Weekly Market Update 3/31/2023

|

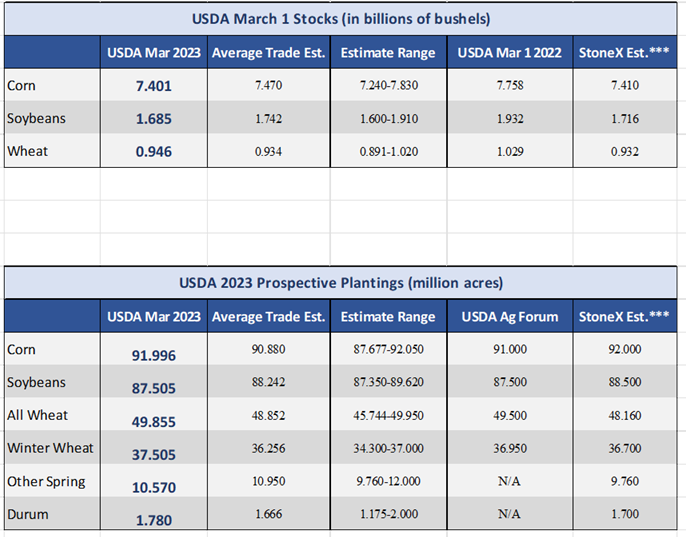

USDA released the Quarterly Stocks and Prospective Plantings Report this morning.

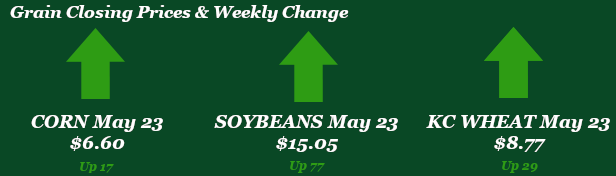

The Grain Stocks Report was the star of the show. Corn and soybean stocks as of March 1st were both tighter than the trade expected. Corn stocks were reported at 7.40 million, compared to a 7.47 million bushel average trade guess, and soybean stocks were reported at 1.69 million bushels, compared with a 1.74 million bushel average trade guess. Corn stocks are down 4.6% year-on-year, while soybean stocks are down 12.8%. Wheat was pretty much as the trade expected at 946 million bushels. The soybean balance sheet probably has the potential to get the wildest, with stocks tighter than expected and intended acres mostly steady year-on-year. The U.S. needs a favorable growing season to be able to restock domestic supplies with these types of numbers.

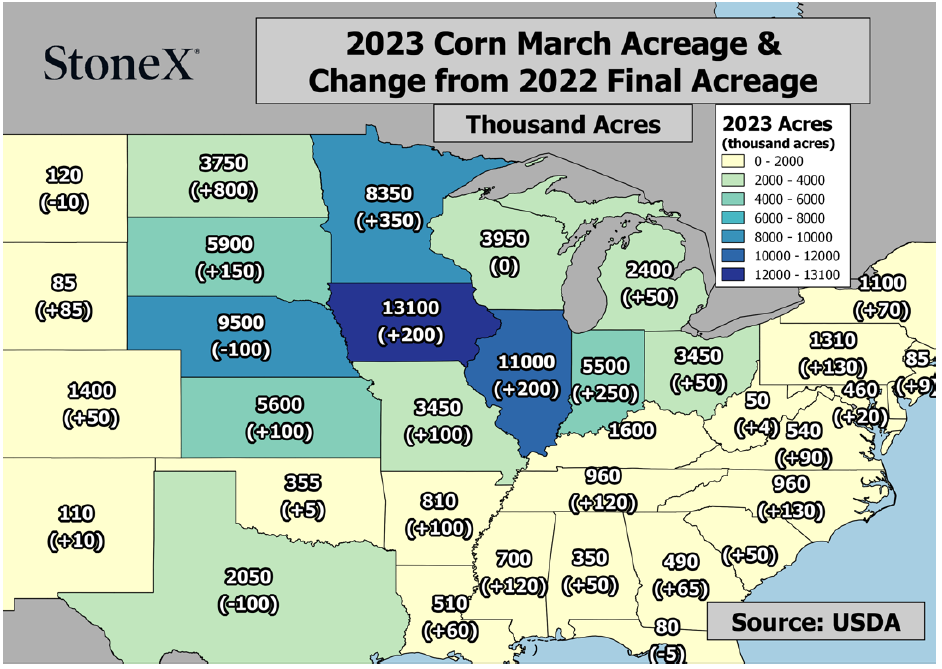

Farmers intend to plant significantly more corn and wheat acres this year. USDA reported that farmers intend to plant almost 92 million acres of corn this year, which is more than a million acres higher than the average trade estimate and a 3.42 million acre (4%) jump from last year. States that saw the largest increases in intended corn acres were in the Corn Belt, including Iowa, Illinois, and Minnesota. Prospective wheat acres were reported just shy of 50 million acres, on the high end of trade estimates and up 9% from 2022. Specifically, winter wheat acres were reported at 37.5 million acres, higher than even the highest trade estimate. Winter wheat saw the biggest increases in acres in Texas, Oklahoma and Kansas. Soybean acres are also up slightly this year. Intended soybean acres were reported at 87.5 million acres, lower than the average trade guess at 88.24 million and mostly steady with last year. Corn Belt states like Iowa and Illinois were left about the same, while the northern plains and some southern states saw increases. Farmers intend to plant a combined 179.5 million acres of corn and soybeans, the fourth-largest corn-plus-soybean area on record. This is up 2% from last year.

It's important to remember that these are only intended planted acres. Typically the acreage number shifts a lot as we move through the year. However, these are the numbers that the trade will be using as a place holder in their balance sheet and looking at as weather and planting issues begin moving to the forefront. Important to note, northern states like North Dakota, South Dakota and Minnesota are expected to see increases for both corn and beans and from all indications, farmers will not be able to be in the field until mid-April due to record snowpack and cold forecasted temperatures.