Weekly Market Update 3/16/2023

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What team won the first NCAA basketball national championship tournament?

-

Which coach has won the most NCAA Tournament games? Hint: He is retired.

Answers at the bottom.

Market News

Black Seas Grain Corridor Deal Russia is open to extending the deal allowing Ukraine to safely export crops out of its Black Sea ports, but for a shorter period than previous terms. Moscow wouldn’t object to extending the agreement when it expires on March 18th, but only for a period of 60 days. The Black Sea Grain Initiative has enabled Ukraine to ship out more than 24 million tons of crops since it was first brokered by the United Nations and Turkey back in July. Each of the previous two terms for the grain deal lasted for 120 days.

Inflation continuing to increase. Services inflation increases yet again, and rates bounce. February inflation numbers are in and services inflation refuses to roll over. Headline and Core CPI rose 0.4% and 0.5% last month, core inflation came in slightly higher than expected. The annual figures are similar, with headline inflation falling to 6.0% from 6.4% and core falling to 5.5% from 5.6%. Both in line with expectations. Food and services inflation is proving to keep inflation sticky. Shelter costs rose 0.8% last month, the second highest monthly increase in the past 6 months and marks 18 consecutive months of increasing rents.

Several states released updated wheat conditions. Colorado improved to 40% good/excellent (+11%), while Kansas was unchanged at 17% good/excellent. Our neighbors to the south saw declines, with Oklahoma reported at 30% good/excellent and Texas at 17%.

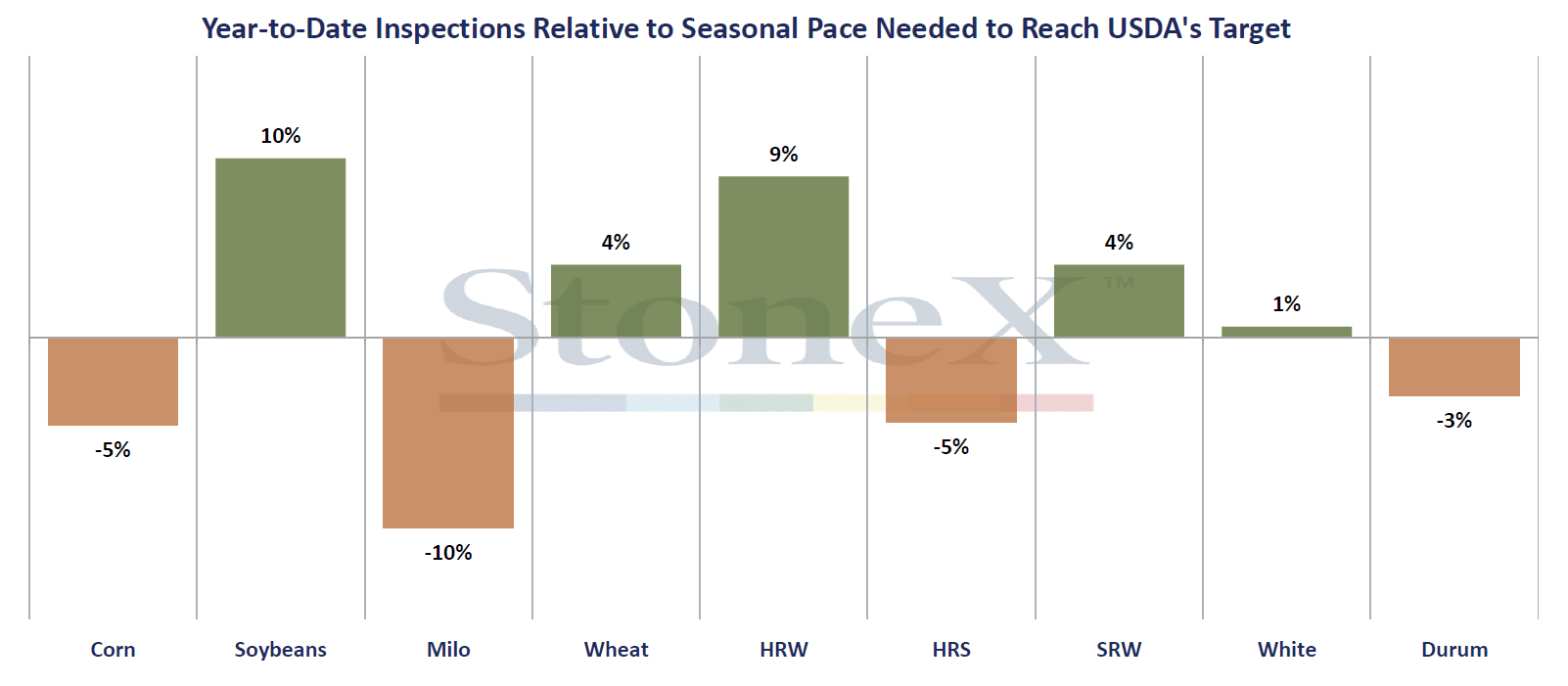

Export inspections were a mixed bag. Corn came in on the high side of estimates at 39.3 million bushels, putting shipments only 5% behind the pace needed to hit USDA’s estimate which has been assisted from the USDA lowering their export number in the March WASDE. Wheat inspections had their worst week since early-January, with 9.1 million bushels reported, led by SRW and HRW shipments to Mexico. HRW movement also included Honduras and Dominican Republic from the Gulf and S. Korea from the PNW. Milo was steady week-on-week at 2.9 million bushels shipped. Beans saw 22.7 million bushels shipped, up from the previous week at 20.2 million. For perspective, we've included a chart below that shows where inspections sit relative to the seasonal pace needed to hit current USDA numbers.

