Weekly Market Update 1/6/2022

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

From what Latin word was the word "tractor" derived?

-

In 1812 the first semi-portable steam engine, called the "barn engine", was used to power what?

Answers at the bottom.

Market News

-

Crude oil managed a 1.00+ rally this week in spite of slipping U.S. demand and OPEC's continued agreemeent to lift output into February. Fuel inventories rose 10 million barrels, while oil stocks fell 2.1 million barrels with softened demand to end the 2021 year. Post-holiday COVID cases spiked sending many American's home, as Monday's new cases totaled 1 million, but some energy markets didn't feel the affects. Natural gas futures saw a little slip late Tuesday as weather seemed more favorable. But short-lived was the slip as forecasts show freezing temps that will renew demand.

-

Fed minutes from December's meeting released on Wednesday showed the Fed discussed unwinding their large balance sheet. Participants noted that increasing the rate sooner/faster may be needed due to labor market, economy and inflation issues. Participants also discussed that unwinding the balance sheet should happen soon after rates begin their increase. “Almost all participants agreed that it would likely be appropriate to initiate balance sheet runoff at some point after the first increase in the target range for the federal funds rate,” the meeting summary stated.

-

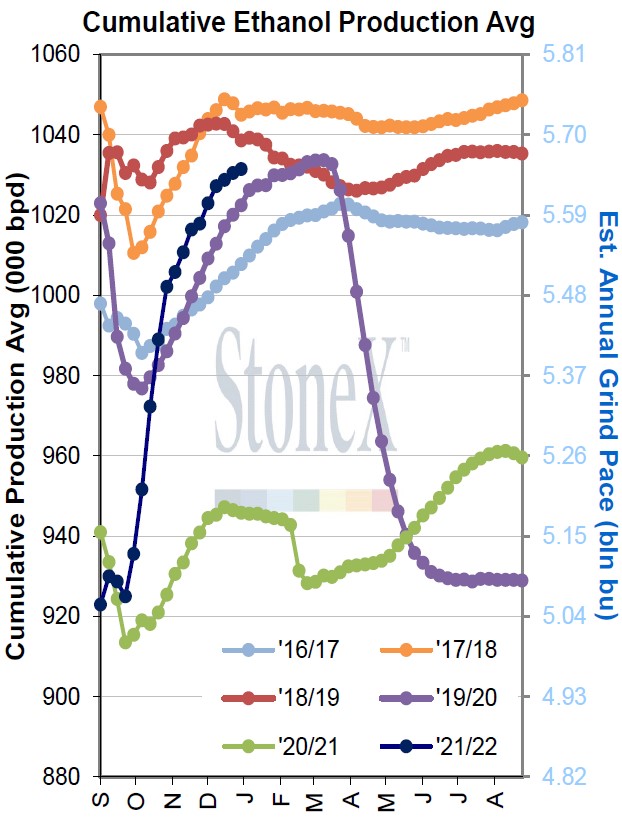

Ethanol production dropped slightly WoW coming it at 1.048 million bpd versus 1.059 million bpd last week. Though there was a slight drop, it is still well above the 935K bpd on the comparable week last year. Cumulative output continues to rise and at 1.032 million bpd puts it about where 19/20 was pre-pandemic.

