Reach New Heights with Summit Max

Apr 18, 2025

By Lindy McMillen, Director of Grain Trading

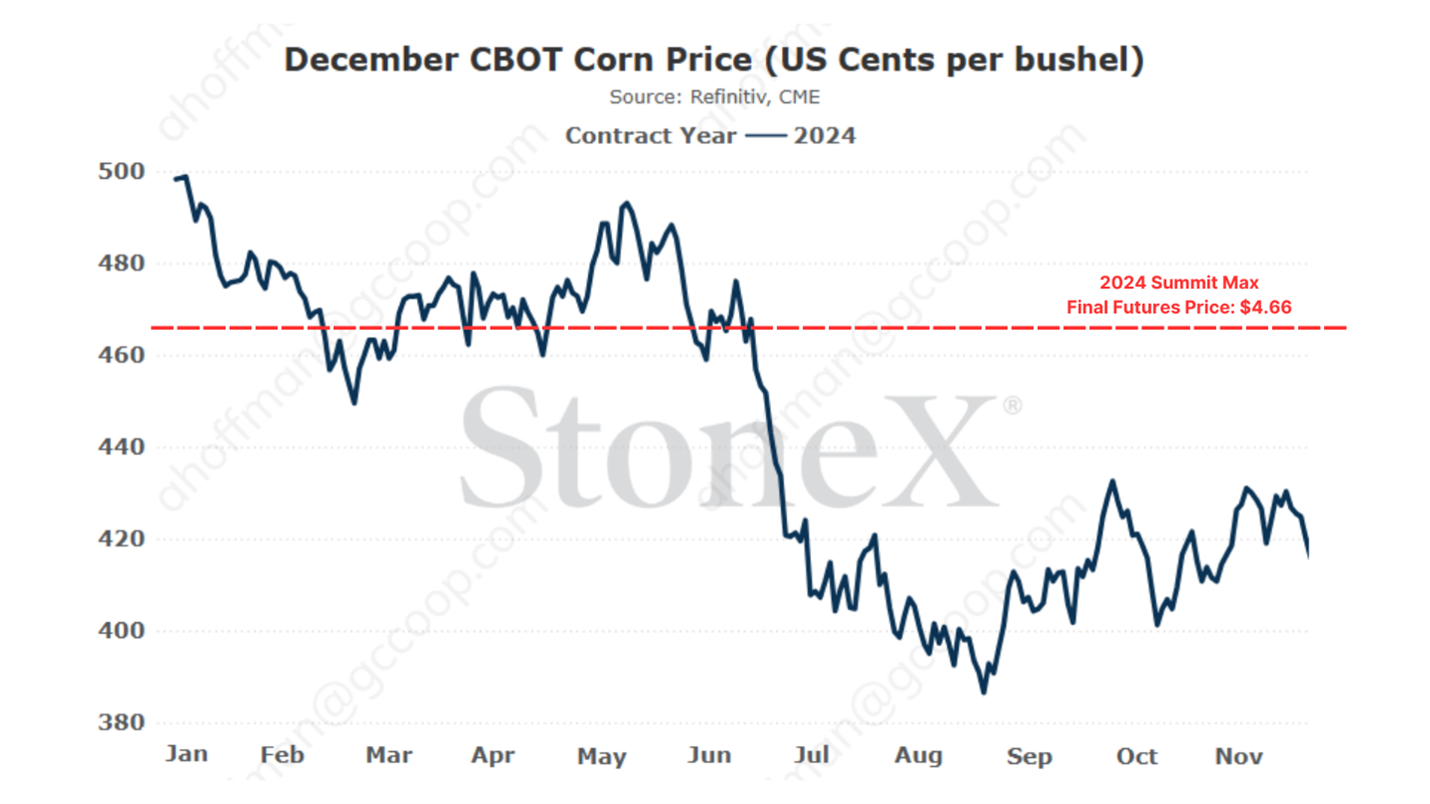

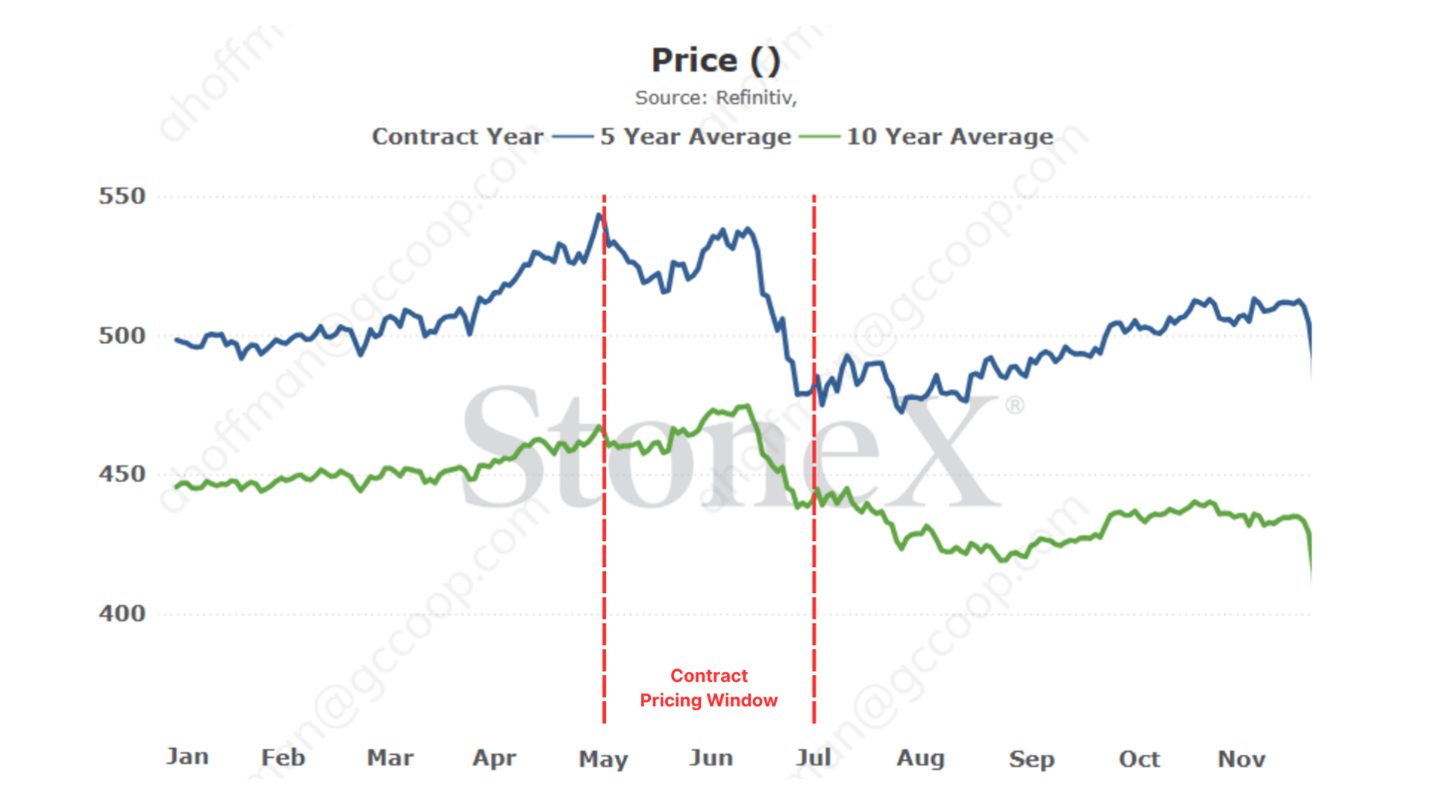

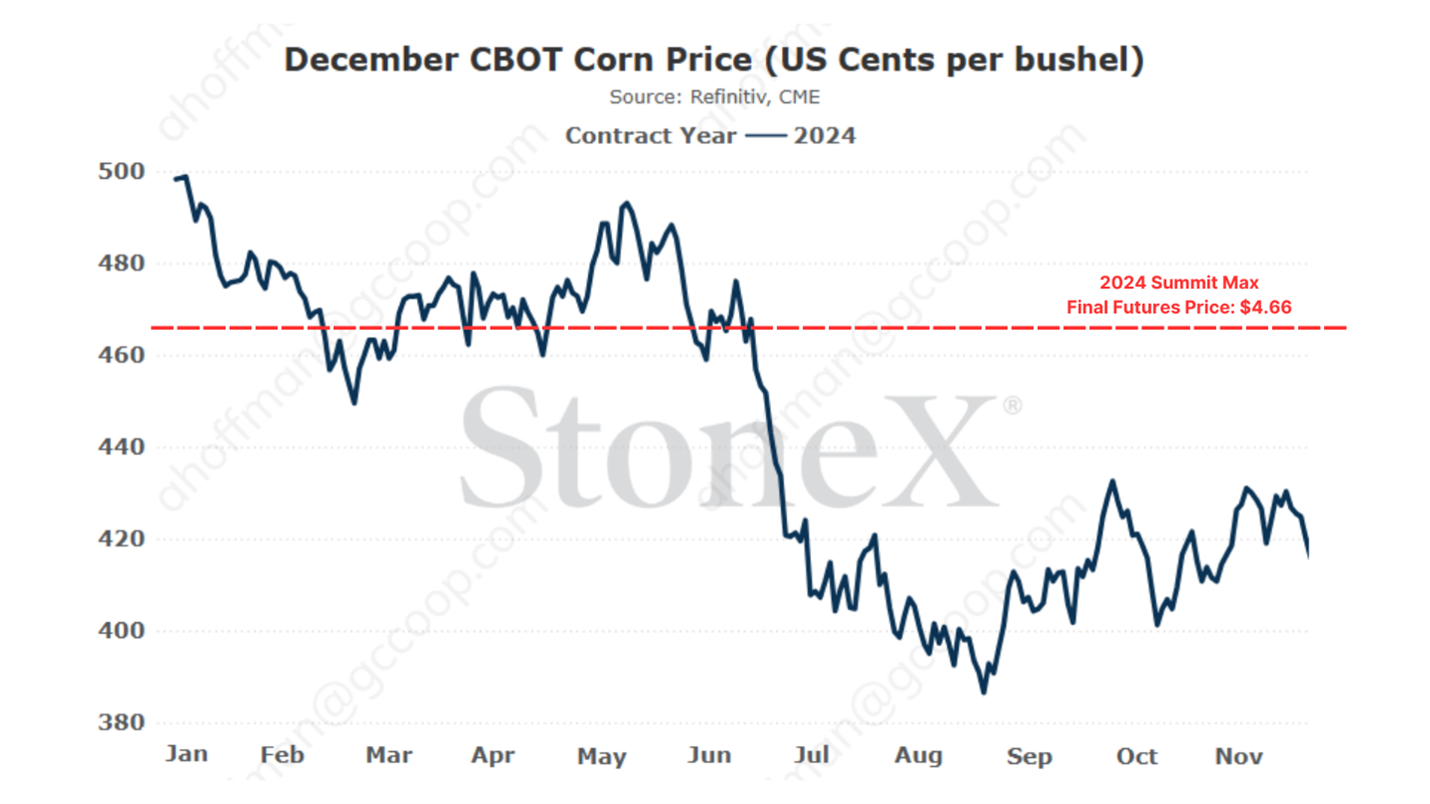

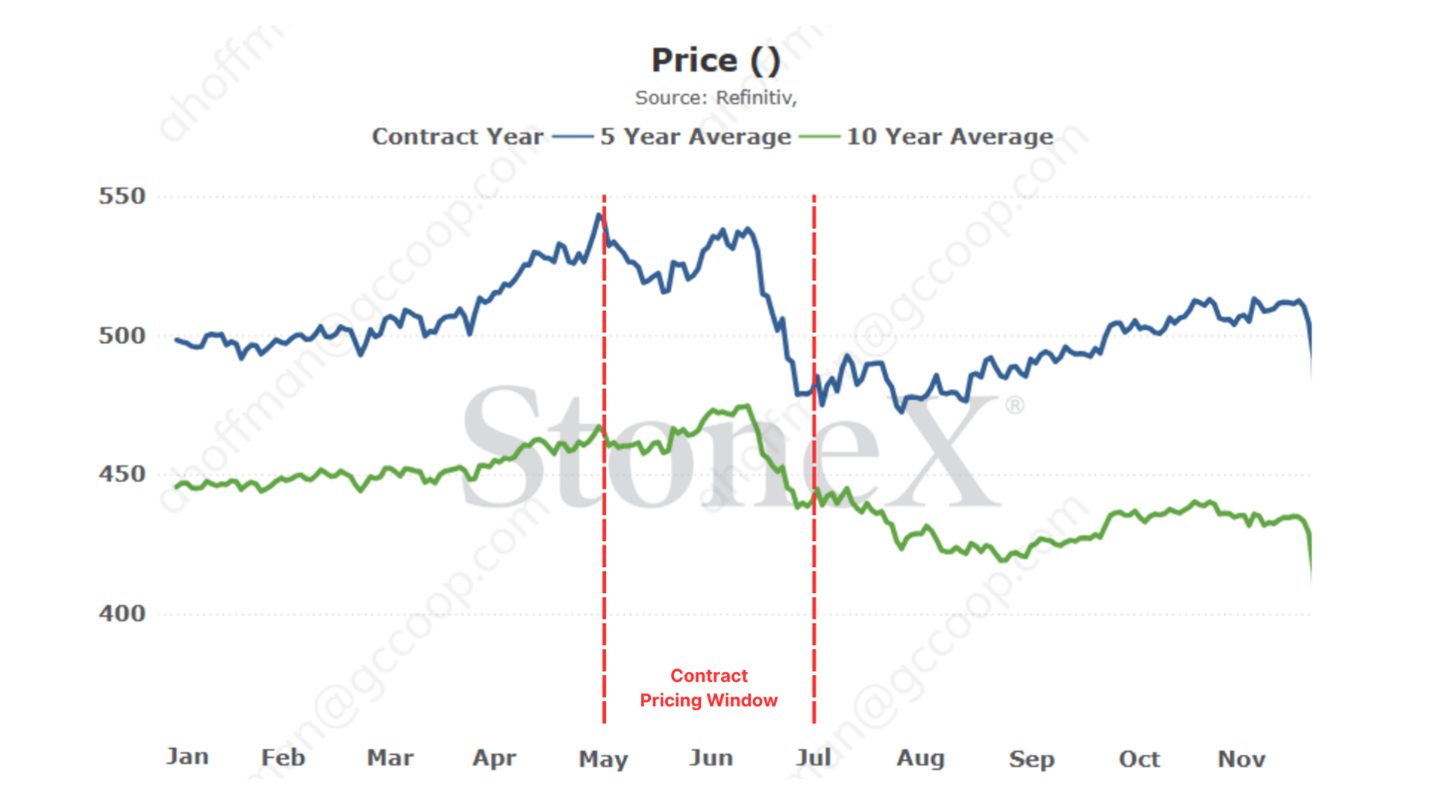

Seasonal corn charts tell us that the best time to be pricing corn is typically during the summer months. Why is that? The market often builds in risk premium due to planting and weather concerns in May, June and early July. The chart below highlights this, showing the price of December Corn futures on a 5-year and 10-year average, as well as contract performance for 2024. All the lines on the graph tell the same story – you should be thinking about selling during the summer. GCC developed