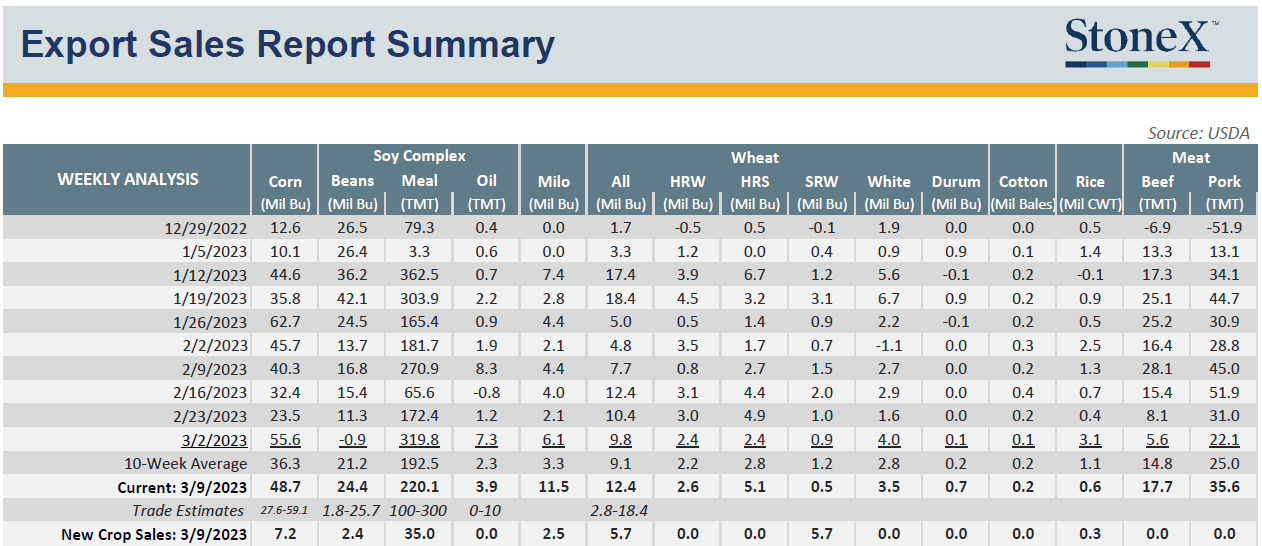

Export sales pretty solid this week. Corn sales were strong, with Japan the main player this week. Buyers have been taking advantage of recent flat price weakness. There are rumors that China has been buying some corn this week, which would be seen in next week's report. Milo also saw decent export sales numbers headed to China, but values aren't flashy numbers like we have seen in years past. Beans saw a decent recovery week on week, it will be interesting to see if it can hang on moving forward. Wheat also came in on the middle to high side of estimates, likely supported by the recent market rundown. This week's report is snapshotted below.

Weather

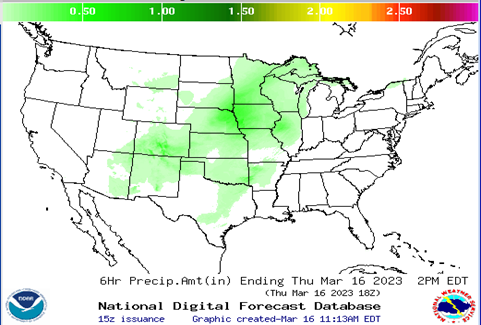

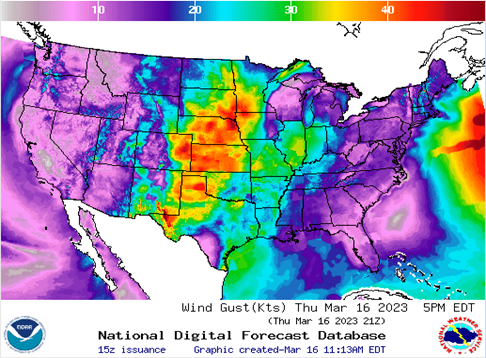

High winds out there today – 30-40 mph with gusts up to 50mph. We have a little chance of moisture via snow showers. Temperatures are trending a little cooler today and over the weekend with highs in the mid-40s and lows in the 20s. The upcoming week could be a different story, looking like more spring weather with consistent warmer temperatures in the 60-70s. Unfortunately, it’s drought-like conditions for the foreseeable future.

|

|

|

Trivia Answers

-

Oregon (1939)

-

Duke’s Mike Krzyzewski with 97.