Weekly Market Update 5-12-23

|

Here is your weekly market update from the Garden City Co-op Grain Origination Team.

Trivia

-

What continent is closest to Antartica: South America, Australia, or Africa?

-

Who was the first U.S. President to visit all 50 states?

Answers at the bottom.

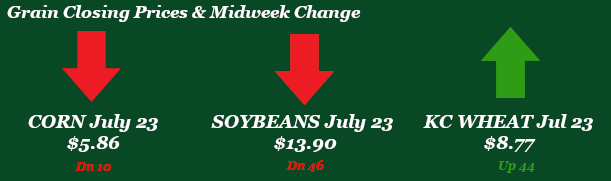

Market News

Black Sea Update Over the weekend a deal to extend the Black Sea Grain Deal looked bleak, but on Tuesday reports from Turkey said “positive progress” was being made between the parties. This was playing a factor in the swings in the market, giving bulls some momentum to end last week and into the start of the week only to get swatted back by bears. Russia had threatened to quit the current agreement on May 18th. We should be seeing more news detailing the length of extending the grain corridor deal within the next few days. News of a deal getting done could weigh on the markets.

Crop Progress Report Planting progress continues to move along. USDA reported that as of May 8th, farmers had planted 49% of their corn crop. This is up from 26% last week and ahead of the 5-year average of 42% planted at this time. Soybeans were reported at 35% planted, up 16% week-on-week and significantly ahead of the 5-year average of 21% planted. Winter wheat conditions were up 1% from last week to 29% good-to-excellent. Kansas, Oklahoma, and Colorado all saw declines while Texas and some Corn Belt states saw increases.

Export inspections were a swing and a miss. USDA reported 37.9 million bushels of corn shipped, below trade estimates and lagging behind the 10-week average of 40.0 million. Mexico, Japan, and China were the top three receivers of U.S. corn with 11.7, 10.6, and 5.4 Mil Bu respectively. The majority of corn shipped continues to come out of the Gulf, with the PNW seeing a decent amount headed to East Asia, and of course about half of Mexico’s corn came from the interior. Wheat inspections were the lowest they've been since the last week of March, reported at 7.7 million bushels for all classes. HRW led the way with 1.9 million bushels to Mexico, 1.5 million bushels to Ethiopia, and the balance headed to Japan and Honduras. Soybeans were reported at 14.5 million bushels, lower than last week but still within the range of estimates. Milo reported 2.0 million bushels shipped, with the vast majority headed to China.

