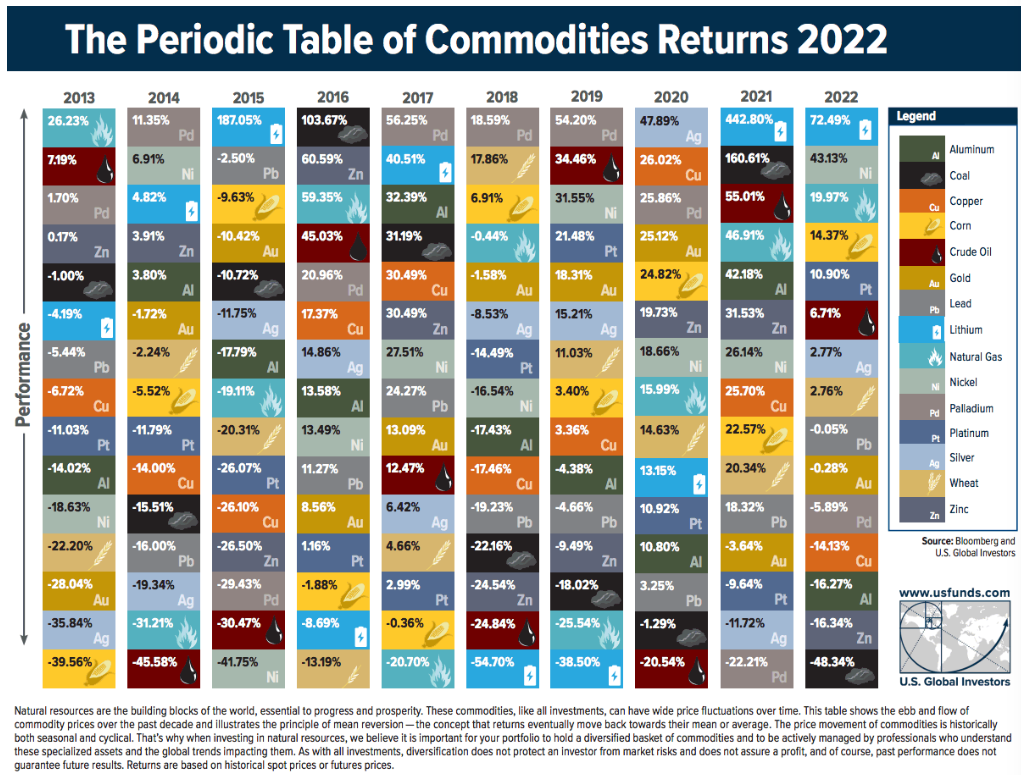

Interesting look at commodity returns... |

|

|

Weather

A nice change from what we've been used to - above normal chances for precipitation in the 6-10 day forecast! Friday and Saturday should hopefully bring snow across GCC territory, with strong chances for 1-6" depending on the location. A chance for more snow is also holding for early next week. Daytime highs will be hanging out in the 30s and 40s for the foreseeable future, with nighttime lows dipping as low as the teens.

|

|

|

Trivia Answers

-

Horse

-

Tea