| ETHANOL PRODUCTION AVG |

|

|

Weather

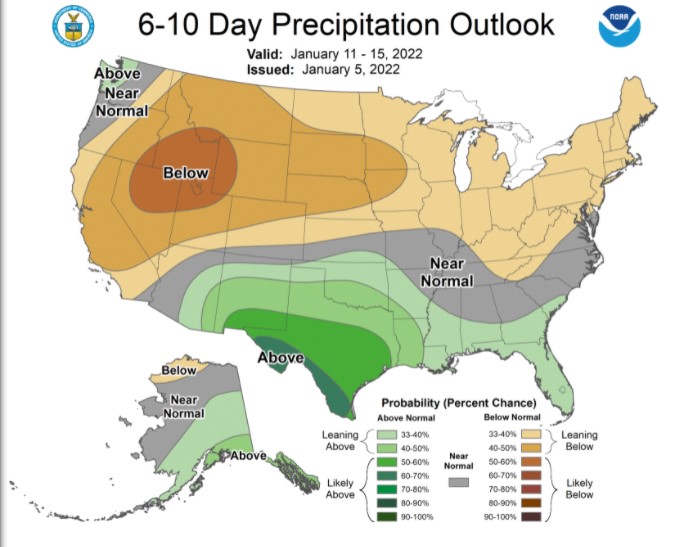

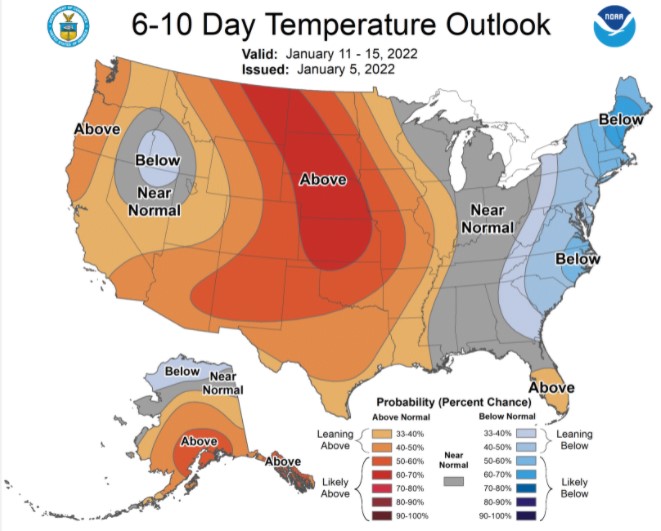

This week's cold snap will be short-lived as southwest Kansas looks to head back into the 40's and 50's by the weekend. Higher than normal temps will hang on into the 10 day forecast with little hope for any much-needed precipitation. This week's drought monitor is not favorable for the area, as severe drought starts to creep into key wheat-growing areas.

|

|

Corn

Overall corn is up for the week but has trended in the red today and yesterday. Tuesday wore the rally pants this week finishing up +20 cents. This was mostly due to StoneX Brazil lowering their South America corn production numbers by 2.5mmt, giving the bulls some fresh news to feed on. Also, the relative dryness occurring in parts of South America as well contributed to the rally. Export inspections were nonstarters this week showing 23.5 million bushels inspected to ship. Export sales showed 10.1 million bushels sold. This was very weak even considering the holiday week and was well below the low end of trade guesses. CFTC reported corn adding 12,929 contracts to the current long of 373,345 contracts. Currently March corn futures have been fighting to stay above the $6.00 level and pressure today from terrible export sales is leading the way for the bears. New crop corn has been range bound since December from about $5.45 to $5.55 and this looks to continue at least until next week when we have a data dump from the USDA on Wednesday. The USDA will release their monthly WASDE report along with final production numbers for this previous crop year. Historically this has led to a very volatile day so strap yourself in.

Wheat

Another ugly day for wheat as technical selling hammers down all the commodities and snow falls across parts of the Kansas and Nebraska. Export inspections were pathetic this week at 1.0 million bushels of HRW, compared with 7.1 million last week. Inspections for all wheat were also disappointing at only 5.2 million bushels, well below the range of estimates. Export sales also a drag at only 1.5 million bushels of old crop HRW, with all wheat reported at 1.8 million bushels of old crop and 0.1 million bushels of new crop. Wheat continues to lag against the pace needed to hit USDA export projections. Monday’s delayed CFTC report showed little movement for HRW, with managed money only adding 599 contracts to bring their net long to 59,406 contracts. This week was the first round of state conditions since late November, with significant declines in all major states as evidence of the detriment of the hot, dry weather pattern we have been in. Kansas was down 29%, Colorado down 13%, Nebraska down 25% and Oklahoma down 28%. In lack of other headlines, expect the wheat market to keep its eyes on row crop action and weather across the Plains.

Soybeans

South American weather is still the headline that the bean market is keenly watching. Forecasts in the 10-16 day range have gotten a bit wetter for the driest parts of the region, pressuring markets in today’s session. Harvest is starting in the northern flooded regions, creating concerns about timely harvest, quality, and logistics. Analysts have rolled in lower projections for their crop this week, but it’s important to keep in perspective that the South American crop will still be huge, even if not as large as originally anticipated. It will be interesting to see what USDA prints in next week’s WASDE. Export inspections were disappointing at 43.8 million bushels, down from last week’s 63.7 million. Export sales were especially ugly at only 14.1 million bushels of old crop and 2.5 million bushels of new crop. CFTC report indicates that the funds have been buyers of beans, adding 25,156 contracts to bring their net long up to 98,080 contracts. Expect daily trade to continue to be driven by South American forecasts.

Milo

The milo market is pretty much nonexistent at the moment. Export inspections this week reported 100,000 bushels of milo inspected to ship. Export sales were much better with 900,000 bushels of milo sold. The milo market is solely driven by China and without much business from them it will remain quiet on the milo front.

Trivia Answers

-

It was derived from the word "trahere" meaning "to pull".

-

A corn threshing machine.