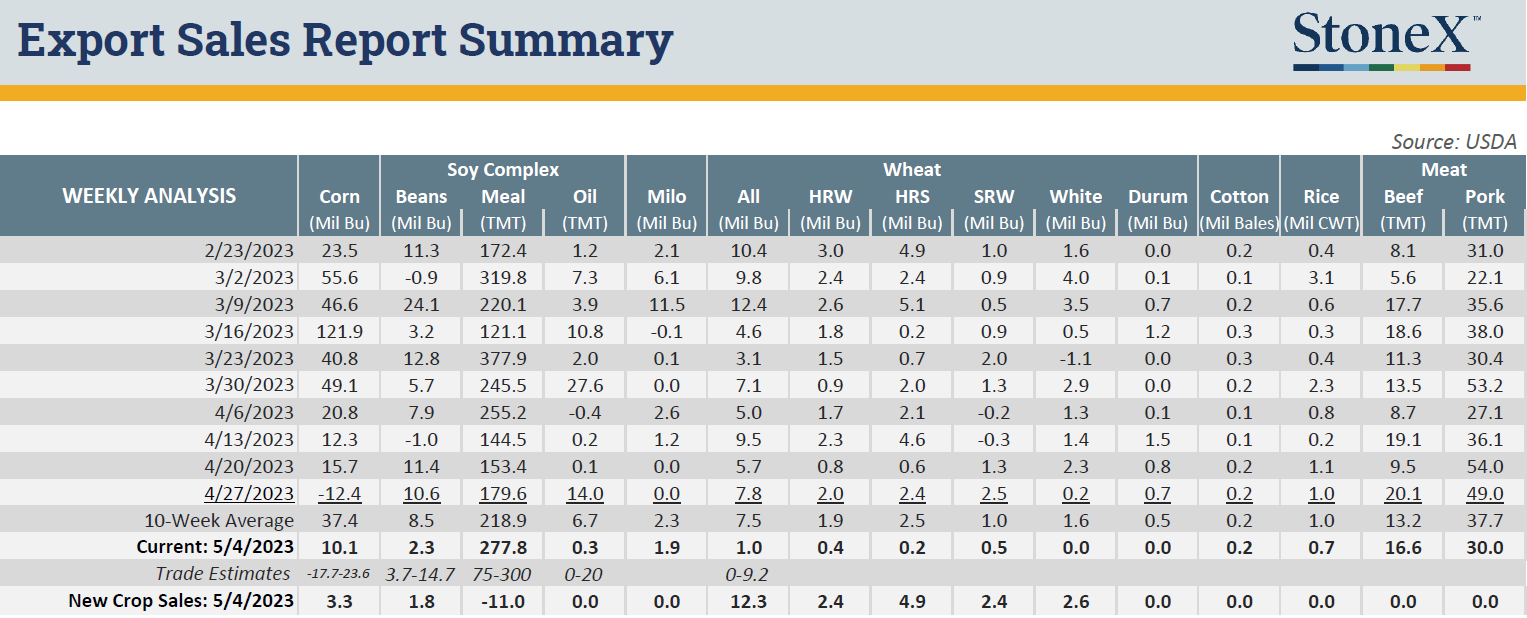

Export sales report was nothing to write home about this week, with the exception of some decent new crop wheat sales. Old crop wheat was reported with one million bushels sold, while new crop wheat posted a hefty 12.3 million bushels. This was led by HRS, but had decent numbers posted for all classes. Corn numbers weren't great with 10.1 million bushels of old crop and 3.3 million bushels of new crop. Japan and Mexico were the big buyers of old crop, while Mexico bought all the new crop. Next week’s export sales report will be interesting as China’s cancellation of sales on Tuesday will be on that report and they cancelled just shy of total sales for this week. Soybeans were also lackluster with 2.3 million bushels in the old crop slot and 1.8 million bushels of new crop. Milo reported at 1.9 million bushels in the old crop slot.

WASDE Recap

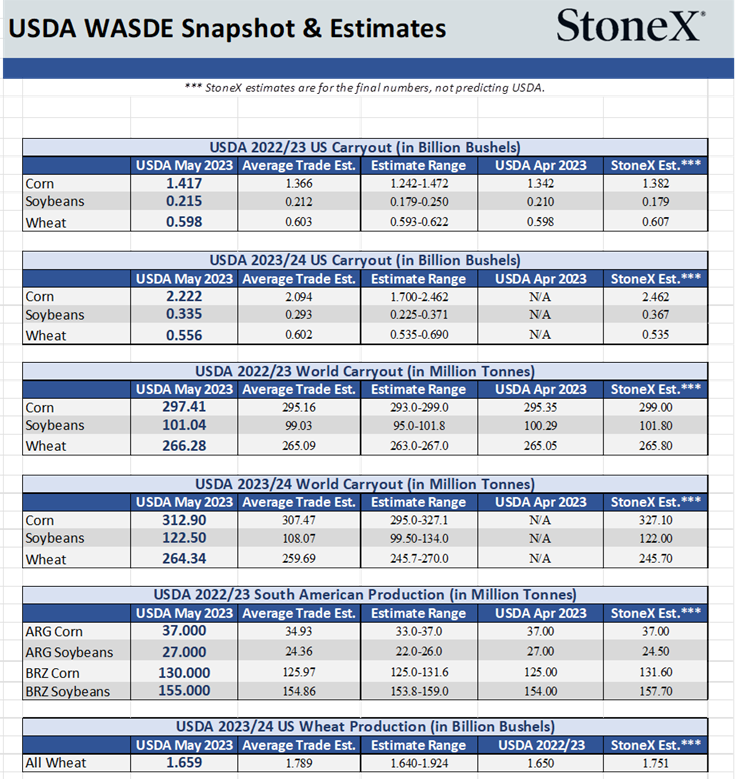

Let's start with wheat which was the mover today to say the least. At one point July KC Wheat futures were up 50 cents. Pretty volatile if you ask me. The USDA lowered HRW production for the U.S. to 518 million bushels down from 550 million bushels. This is a significant drop but considering how dry Kansas, Oklahoma, and Texas has been it’s tough to argue with the number. Kansas production was pegged at 191 million bushels this year compared to 244 million last year. Kansas wheat tour begins next week running Monday-Thursday which should cause more volatility in the market moving forward. Wheat production for 23/24 was released with 1.6 billion bushels harvested and acres at 37 million, some may argue this being too high and yield at 44.7. Old crop numbers were unchanged for carryout. Something to keep an eye on is corn weighing wheat prices down. With a bearish corn market wheat can’t get to out of whack compared to corn prices. Either corn must run with wheat higher, or wheat must fall, and the path of least resistance could be argued is down. Corn: No big shockers in the corn numbers from the USDA. Exports for 22/23 were lowered by 75 million bushels that saw old crop carryout raised to 1.417 billion bushels. The 23/24 balance sheet was released with numbers from the March prospective planting numbers plugged in. Milo: A bigger crop is on the balance sheet for 23/24 at 360 million bushels offset with higher exports at 235 million bushels. Which means a certain country will have to step up to the plate. Soybeans: Beans were similar to corn and milo as non-stories. Old crop carryout increased to 215 million bushels due to an increase in imports. New crop balance sheet was steady as she goes with the only noteworthy information is demand up 2.25% due to crush moving to 90 million bushels “increased capacity”.

Weather

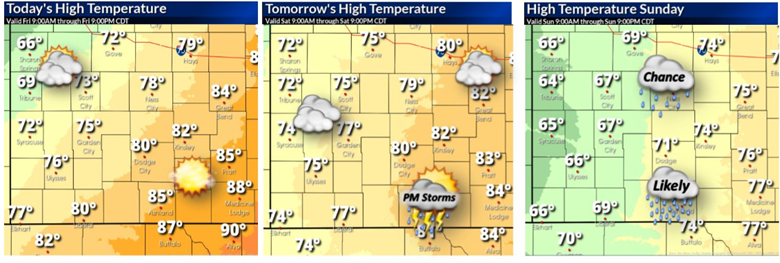

Yesterday we started the day off with some much-needed morning showers. Precipitation chances will increase over the weekend across southwest Kansas. As the precipitation chances increase, the high temperatures will decrease. The rest of this week and ahead looks promising for moisture – with chances late tomorrow evening and a 50% chance Sunday and Monday. Temperatures look mild with highs in the 70s and 80 and lows in the 50s. It will be breezy here for the weekend but calm throughout the week.

Trivia Answers

-

South America

-

Richard Nixon