Weekly Market Update 10/14/2021

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What weapon has become known as “the gun that won the west”?

-

What is the oldest military post in continuous operation west of the Mississippi River?

Answers at the bottom.

Market News

-

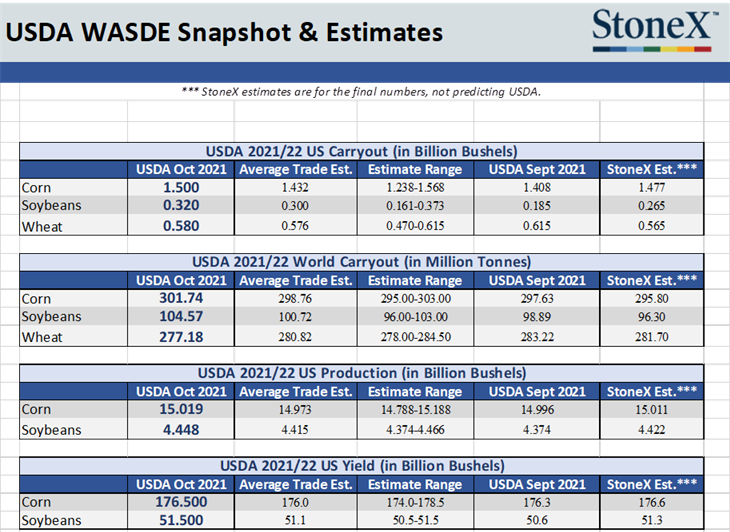

USDA released the October WASDE report on Tuesday with a few added surprises. Soybeans and corn were bearish while wheat was bullish. More details below in the commodity updates.

-

The Dow Jones is off yesterday’s lows up 469.2 points today at 34847.01. The S&P is up to its weekly high at 4422.71 up 58.91 points today. The NASDAQ is very similar to the other 2 indexes up 197.47 points today currently at 14769.11 flirting with the high for the week. The U.S. Dollar Index is slightly down today .08 points currently at $94.00 today.

-

More than 10,000 John Deere workers went on strike just after midnight. This is the first strike at John Deere since 1986. About 90% of workers rejected a labor contract that was tentatively agreed too. The workers believe that the agreement was not sufficient due to the pandemic and the labor shortages resulting from this and complications in the work force from the pandemic. The strike would cover about 14 John Deere plants across the U.S.

|

USDA October WASDE |

|

|

Weather

Much needed rains across the growing areas earlier this week. The 6–10-day outlook is drying up with no rain in the forecast. Temperatures will continue to be in the high 60s to 70s slightly above average for this time of year.

|

|

Corn

Corn has lost almost 14 cents on the week as USDA carryin and yield increase weighed on futures. Fund sell off is also pressuring markets this week. Tuesday’s USDA October S & D report had carryin pegged at 1,236 million bushels verses Septembers 1,187 million bushels. Yield increased by .2 bpa to 176.5 vs September’s 176.3 million bushels. Total corn use decreased slightly to 14,780 million bushels. Reports this week were delayed a day. Tuesday’s export inspections pegged corn exports at 29.4 million bushels versus 34.3 million bushels last week and the 10-week average of 37.1 million bushels. Crop progress had corn harvest 41% complete for the US and 66% complete for Kansas. Corn conditions improved for the US to 60% good to excellent and stayed steady for Kansas at 62% good to excellent. Ethanol this week showed stocks decreasing slightly while production showed a sharp upturn as demand increased. Export sales delayed until Friday this week, though corn did see some flash sales to unknown. Locally basis stays steady as harvest progresses.

Wheat

Wheat lower on the week, but still sitting pretty compared with the other commodities. The wheat complex saw gains after USDA faded U.S. and global supplies in the October WASDE. U.S. yield and acres were decreased, pushing U.S. carryout down 35 million bushels overall from September to 580 million bushels. Global carryout was lower than the lowest trade guess at 277.18 MMT, with decreases in production for the U.S., Canada and the Middle East. Weekly export inspections were in line with expectations at 16.0 million bushels, with HRW the leader of the complex at 7.1 million bushels. No export sales report until tomorrow due to the holiday. Friday’s CFTC report indicated that the funds added 3,819 contracts to bring their net long up to 49,946. However, wheat fell victim to the huge sell off that occurred across commodities yesterday, taking an 18-cent hit in the December contract during Wednesday’s session. USDA reports that the winter wheat crop is 60% planted and 31% emerged, with many key areas receiving beneficial rains in the last week. New crop 2022 wheat has been flirting around $7.00 cash this week at our locations – perhaps worth some thought on what could make sense for your operation’s marketing plan.

Soybeans

A bearish WASDE has beans taking a beating this week – November soybeans traded below $12.00 for the first time since March. The market was expecting a slightly bearish report based on adjustments made in the September 30th Stocks Report, but did not expect a 70 million bushel increase in U.S. production. The uptick is attributed to increased planted and harvested acres, as well as a 0.9 increase to yield at 51.5 bushels/acre. U.S. soybean carryout is up 135 million bushels month-over-month to 320 million, above the average trade guess. World production also increased, which pushed the carryout up 5.7 MMT. Overall, a more bearish report than expected that set the tone for yesterday’s huge fund sell off. Friday’s CFTC report showed the funds as sellers, reducing their net long by 9,858 contracts to 49,453 contracts. Export inspections were higher than expected at 59.2 million bushels. Rains across the belt have delayed harvest, but USDA still indicates that harvest has gone at a much more rapid pace than normal. On Tuesday, they reported the crop at 49% harvested, well ahead of the 5-year average of 40%. Chinese demand remains relatively slow, as the South American crop looks promising. In other news, Bartlett announced this week that they will be building a crush facility in southeast Kansas with the capability to crush 38.5 million bushels a year. This week’s reports are delayed because of the government holiday Monday, so tomorrow will be a data dump of export sales and NOPA crush.

Milo

Milo taking the slide down with corn, and little in the way of market news. Export inspections pegged milo at a mere .4 million bushels. Sorghum harvest chugs along as US harvest is pegged at 49% while Kansas sits at 32% harvested. Sorghum condition took a small hit, down to 55% good to excellent from 56% good to excellent for the US while Kansas conditions came in at 54% good to excellent versus last week’s 56% good to excellent. Locally basis is flat.

Trivia Answers

-

The Colt Peacemaker – First manufactured in1873 and sold for $17.00 at the time.

-

Fort Leavenworth, Kansas – Est. in 1827