Petroleum Energy Update

Oct 10, 2025

By Michael Nigro, GCC Energy Risk & Pricing Analyst

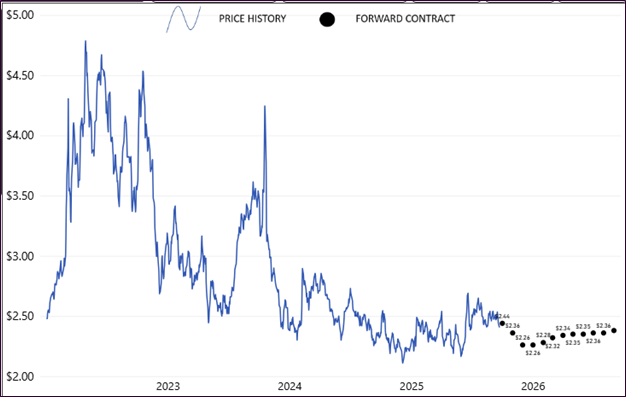

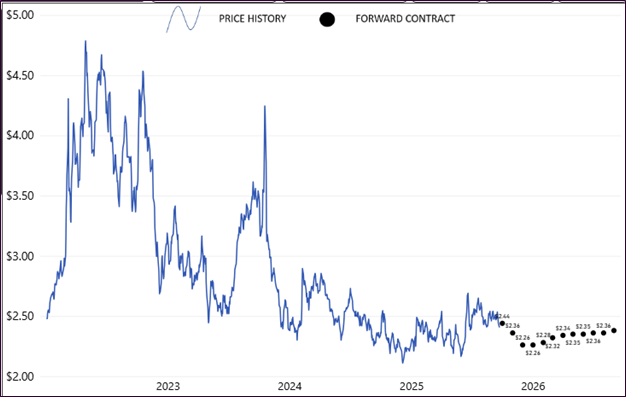

Energy markets continue to face significant headwinds as they have done for much of the year. EIA forecasts weak demand for Q4 and into 2026 at the same time OPEC+ continues to unwind production cuts effectively increasing global supply. Tariffs, inflation and other general economic impacts are also presenting bearish pressure on energy. This is generally viewed as positive as the net result is lower product prices. Current price points for gas and diesel have been low compared to recent history. It has been almost 2 years now since we’ve seen the $3 and $4 diesel prices. The graphs below illustrate our 3 year Scott City price levels for diesel and gas.

Product Price History – Scott City Terminal #2 Clear Diesel

Product Price History – Scott City Terminal Unleaded 10%

(Source: CHS – Base product price, no taxes or delivery fees included))

Compared to a year ago, Scott City Diesel prices are about .10¢ to .15¢ higher and gas prices are .20¢ to .25¢ lower.

The graphs also offer insight into futures. The black dots on the right side of each give a general indication that forward contract prices can be locked in relatively around the same price points to where current daily prices are at (with gas seeing some price increases sometime in 2026 as of the time of this writing). Based on recent historical levels, forward contract prices are very close to the lows and one could view this as a promising time to lock in some fuel prices.

Contact one of our local reps if you would like to review contract prices specific to your needs!

Energy markets continue to face significant headwinds as they have done for much of the year. EIA forecasts weak demand for Q4 and into 2026 at the same time OPEC+ continues to unwind production cuts effectively increasing global supply. Tariffs, inflation and other general economic impacts are also presenting bearish pressure on energy. This is generally viewed as positive as the net result is lower product prices. Current price points for gas and diesel have been low compared to recent history. It has been almost 2 years now since we’ve seen the $3 and $4 diesel prices. The graphs below illustrate our 3 year Scott City price levels for diesel and gas.

Product Price History – Scott City Terminal #2 Clear Diesel

Product Price History – Scott City Terminal Unleaded 10%

(Source: CHS – Base product price, no taxes or delivery fees included))

Compared to a year ago, Scott City Diesel prices are about .10¢ to .15¢ higher and gas prices are .20¢ to .25¢ lower.

The graphs also offer insight into futures. The black dots on the right side of each give a general indication that forward contract prices can be locked in relatively around the same price points to where current daily prices are at (with gas seeing some price increases sometime in 2026 as of the time of this writing). Based on recent historical levels, forward contract prices are very close to the lows and one could view this as a promising time to lock in some fuel prices.

Contact one of our local reps if you would like to review contract prices specific to your needs!