Weekly Market Update 7-27-23

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

How many times has The Wizard of Oz been remade?

-

Which letter is representative of the number 50 in Roman numerals?

Answers at the bottom.

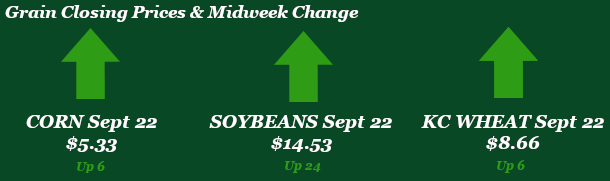

Market News

Russia/Ukraine War: Markets started of the week spicy after weekend news of Russia striking grain facilities along the Danube River. This disruption to the supply chain sent commodity markets sky rocketing, but it was very short lived. Front end KC Wheat month of September gave back all the gains from Monday. This was due to news coming out of Ukraine that most facilities have continued working although only during daytime hours. Markets are still very reactive to this situation as it has dragged on for close to 1.5 years now. Look for markets to remain volatile for the foreseeable future.

Export Inspections: Corn: Corn had a lackluster week for export inspections with 12.2 million bushels shipped. This was at the bottom of trade estimates. Mexico was the top destination followed by Honduras and Japan. Overall, for the year corn is right at USDA’s seasonal pace. Soybeans: Beans saw a decent week with 10.4 million bushels shipped, close to the top of trade ranges. Germany, Mexico, and Italy were the top 3 destinations. Milo: Milo saw a pop with 6.7 million bushels shipped. China was the top destination. China steers the ship with milo and when they want it they get it. Wheat: Wheat outperformed trade estimates this week with 13.2 million bushels shipped. HRS was the top variety of wheat shipped. The Philippines was far and away the top destination on the week taking more that 5 million bushels. With demand weak the past month or so it is no surprise export inspections haven’t been a smash hit lately. A pick in up in demand for export sales should start to reflect better inspections reports in the near future.

Export Sales: Corn: We are finally seeing a pop in demand from the new crop side of sales which is a sight for sore eyes. The export sales report pegged old crop sales at 12.4 million bushels which is within trade estimates, 13.2 million bushels of new crop is the number that jumps out. The top buyers this week would be Mexico, Japan, and Canada with Mexico and Canada the top new crop buyers. Soybeans: Old crop sales were so-so for beans with 7.3 million bushels sold, new crop is where the excitement is with 20 million bushels sold. China was the top buyer of new crop bushels while the Netherlands and Germany were the top old crop buyers. Milo: Milo saw some pop this week for new crop as well. Old crop couldn’t match the 9.4 million bushels sold last week and failed to hit the 10-week average of 3.8 million bushels, but new crop saw 4.8 million bushels sold. China and unknown were the only buyers for milo. Wheat: Wheat is middling trade estimates at 8.6 million bushels sold. HRS narrowly edged out SRW as the top variety sold. Top buyer on the week was the Philippines with over 2.5 million bushels. Overall if we can see some sustained sales of new crop for corn and soybeans we could see some rallying within those commodities.

Interest Rate Update: Yesterday the Federal Reserve's Open Market Committee voted unanimously to raise the Federal Funds rate by 25 basis points to a range of 5.25-5.50%. The hike was largely expected by the market, and puts interest rates at their highest level in 22 years. This is the 11th rate increase since March 2022. Fed Chair Jerome Powell leaned into the strong June CPI report as evidence of improvements in the right direction, but reiterated that the group would continue a "meeting by meeting" approach. The next FOMC meeting won't be until September.

Weather

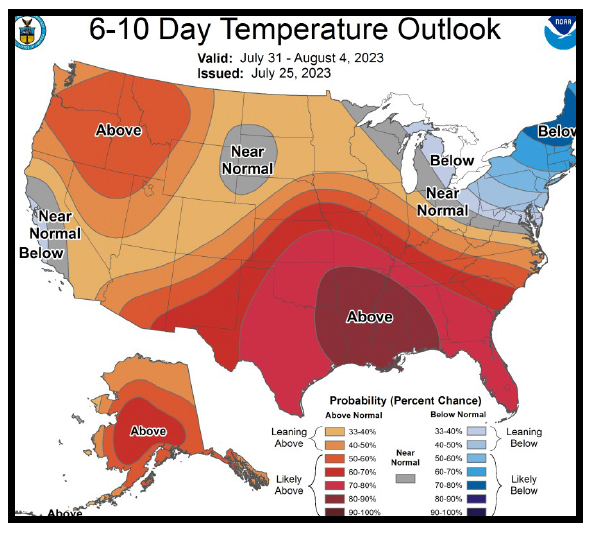

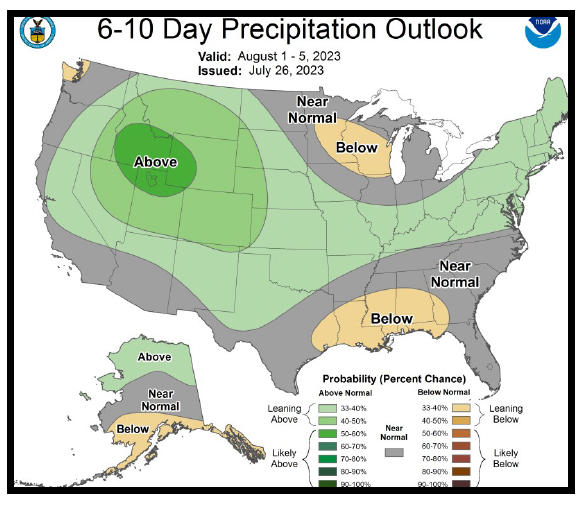

U.S. plains and central Midwest as well as parts of Texas seeing the first big heat wave for the summer. Rain was light at the beginning of this week with temperatures on the rise starting the week 90s and 100s for the belt. NE/IA and KS/MO borders along with the Ohio River Valley northern belt will see decent chances through Friday while the central and southern Midwest remains dry and extremely hot, with heat indexes between 105-108 degrees. Favoring the high side of normal if anything, high temps expected to close out this work week but decrease after that. Mostly mixed precipitation chances into late July and the first week of August. Locally with the 10-day forecast highs will be in the upper 90s lows in the 70s, best chance of rain through the end of next week 30-40% likelihood. Windspeeds tolerable 10-20 MPH.

|

|

Trivia Answers

-

18 times

-

L