Weekly Market Update 3/23/2023

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What is the lowest seed number to ever win the NCAA Men's Basketball Tournament? Bonus: Name the team and year.

-

When was the last time K-State Men's Basketball made the Final Four?

Answers at the bottom.

Market News

Fed raises the interest rate yet again. The Fed hikes rates by 25 basis points, despite some consideration for a pause. The rate hike was generally expected but the surprise to many was the committee voted unanimously for rise (11-0). The move set the U.S. central bank’s benchmark overnight interest rate in the 4.75%-5.00% range. The Fed has changed its official statement of “ongoing increases may be appropriate” to “some additional policy firming may be appropriate”. The market is seeing this a dovish lean regarding rates and inflation. What this could mean is one or two more rate hikes ahead, but rate cuts this year are not on the radar.

Black Sea Grain Initiative is extended, at least for now. On Saturday, the Black Sea grain deal was extended for another 60 days; this was half of the intended time period of an extension. Russia warned that any further extension beyond mid-May would depend on the removal of some western sanctions. The deal had been set to expire on Saturday. The United Nations and Turkey said on Saturday that the deal had been extended, but did not specify for how long. Ukraine said it had been extended for 120 days, but Russia's cooperation is needed and Moscow only agreed to renew for 60 days. The pact was put in place back in July and was renewed for another 120 days in November. The purpose of the deal was to combat a potential global food crisis after the Russian invasion of Ukraine and Black Sea blockade. U.N. Spokesman Stephane Dujarric said in a statement that "The Black Sea Grain Initiative, alongside the Memorandum of Understanding on promoting Russian food products and fertilizers to the world markets, are critical for global food security, especially for developing countries.”

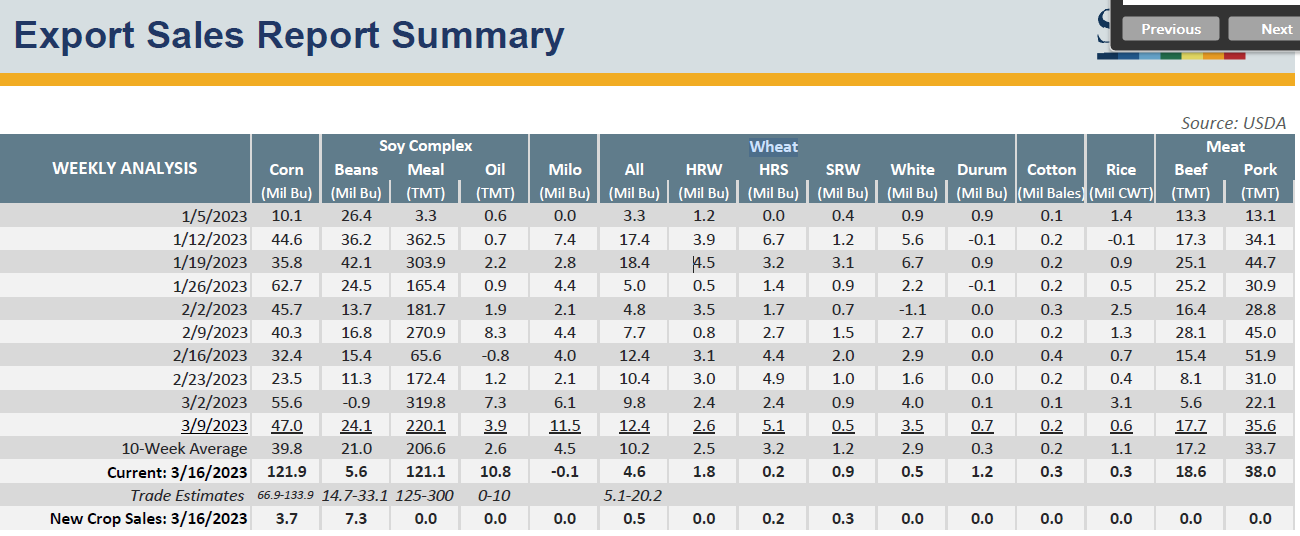

Export sales this week are pathetic, with the exception of corn. Beans were on the low end of estimates at 5.6 millon bushels of old crop and 33.1 million bushels of new crop, with China, Mexico and the Netherlands being the top three weekly destinations. Wheat came in below even the lowest estimate, at 4.6 million bushels sold across all classes. Mexico bought almost all HRW that was sold this week. Milo had net cancellations for the week - disappointing after an incredibly solid week last week. Corn was the only bright spot, with 121.9 million bushels sold in the old crop spot and 3.7 million bushels sold in the new crop slot. China was the large buyer of corn last week, and we have continued to see Chinese flash sales this week.

Meanwhile, export inspections were okay. Corn was reported at 46.8 million busehsl shipped, on the high end of estimates. We are still about 80.5 million bushels behind the pace needed to meet USDA’s estimate, but any weeks we get like last week definitely help the cause. Last week Mexico, Japan, and China were the three big destinations for corn, and we are finally starting to see some decent shipments out of the Pacific. Wheat shipments were in the middle of the range of estimates at 13.8 million bushels, up from last week at 9.4 million. HRW was shipped to Ethiopia, Mexico and Taiwan. Soybeans came in at 26.3 million bushels, dragging behind the 10-week average of 53.5 million but ahead of last week's 23.3 mllion. Beans are about 10% ahead of the pace needed to hit current USDA estimates.

Next Friday is a big USDA report day. USDA will release both Quarterly Grain Stocks and the Prospective Plantings Report on next Friday, March 31st. This is historically one of the biggest USDA reports of the year and is a major market mover. Because of this, we will delay our weekly commentary until Friday afternoon so we can get that information into your hands. Please reach out to the Grain Team if you'd like to get offers working prior to the report.

Weather

Here in Southwest Kansas, there is a mixture of weather signals with some chances for moisture this weekend. Chance of some AM showers for Friday and freezing rain Saturday for the upcoming week. Temperatures will be all over the board with highs from the upper 40s up into the 70s throughout the work week, while lows are still a little cooler in the 20s and 30s. Wind is expected throughout the week ranging from 10-20 mph.

|

|

|

Trivia Answers

-

A #8 seed. Villanova in 1985.

-

1964