our in-house Summit Max contract to allow our farmers an easy way to price bushels during this typically advantageous time of year.

GCC’s Summit Max contract prices December Corn futures for new crop corn or milo using the average of the daily high of the trading day from May 1st-July 18th. Essentially, an equal portion of your contracted bushels are priced at the high of the day every day during the pricing period, regardless of where the futures price closes each day. At the end of the pricing period, futures on your contract are set at the average of these daily highs. The contract will incur a 10-cent fee, and you are responsible for setting basis on or before October 1st.

Summit Max is just one tool we are excited to offer for your operation’s grain marketing toolbox. Enrollment ends on April 30th – contact a member of the Grain Team to sign up your bushels today!

Seasonal corn charts tell us that the best time to be pricing corn is typically during the summer months. Why is that? The market often builds in risk premium due to planting and weather concerns in May, June and early July. The chart below highlights this, showing the price of December Corn futures on a 5-year and 10-year average, as well as contract performance for 2024. All the lines on the graph tell the same story – you should be thinking about selling during the summer. GCC developed our in-house Summit Max contract to allow our farmers an easy way to price bushels during this typically advantageous time of year.

GCC’s Summit Max contract prices December Corn futures for new crop corn or milo using the average of the daily high of the trading day from May 1st-July 18th. Essentially, an equal portion of your contracted bushels are priced at the high of the day every day during the pricing period, regardless of where the futures price closes each day. At the end of the pricing period, futures on your contract are set at the average of these daily highs. The contract will incur a 10-cent fee, and you are responsible for setting basis on or before October 1st.

Summit Max is just one tool we are excited to offer for your operation’s grain marketing toolbox. Enrollment ends on April 30th – contact a member of the Grain Team to sign up your bushels today!